What is Polyisocyanurate Foam (PIR) Sandwich Panel - Global Market?

Polyisocyanurate Foam (PIR) Sandwich Panels are a type of building material that has gained significant traction in the global market due to their excellent thermal insulation properties and structural strength. These panels are composed of a rigid PIR foam core sandwiched between two layers of metal or other durable materials. The PIR core is known for its high thermal resistance, making it an ideal choice for energy-efficient construction. The global market for these panels is driven by the increasing demand for sustainable and energy-efficient building solutions. As construction standards evolve to prioritize energy conservation, PIR sandwich panels offer a viable solution by reducing heat transfer and maintaining indoor temperatures. Additionally, their lightweight nature and ease of installation make them a preferred choice for both new constructions and retrofitting projects. The versatility of PIR sandwich panels allows them to be used in various applications, including commercial buildings, industrial facilities, and residential structures. With the growing emphasis on reducing carbon footprints and enhancing building performance, the demand for PIR sandwich panels is expected to continue rising, reflecting a broader trend towards sustainable construction practices.

Thickness below 51 mm, Thickness 51 mm-100 mm, Thickness above 100mm in the Polyisocyanurate Foam (PIR) Sandwich Panel - Global Market:

When it comes to the thickness of Polyisocyanurate Foam (PIR) Sandwich Panels, the global market categorizes them into three main segments: thickness below 51 mm, thickness between 51 mm and 100 mm, and thickness above 100 mm. Each thickness category serves distinct purposes and offers unique benefits, catering to different construction needs. Panels with a thickness below 51 mm are typically used in applications where space constraints are a concern, or where additional structural support is not a primary requirement. These thinner panels are often employed in interior partitions or in areas where minimal thermal insulation is sufficient. Despite their reduced thickness, they still provide a reasonable level of insulation and are lightweight, making them easy to handle and install. On the other hand, panels with a thickness ranging from 51 mm to 100 mm are more commonly used in standard building applications. This thickness range strikes a balance between insulation performance and structural integrity, making them suitable for both walls and roofs in residential and commercial buildings. They offer enhanced thermal resistance, which is crucial for maintaining energy efficiency in buildings. Moreover, these panels can withstand moderate environmental stresses, providing durability and longevity to the structures they are used in. Lastly, panels with a thickness above 100 mm are designed for applications that demand superior insulation and strength. These thicker panels are often used in cold storage facilities, industrial buildings, and other environments where maintaining specific temperature conditions is critical. The increased thickness provides exceptional thermal insulation, reducing energy consumption and ensuring temperature stability. Additionally, they offer enhanced load-bearing capacity, making them suitable for heavy-duty applications. The choice of panel thickness is influenced by factors such as climate conditions, building design, and specific insulation requirements. As the global market for PIR sandwich panels continues to grow, manufacturers are focusing on developing panels with varying thicknesses to cater to the diverse needs of the construction industry. This segmentation allows builders and architects to select the most appropriate panel thickness for their projects, ensuring optimal performance and efficiency.

Building Wall, Building Roof, Cold Storage in the Polyisocyanurate Foam (PIR) Sandwich Panel - Global Market:

Polyisocyanurate Foam (PIR) Sandwich Panels are extensively used in various construction applications, including building walls, building roofs, and cold storage facilities, due to their superior insulation properties and structural benefits. In building walls, PIR sandwich panels serve as an effective barrier against heat transfer, helping to maintain comfortable indoor temperatures regardless of external weather conditions. Their high thermal resistance reduces the need for additional heating or cooling, leading to significant energy savings. Moreover, these panels are lightweight and easy to install, which can expedite construction timelines and reduce labor costs. The use of PIR panels in walls also contributes to sound insulation, enhancing the overall comfort of the building's occupants. When it comes to building roofs, PIR sandwich panels offer similar advantages. They provide excellent thermal insulation, which is crucial for preventing heat loss in colder climates and minimizing heat gain in warmer regions. This helps in maintaining a stable indoor environment and reduces the reliance on HVAC systems, thereby lowering energy consumption. Additionally, the structural strength of PIR panels makes them suitable for roofing applications, as they can withstand various environmental stresses such as wind, rain, and snow. Their durability ensures a long lifespan, reducing the need for frequent repairs or replacements. In cold storage facilities, the use of PIR sandwich panels is particularly beneficial due to their exceptional insulation capabilities. Maintaining precise temperature conditions is critical in cold storage to preserve the quality and safety of perishable goods. PIR panels help achieve this by minimizing heat transfer and ensuring consistent temperature control. Their high thermal resistance reduces the energy required to maintain low temperatures, resulting in cost savings for facility operators. Furthermore, the panels' moisture resistance prevents condensation and mold growth, which can compromise the integrity of stored products. Overall, the versatility and performance of PIR sandwich panels make them an ideal choice for a wide range of construction applications, contributing to energy efficiency, structural integrity, and occupant comfort.

Polyisocyanurate Foam (PIR) Sandwich Panel - Global Market Outlook:

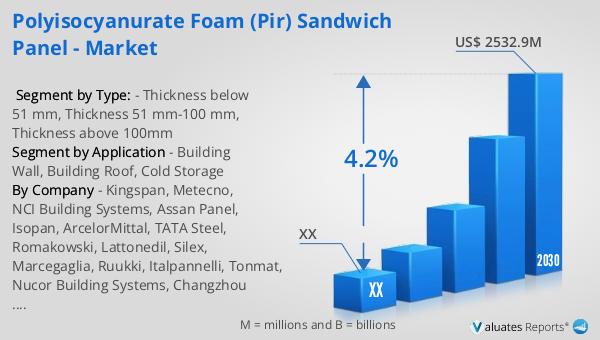

The global market for Polyisocyanurate Foam (PIR) Sandwich Panels was valued at approximately $1,906.8 million in 2023. Looking ahead, the market is projected to grow, reaching an estimated size of $2,532.9 million by the year 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 4.2% over the forecast period from 2024 to 2030. This steady increase in market size reflects the rising demand for energy-efficient and sustainable building materials across various sectors. As construction practices continue to evolve, there is a growing emphasis on reducing energy consumption and enhancing building performance. PIR sandwich panels, with their superior insulation properties and structural benefits, are well-positioned to meet these demands. The market's expansion is also driven by the increasing adoption of green building standards and regulations, which prioritize the use of materials that contribute to energy efficiency and environmental sustainability. As a result, manufacturers are focusing on developing innovative PIR panel solutions to cater to the diverse needs of the construction industry. This includes offering panels with varying thicknesses and enhanced performance characteristics to suit different applications. Overall, the positive market outlook for PIR sandwich panels underscores their importance in the global construction landscape and their potential to drive sustainable building practices.

| Report Metric | Details |

| Report Name | Polyisocyanurate Foam (PIR) Sandwich Panel - Market |

| Forecasted market size in 2030 | US$ 2532.9 million |

| CAGR | 4.2% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Kingspan, Metecno, NCI Building Systems, Assan Panel, Isopan, ArcelorMittal, TATA Steel, Romakowski, Lattonedil, Silex, Marcegaglia, Ruukki, Italpannelli, Tonmat, Nucor Building Systems, Changzhou Jingxue, Alubel, Zhongjie Group, BCOMS, TENAX PANEL |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |