What is Global Medical Newborn Screening Solutions Market?

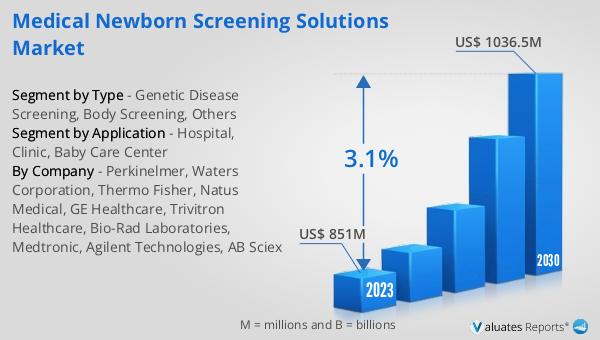

The Global Medical Newborn Screening Solutions Market is a vital segment within the healthcare industry, focusing on the early detection of potential health disorders in newborns. This market encompasses a range of technologies, services, and solutions designed to screen infants shortly after birth for a variety of genetic, metabolic, hormonal, and functional conditions that can lead to significant health problems or life-threatening diseases if not diagnosed and treated promptly. The importance of this market lies in its ability to offer a critical window for early intervention, thereby improving the long-term health outcomes for millions of children worldwide. With a valuation of US$ 851 million in 2023, the market is on a growth trajectory, expected to ascend to US$ 1036.5 million by 2030. This growth is propelled by advancements in medical technologies, increasing awareness among parents and healthcare providers about the benefits of early detection, and the implementation of newborn screening programs by governments across the globe. The expansion reflects a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2024 to 2030, underscoring the growing emphasis on preventive healthcare measures and the rising demand for newborn screening services globally.

Genetic Disease Screening, Body Screening, Others in the Global Medical Newborn Screening Solutions Market:

The Global Medical Newborn Screening Solutions Market is intricately segmented into Genetic Disease Screening, Body Screening, and Others, each playing a crucial role in safeguarding the health of newborns. Genetic Disease Screening is a cornerstone of this market, focusing on identifying inherited disorders that can significantly impact a child's health or development. This segment utilizes advanced technologies to analyze DNA samples for mutations or abnormalities that could lead to conditions such as cystic fibrosis, sickle cell anemia, or metabolic disorders, enabling early intervention and management. Body Screening, on the other hand, involves physical examinations and tests to detect conditions that might not have genetic origins but are equally critical to address promptly, including congenital heart defects, hearing loss, and critical congenital heart disease. The 'Others' category encompasses a broad array of additional screening tests and solutions designed to identify less common but potentially severe conditions. Together, these segments form a comprehensive approach to newborn screening, ensuring that a wide spectrum of health issues can be detected and addressed at the earliest possible stage. The integration of these screening solutions into healthcare systems worldwide represents a significant advancement in pediatric care, aiming to reduce morbidity and mortality among newborns through early detection and timely intervention.

Hospital, Clinic, Baby Care Center in the Global Medical Newborn Screening Solutions Market:

The utilization of Global Medical Newborn Screening Solutions Market spans across Hospitals, Clinics, and Baby Care Centers, each setting playing a pivotal role in the implementation of newborn screening programs. Hospitals, often the first point of contact for newborns and their families, are crucial in administering a wide array of screening tests before the baby is discharged. The comprehensive infrastructure and access to a variety of medical professionals make hospitals an ideal setting for conducting these essential screenings. Clinics, on the other hand, offer a more accessible option for follow-up screenings or for those who may not have given birth in a hospital setting. They play a vital role in ensuring continuity of care and in reaching populations that might otherwise be underserved. Baby Care Centers, including specialized neonatal and pediatric care facilities, provide targeted screening services focused on early detection and intervention for specific conditions. These centers often work in conjunction with hospitals and clinics to ensure a seamless care continuum for newborns and their families. The collaboration across these settings ensures that newborn screening solutions are widely available, maximizing the potential for early detection and treatment of health issues, thereby contributing significantly to the reduction of infant morbidity and mortality rates.

Global Medical Newborn Screening Solutions Market Outlook:

The market outlook for the Global Medical Newborn Screening Solutions Market presents a promising future, with its valuation projected to grow from US$ 851 million in 2023 to US$ 1036.5 million by 2030. This growth trajectory, representing a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2024 to 2030, signifies the increasing recognition of the importance of early detection and intervention in newborn health. This market's expansion is part of a broader trend within the global medical devices sector, which itself is estimated to be worth US$ 603 billion in 2023, with expectations to grow at a CAGR of 5% over the next six years. The parallel growth of both the newborn screening solutions market and the larger medical devices sector underscores the evolving landscape of healthcare, where there is a growing emphasis on preventive care and the adoption of advanced technologies to improve health outcomes from the earliest stages of life. The focus on newborn screening solutions reflects a global commitment to enhancing pediatric care and ensuring a healthier start for the next generation.

| Report Metric | Details |

| Report Name | Medical Newborn Screening Solutions Market |

| Accounted market size in 2023 | US$ 851 million |

| Forecasted market size in 2030 | US$ 1036.5 million |

| CAGR | 3.1% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Perkinelmer, Waters Corporation, Thermo Fisher, Natus Medical, GE Healthcare, Trivitron Healthcare, Bio-Rad Laboratories, Medtronic, Agilent Technologies, AB Sciex |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |