What is Contactless Payment Transaction - Global Market?

Contactless payment transactions refer to a method of payment that allows consumers to make purchases without physically touching a payment terminal. This technology uses radio-frequency identification (RFID) or near-field communication (NFC) to enable secure transactions between a contactless card or device and a payment terminal. The global market for contactless payment transactions has been growing rapidly due to the convenience and speed it offers to consumers and businesses alike. With the increasing adoption of smartphones and wearable devices, more people are opting for contactless payments as they provide a seamless and efficient way to complete transactions. This market is driven by the demand for faster checkouts, enhanced security features, and the growing trend of digitalization in financial services. As more retailers and service providers adopt contactless payment systems, the global market is expected to expand further, offering new opportunities for innovation and growth in the financial technology sector. The ease of use and the ability to integrate with various digital platforms make contactless payments an attractive option for both consumers and businesses, paving the way for a cashless future.

Wearable Devices, Contactless Card (RFID/NFC), Contactless Mobile Payment in the Contactless Payment Transaction - Global Market:

Wearable devices, contactless cards, and mobile payments are key components of the contactless payment transaction market. Wearable devices, such as smartwatches and fitness trackers, have become increasingly popular as they offer the convenience of making payments directly from the wrist. These devices are equipped with NFC technology, allowing users to tap their wearable on a payment terminal to complete a transaction. This hands-free approach is particularly appealing to consumers who are looking for quick and easy payment solutions. Contactless cards, on the other hand, are traditional debit or credit cards embedded with RFID or NFC chips. These cards allow users to make payments by simply tapping the card on a compatible terminal, eliminating the need to swipe or insert the card. This method is not only faster but also reduces wear and tear on the card itself. Contactless mobile payments involve using smartphones or tablets to make transactions. Mobile payment apps, such as Apple Pay, Google Pay, and Samsung Pay, have gained significant traction as they offer a secure and convenient way to pay. Users can store their card information on their mobile devices and use NFC technology to complete transactions at contactless-enabled terminals. The integration of biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security to mobile payments, making them a preferred choice for many consumers. The global market for contactless payment transactions is driven by the increasing adoption of these technologies, as they offer a seamless and efficient payment experience. As more consumers embrace digital wallets and contactless payment methods, businesses are also adapting to meet this demand by upgrading their payment infrastructure. This shift towards contactless payments is not only enhancing the customer experience but also driving innovation in the financial technology sector. With the continued growth of wearable devices, contactless cards, and mobile payments, the global market for contactless payment transactions is poised for significant expansion in the coming years.

Transport, Hospitality, Media and Entertainment, Healthcare, Retail in the Contactless Payment Transaction - Global Market:

The usage of contactless payment transactions has permeated various sectors, including transport, hospitality, media and entertainment, healthcare, and retail, each benefiting uniquely from this technology. In the transport sector, contactless payments have revolutionized the way commuters pay for their journeys. Public transportation systems in major cities have adopted contactless payment methods, allowing passengers to simply tap their cards or devices to pay for fares. This not only speeds up the boarding process but also reduces the need for cash handling, making it a more efficient and secure option for both operators and passengers. In the hospitality industry, contactless payments enhance the guest experience by offering a seamless and convenient way to pay for services. Hotels and restaurants are increasingly adopting contactless payment systems to streamline check-ins, check-outs, and dining experiences, allowing guests to enjoy their stay without the hassle of traditional payment methods. The media and entertainment sector has also embraced contactless payments, particularly in venues such as cinemas, theaters, and amusement parks. By enabling quick and easy transactions, contactless payments help reduce queues and improve the overall customer experience. In healthcare, contactless payments offer a secure and efficient way to manage transactions, whether it's paying for consultations, treatments, or medications. This technology minimizes the need for physical contact, which is particularly important in healthcare settings where hygiene is a top priority. Lastly, the retail sector has seen a significant shift towards contactless payments, driven by the demand for faster and more convenient shopping experiences. Retailers are investing in contactless payment infrastructure to cater to the growing number of consumers who prefer to pay with a tap of their card or device. This not only enhances the customer experience but also helps retailers streamline their operations and reduce transaction times. Overall, the adoption of contactless payment transactions across these sectors is transforming the way businesses operate and interact with their customers, paving the way for a more efficient and cashless future.

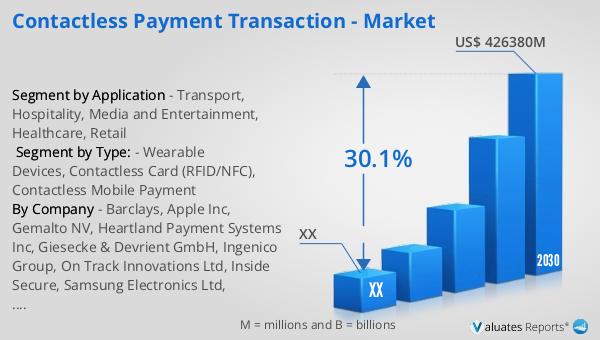

Contactless Payment Transaction - Global Market Outlook:

The global market for contactless payment transactions was valued at approximately $65.71 billion in 2023, and it is projected to grow significantly, reaching an estimated $426.38 billion by 2030. This impressive growth trajectory reflects a compound annual growth rate (CAGR) of 30.1% during the forecast period from 2024 to 2030. This rapid expansion is indicative of the increasing adoption of contactless payment technologies across various sectors and regions. In North America, the market for contactless payment transactions was valued at a substantial amount in 2023, and it is expected to continue its upward trend, reaching new heights by 2030. The CAGR for this region during the forecast period is also expected to be robust, highlighting the growing acceptance and integration of contactless payment solutions in everyday transactions. This growth is driven by the convenience, speed, and security that contactless payments offer, making them an attractive option for both consumers and businesses. As more people embrace digital payment methods, the global market for contactless payment transactions is set to expand, offering new opportunities for innovation and development in the financial technology sector. The increasing demand for seamless and efficient payment solutions is propelling the market forward, paving the way for a future where contactless payments become the norm.

| Report Metric | Details |

| Report Name | Contactless Payment Transaction - Market |

| Forecasted market size in 2030 | US$ 426380 million |

| CAGR | 30.1% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Barclays, Apple Inc, Gemalto NV, Heartland Payment Systems Inc, Giesecke & Devrient GmbH, Ingenico Group, On Track Innovations Ltd, Inside Secure, Samsung Electronics Ltd, Wirecard AG, Verifone Systems Inc |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |