What is Car Front Bumper - Global Market?

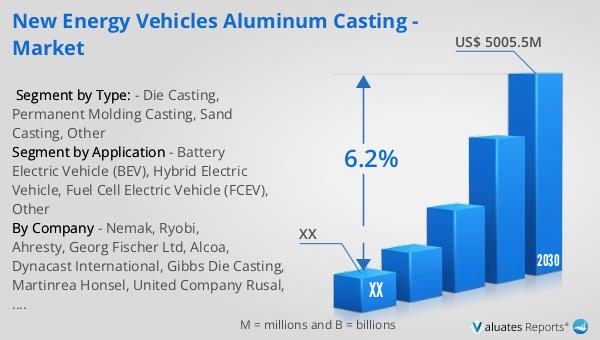

The car front bumper is a crucial component of any vehicle, serving both functional and aesthetic purposes. It is designed to absorb impact in the event of a collision, thereby protecting the vehicle's front end and minimizing damage to critical components like the engine and radiator. The global market for car front bumpers is vast and diverse, encompassing a wide range of materials, designs, and technologies. Manufacturers are continually innovating to improve the durability, safety, and design of bumpers, catering to the evolving demands of consumers and regulatory standards. The market is influenced by various factors, including advancements in automotive technology, increasing vehicle production, and growing consumer awareness about vehicle safety. Additionally, the rise in electric vehicles and autonomous driving technologies is shaping the future of car front bumpers, as these vehicles require specialized designs to accommodate sensors and other advanced features. As a result, the car front bumper market is poised for significant growth, driven by the need for enhanced safety features and the increasing adoption of lightweight materials to improve fuel efficiency.

Plastic Bumper, Others in the Car Front Bumper - Global Market:

Plastic bumpers are a popular choice in the car front bumper market due to their lightweight nature and cost-effectiveness. They are typically made from materials like polypropylene, polycarbonate, and ABS (Acrylonitrile Butadiene Styrene), which offer a good balance of strength, flexibility, and resistance to impact. The use of plastic bumpers has increased significantly over the years, as they contribute to overall vehicle weight reduction, leading to improved fuel efficiency and reduced emissions. Moreover, plastic bumpers are easier to mold and shape, allowing manufacturers to create intricate designs that enhance the aesthetic appeal of vehicles. They also offer better corrosion resistance compared to metal bumpers, making them a durable option for various weather conditions. However, plastic bumpers have their limitations, particularly in terms of impact resistance. In high-speed collisions, they may not provide the same level of protection as metal bumpers, which can absorb more energy. To address this, manufacturers are exploring advanced materials and technologies, such as reinforced plastics and composite materials, to enhance the performance of plastic bumpers. Additionally, the integration of sensors and cameras in modern vehicles has led to the development of smart bumpers, which incorporate these technologies to improve safety and functionality. These advancements are driving the demand for plastic bumpers in the global market, as they offer a versatile and cost-effective solution for modern vehicles. On the other hand, the "Others" category in the car front bumper market includes materials like aluminum, steel, and carbon fiber. Aluminum bumpers are known for their lightweight and high-strength properties, making them an ideal choice for performance vehicles. They offer excellent impact resistance and can be easily recycled, aligning with the growing trend towards sustainability in the automotive industry. Steel bumpers, while heavier, provide superior protection in collisions and are often used in commercial vehicles and trucks where durability is a priority. Carbon fiber bumpers, although expensive, are gaining popularity in high-end and sports cars due to their exceptional strength-to-weight ratio and sleek appearance. The choice of bumper material often depends on the vehicle type, intended use, and consumer preferences. As the automotive industry continues to evolve, the demand for innovative and sustainable materials in car front bumpers is expected to rise, driving further growth in the global market.

Passenger Vehicle, Commercial Vehicle in the Car Front Bumper - Global Market:

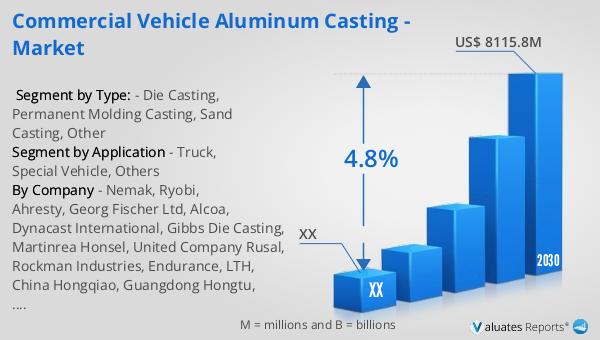

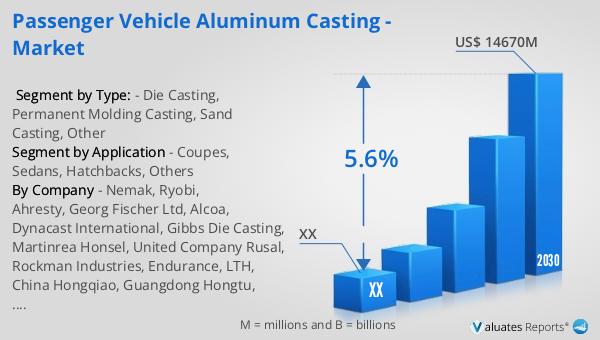

Car front bumpers play a vital role in both passenger and commercial vehicles, serving as the first line of defense in the event of a collision. In passenger vehicles, front bumpers are designed to absorb impact and protect the occupants by minimizing damage to the vehicle's structure. They are also crucial for pedestrian safety, as modern bumpers are engineered to reduce the severity of injuries in the event of an accident. The design and material of front bumpers in passenger vehicles are influenced by factors such as aesthetics, safety regulations, and fuel efficiency. Manufacturers are increasingly using lightweight materials like plastic and aluminum to enhance fuel economy without compromising on safety. Additionally, the integration of advanced technologies, such as sensors and cameras, in front bumpers is becoming more common in passenger vehicles, supporting features like adaptive cruise control and collision avoidance systems. In commercial vehicles, front bumpers are designed to withstand more rigorous conditions and provide enhanced protection due to the nature of their use. These vehicles often operate in challenging environments and are subject to higher risks of collisions. As a result, commercial vehicle bumpers are typically made from more robust materials like steel or reinforced plastics to ensure durability and longevity. The focus is on maximizing safety and minimizing downtime, as commercial vehicles are critical to business operations. The global market for car front bumpers in both passenger and commercial vehicles is driven by the need for improved safety features, regulatory compliance, and advancements in automotive technology. As the automotive industry continues to innovate, the role of front bumpers is expanding beyond traditional safety functions to include smart technologies that enhance vehicle performance and safety. This evolution is expected to drive further growth in the car front bumper market, as manufacturers strive to meet the diverse needs of consumers and businesses worldwide.

Car Front Bumper - Global Market Outlook:

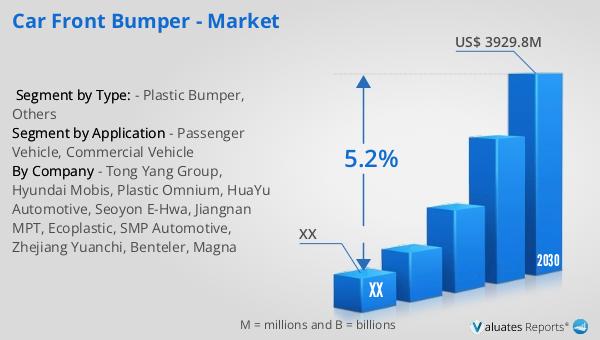

The global market for car front bumpers was valued at approximately $2,745 million in 2023 and is projected to grow to around $3,929.8 million by 2030, reflecting a compound annual growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2030. Currently, over 90% of the world's automobiles are concentrated in three major regions: Asia, Europe, and North America. Asia leads the pack, accounting for 56% of global automobile production, followed by Europe at 20%, and North America at 16%. This distribution highlights the significant role these regions play in the automotive industry and, consequently, in the car front bumper market. The growth in these regions is driven by factors such as increasing vehicle production, rising consumer demand for advanced safety features, and the adoption of new technologies in vehicle manufacturing. As the automotive industry continues to evolve, the demand for innovative and efficient car front bumpers is expected to rise, further fueling market growth. The focus on sustainability and lightweight materials is also influencing market dynamics, as manufacturers seek to improve fuel efficiency and reduce emissions. This market outlook underscores the importance of strategic investments and innovations in the car front bumper industry to meet the growing demands of the global automotive market.

| Report Metric | Details |

| Report Name | Car Front Bumper - Market |

| Forecasted market size in 2030 | US$ 3929.8 million |

| CAGR | 5.2% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Tong Yang Group, Hyundai Mobis, Plastic Omnium, HuaYu Automotive, Seoyon E-Hwa, Jiangnan MPT, Ecoplastic, SMP Automotive, Zhejiang Yuanchi, Benteler, Magna |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |