What is Global Traffic Accident Liability Insurance Market?

The Global Traffic Accident Liability Insurance Market is a specialized segment of the insurance industry that focuses on providing financial protection to individuals and businesses involved in traffic accidents. This market is crucial because it helps cover the costs associated with damages or injuries resulting from road accidents. The insurance policies under this market are designed to offer liability coverage, which means they cover the policyholder's legal responsibility for causing harm to others, whether it be bodily injury or property damage. This type of insurance is essential for vehicle owners, as it ensures that they are financially protected against claims made by third parties. The market is influenced by various factors, including the increasing number of vehicles on the road, rising accident rates, and stringent government regulations mandating insurance coverage. As urbanization and industrialization continue to grow, the demand for traffic accident liability insurance is expected to rise, making it a vital component of the global insurance industry. The market is also characterized by the presence of numerous insurance providers offering a range of products tailored to meet the diverse needs of consumers, from personal vehicle owners to large commercial fleets.

Personal Accident Insurance, Cargo Transportation Insurance, Motor Vehicle Insurance in the Global Traffic Accident Liability Insurance Market:

Personal Accident Insurance, Cargo Transportation Insurance, and Motor Vehicle Insurance are integral components of the Global Traffic Accident Liability Insurance Market, each serving distinct purposes but collectively contributing to comprehensive coverage. Personal Accident Insurance is designed to provide financial compensation to individuals who suffer injuries or death due to accidents. This type of insurance is crucial for individuals who want to ensure that they or their families are financially protected in the event of an unforeseen accident. It typically covers medical expenses, loss of income, and other related costs, offering peace of mind to policyholders. On the other hand, Cargo Transportation Insurance is specifically tailored for businesses involved in the transportation of goods. This insurance covers the loss or damage of cargo during transit, whether by road, sea, or air. It is essential for businesses that rely on the timely and safe delivery of goods, as it protects against financial losses that could arise from accidents, theft, or natural disasters. Motor Vehicle Insurance, perhaps the most well-known type, provides coverage for vehicles against damages resulting from accidents, theft, or other perils. It is mandatory in many countries, ensuring that vehicle owners are financially responsible for any harm they may cause to others on the road. This insurance not only covers the repair or replacement costs of the insured vehicle but also offers liability coverage for damages inflicted on third parties. Together, these insurance types form a robust framework that supports the Global Traffic Accident Liability Insurance Market, addressing the diverse needs of individuals and businesses alike. As the world becomes increasingly interconnected and reliant on transportation, the importance of these insurance products continues to grow, providing essential protection and financial security in an ever-evolving landscape.

Domestic, Business in the Global Traffic Accident Liability Insurance Market:

The usage of the Global Traffic Accident Liability Insurance Market extends across various areas, including domestic and business sectors, each with unique requirements and benefits. In the domestic sphere, traffic accident liability insurance is primarily utilized by individual vehicle owners who seek protection against the financial repercussions of road accidents. For families and individuals, this insurance offers peace of mind by covering medical expenses, vehicle repair costs, and liability claims from third parties. It ensures that in the event of an accident, the policyholder is not burdened with overwhelming financial responsibilities, allowing them to focus on recovery and well-being. Additionally, domestic usage of this insurance often includes coverage for personal accidents, providing further financial security for policyholders and their families. In the business sector, traffic accident liability insurance plays a critical role in safeguarding companies involved in transportation and logistics. Businesses that operate fleets of vehicles, such as delivery services, trucking companies, and ride-sharing platforms, rely heavily on this insurance to protect their assets and ensure operational continuity. It covers the costs associated with vehicle repairs, legal liabilities, and compensation claims, enabling businesses to manage risks effectively and maintain their reputation. Moreover, for companies involved in the transportation of goods, cargo transportation insurance is indispensable. It protects against potential losses from damaged or lost cargo, ensuring that businesses can fulfill their commitments to clients without incurring significant financial setbacks. As businesses continue to expand and global trade intensifies, the demand for comprehensive traffic accident liability insurance solutions is expected to grow, highlighting its importance in both domestic and business contexts. This insurance not only provides financial protection but also fosters a sense of security and confidence, allowing individuals and businesses to navigate the complexities of modern transportation with assurance.

Global Traffic Accident Liability Insurance Market Outlook:

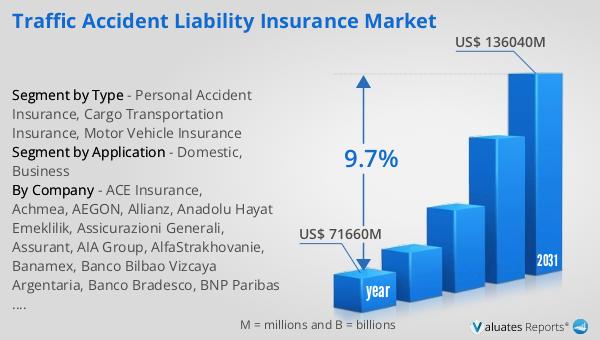

The global market for Traffic Accident Liability Insurance has shown significant growth and potential over the years. In 2024, the market was valued at approximately US$ 71,660 million, reflecting its substantial role in providing financial protection against traffic-related incidents. This market is projected to expand further, reaching an estimated size of US$ 136,040 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 9.7% during the forecast period. Such a robust growth rate underscores the increasing demand for traffic accident liability insurance worldwide. Several factors contribute to this upward trend, including the rising number of vehicles on the road, heightened awareness of the importance of insurance coverage, and stringent regulatory requirements mandating insurance for vehicle owners. As urbanization and industrialization continue to progress, more individuals and businesses are recognizing the necessity of having adequate insurance protection to mitigate the financial risks associated with traffic accidents. The market's expansion also reflects the efforts of insurance providers to offer innovative and tailored products that cater to the diverse needs of consumers, from personal vehicle owners to large commercial enterprises. As the global landscape evolves, the Traffic Accident Liability Insurance Market is poised to play an increasingly vital role in ensuring financial security and stability for individuals and businesses alike.

| Report Metric | Details |

| Report Name | Traffic Accident Liability Insurance Market |

| Accounted market size in year | US$ 71660 million |

| Forecasted market size in 2031 | US$ 136040 million |

| CAGR | 9.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | ACE Insurance, Achmea, AEGON, Allianz, Anadolu Hayat Emeklilik, Assicurazioni Generali, Assurant, AIA Group, AlfaStrakhovanie, Banamex, Banco Bilbao Vizcaya Argentaria, Banco Bradesco, BNP Paribas Cardif, China Life Insurance Company, China Pacific Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |