What is International Money Transfer Software - Global Market?

International money transfer software is a crucial component in the global financial ecosystem, facilitating the seamless movement of funds across borders. This software is designed to handle the complexities of international transactions, including currency conversion, compliance with various regulatory requirements, and ensuring secure and efficient transfers. The global market for this software is driven by the increasing demand for fast, reliable, and cost-effective money transfer solutions, especially in an era where globalization and digitalization are at the forefront. Businesses and individuals alike rely on these platforms to send and receive money internationally, whether for personal remittances, business transactions, or other financial activities. The software typically integrates with banking systems and other financial networks to provide a comprehensive solution that meets the diverse needs of users. As the world becomes more interconnected, the demand for international money transfer software continues to grow, with advancements in technology further enhancing the capabilities and reach of these platforms. The market is characterized by a mix of established players and innovative startups, all striving to offer the best possible service in terms of speed, security, and cost.

Local Deployment, Cloud-based in the International Money Transfer Software - Global Market:

In the realm of international money transfer software, deployment options play a significant role in determining the flexibility, scalability, and accessibility of the service. Local deployment refers to the installation and operation of the software on a company's own servers and infrastructure. This approach offers businesses greater control over their data and systems, allowing for customization to meet specific needs and compliance with local regulations. However, it also requires significant investment in IT resources and expertise to manage and maintain the infrastructure. On the other hand, cloud-based deployment offers a more flexible and scalable solution, where the software is hosted on remote servers and accessed via the internet. This model allows businesses to quickly adapt to changing demands, as they can easily scale up or down based on their needs. Cloud-based solutions also reduce the burden of managing IT infrastructure, as the service provider takes care of maintenance, updates, and security. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the resources to manage complex IT systems. Additionally, cloud-based deployment offers the advantage of accessibility, as users can access the software from anywhere with an internet connection, facilitating remote work and international collaboration. The choice between local deployment and cloud-based solutions often depends on a company's specific needs, resources, and strategic goals. Some businesses may prefer the control and customization offered by local deployment, while others may prioritize the flexibility and cost-effectiveness of cloud-based solutions. As the global market for international money transfer software continues to evolve, we can expect to see further innovations in deployment options, with hybrid models that combine the best of both worlds becoming increasingly popular. These hybrid solutions allow businesses to maintain control over critical data and systems while leveraging the scalability and accessibility of the cloud for other functions. Ultimately, the choice of deployment model will depend on a variety of factors, including the size and nature of the business, regulatory requirements, and the specific features and capabilities needed to support international money transfers.

Personal, Enterprise in the International Money Transfer Software - Global Market:

International money transfer software serves a wide range of users, from individuals sending money to family and friends abroad to large enterprises conducting cross-border transactions. For personal users, these platforms offer a convenient and cost-effective way to send and receive money internationally. With features such as real-time exchange rates, low transaction fees, and user-friendly interfaces, individuals can easily manage their international financial activities. This is particularly important for expatriates, migrant workers, and others who regularly send remittances to support their families in different countries. The software also provides peace of mind with robust security measures to protect personal information and financial data. On the enterprise side, international money transfer software is an essential tool for businesses engaged in global trade and commerce. Companies can use these platforms to pay suppliers, receive payments from international clients, and manage their foreign exchange exposure. The software often integrates with existing financial systems, providing a seamless and efficient solution for managing cross-border transactions. For enterprises, the ability to quickly and securely transfer funds across borders is critical to maintaining smooth operations and competitive advantage in the global market. The software also helps businesses comply with international regulations and standards, reducing the risk of financial penalties and reputational damage. As the global economy becomes increasingly interconnected, the demand for international money transfer software is expected to grow, with both personal and enterprise users seeking solutions that offer speed, security, and cost-effectiveness.

International Money Transfer Software - Global Market Outlook:

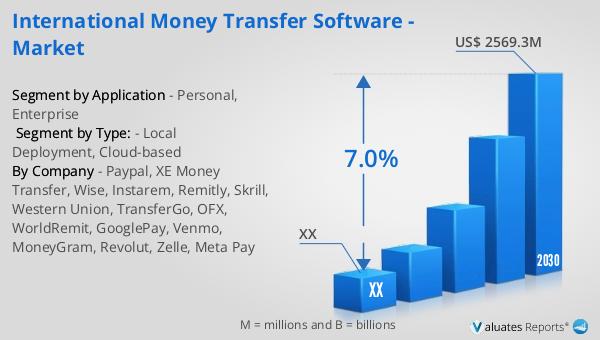

The international money transfer software market is experiencing significant growth, with its value estimated at $1.6 billion in 2023. This market is projected to expand to approximately $2.57 billion by 2030, reflecting a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2024 to 2030. This growth is driven by several factors, including the increasing globalization of business operations, the rise of digital payment solutions, and the growing demand for efficient and secure cross-border transactions. As more individuals and businesses engage in international financial activities, the need for reliable and cost-effective money transfer solutions becomes increasingly important. The market is characterized by a diverse range of players, from established financial institutions to innovative fintech startups, all competing to offer the best possible service to their customers. With advancements in technology and the increasing adoption of digital payment methods, the international money transfer software market is poised for continued growth and innovation. Companies in this space are constantly seeking to enhance their offerings, with a focus on improving speed, security, and user experience. As the market evolves, we can expect to see further developments in areas such as blockchain technology, artificial intelligence, and machine learning, all of which have the potential to revolutionize the way international money transfers are conducted.

| Report Metric | Details |

| Report Name | International Money Transfer Software - Market |

| Forecasted market size in 2030 | US$ 2569.3 million |

| CAGR | 7.0% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Paypal, XE Money Transfer, Wise, Instarem, Remitly, Skrill, Western Union, TransferGo, OFX, WorldRemit, GooglePay, Venmo, MoneyGram, Revolut, Zelle, Meta Pay |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |