What is Global Medical Malpractice Compulsory Liability Insurance Market?

The Global Medical Malpractice Compulsory Liability Insurance Market is a specialized segment within the broader insurance industry, focusing on providing coverage for healthcare professionals against claims of negligence or malpractice. This type of insurance is mandatory in many regions, ensuring that medical practitioners have financial protection in the event of a lawsuit. The market encompasses a wide range of policies tailored to different medical professions, including doctors, nurses, and other healthcare providers. These policies are designed to cover legal fees, settlements, and any damages awarded to plaintiffs. The demand for such insurance is driven by the increasing number of malpractice claims and the rising costs associated with legal proceedings. As healthcare systems become more complex and patient awareness grows, the need for comprehensive malpractice insurance continues to expand. This market is characterized by a diverse range of providers, from large multinational insurance companies to smaller, specialized firms, each offering various levels of coverage and premium rates. The global nature of this market means that it is influenced by regional legal frameworks, healthcare standards, and economic conditions, making it a dynamic and evolving sector within the insurance industry.

Personal Purchase, Company Purchase in the Global Medical Malpractice Compulsory Liability Insurance Market:

In the Global Medical Malpractice Compulsory Liability Insurance Market, purchases can be categorized into personal and company purchases, each serving distinct needs and purposes. Personal purchase refers to individual healthcare professionals acquiring insurance policies to protect themselves against potential malpractice claims. This is particularly crucial for independent practitioners or those working in private practices, as they bear the full responsibility for any legal actions taken against them. Personal purchases allow these professionals to tailor their coverage to their specific needs, considering factors such as their area of specialization, the volume of patients they see, and their risk exposure. On the other hand, company purchase involves healthcare institutions, such as hospitals, clinics, and medical groups, acquiring malpractice insurance to cover their staff collectively. This approach provides a blanket of protection for all employees, ensuring that the institution is safeguarded against claims that may arise from the actions of its staff. Company purchases are often more cost-effective for larger organizations, as they can negotiate better terms and premiums due to the volume of coverage required. Additionally, company purchases help maintain a consistent level of protection across the organization, ensuring that all employees are adequately covered. Both personal and company purchases are essential components of the Global Medical Malpractice Compulsory Liability Insurance Market, addressing the diverse needs of healthcare professionals and institutions worldwide.

Coverage: Up to $1 Million, Coverage: $1 Million to $5 Million, Coverage: $5 Million to $20 Million, Coverage: Over $20 Million in the Global Medical Malpractice Compulsory Liability Insurance Market:

The usage of Global Medical Malpractice Compulsory Liability Insurance Market varies significantly based on the coverage amount, which can range from up to $1 million to over $20 million. Coverage up to $1 million is typically suitable for individual practitioners or small practices with a lower risk profile. This level of coverage provides basic protection against common malpractice claims, ensuring that legal fees and settlements are covered without imposing a significant financial burden on the insured. For those requiring more substantial protection, coverage ranging from $1 million to $5 million is often chosen by mid-sized practices or specialists who face higher risks due to the nature of their work. This level of coverage offers a more comprehensive safety net, accommodating larger claims and providing peace of mind to practitioners who may be involved in more complex medical procedures. Coverage between $5 million and $20 million is generally sought by larger healthcare institutions or high-risk specialties, such as surgery or obstetrics, where the potential for significant claims is greater. This extensive coverage ensures that even the most substantial legal costs and settlements can be managed without jeopardizing the financial stability of the insured. Finally, coverage over $20 million is typically reserved for large hospitals, healthcare systems, or medical groups with extensive operations and a high volume of patients. This level of coverage provides the utmost protection, safeguarding the institution against catastrophic claims that could otherwise have severe financial implications. Each coverage tier within the Global Medical Malpractice Compulsory Liability Insurance Market serves a specific purpose, catering to the diverse needs of healthcare professionals and organizations worldwide.

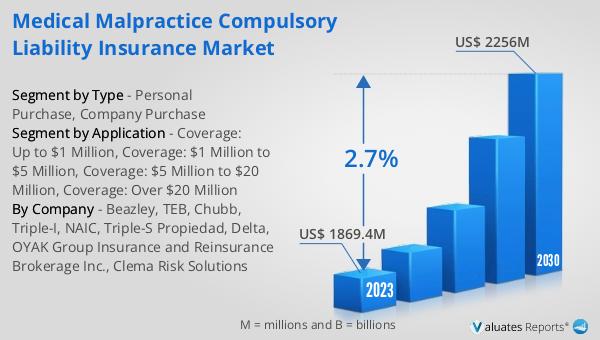

Global Medical Malpractice Compulsory Liability Insurance Market Outlook:

The outlook for the Global Medical Malpractice Compulsory Liability Insurance Market indicates a steady growth trajectory over the coming years. In 2024, the market was valued at approximately $1,970 million, reflecting the significant demand for malpractice insurance among healthcare professionals and institutions. This demand is driven by the increasing complexity of healthcare systems, rising patient awareness, and the growing number of malpractice claims. As the market evolves, it is projected to reach a revised size of $2,367 million by 2031, representing a compound annual growth rate (CAGR) of 2.7% during the forecast period. This growth is indicative of the ongoing need for comprehensive malpractice coverage, as healthcare providers seek to protect themselves against potential legal actions. The market's expansion is also influenced by regional legal frameworks, economic conditions, and advancements in medical technology, which can impact the frequency and severity of malpractice claims. As a result, insurance providers are continually adapting their offerings to meet the changing needs of the healthcare industry, ensuring that practitioners and institutions have access to the necessary protection. The Global Medical Malpractice Compulsory Liability Insurance Market remains a vital component of the broader insurance landscape, providing essential coverage for healthcare professionals worldwide.

| Report Metric | Details |

| Report Name | Medical Malpractice Compulsory Liability Insurance Market |

| Accounted market size in year | US$ 1970 million |

| Forecasted market size in 2031 | US$ 2367 million |

| CAGR | 2.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Beazley, TEB, Chubb, Triple-I, NAIC, Triple-S Propiedad, Delta, OYAK Group Insurance and Reinsurance Brokerage Inc., Clema Risk Solutions |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |