What is Global Microlens Arrays Market?

The Global Microlens Arrays Market is a fascinating segment of the optical components industry, characterized by its intricate design and wide-ranging applications. Microlens arrays are essentially a collection of tiny lenses, each with a diameter ranging from a few micrometers to a few millimeters. These arrays are used to manipulate light in various ways, such as focusing, diffusing, or collimating light beams. The market for microlens arrays is driven by their increasing use in diverse fields like telecommunications, consumer electronics, automotive, and medical devices. The demand for high-quality imaging and efficient light management solutions has propelled the growth of this market. Additionally, advancements in manufacturing technologies have made it possible to produce microlens arrays with higher precision and at lower costs, further fueling their adoption. The global market is also influenced by the rising trend of miniaturization in electronic devices, where microlens arrays play a crucial role in enhancing optical performance without increasing the size of the device. As industries continue to innovate and seek more efficient optical solutions, the microlens arrays market is poised for significant growth.

Aspherical Microlens Array, Spherical Microlens Array in the Global Microlens Arrays Market:

Aspherical and spherical microlens arrays are two primary types of microlens arrays, each with distinct characteristics and applications. Aspherical microlens arrays are designed with non-spherical surfaces, which allow them to focus light more precisely and reduce optical aberrations. This makes them ideal for applications requiring high precision and clarity, such as in advanced imaging systems and optical sensors. The aspherical design helps in minimizing distortions and improving the overall quality of the image or signal being processed. On the other hand, spherical microlens arrays have a simpler, spherical shape, which makes them easier and cheaper to manufacture. They are commonly used in applications where cost-effectiveness is a priority, and the precision of light manipulation is less critical. In the global microlens arrays market, aspherical microlens arrays hold a significant share due to their superior performance in high-end applications. However, spherical microlens arrays continue to be popular in industries where budget constraints are a major consideration. The choice between aspherical and spherical microlens arrays often depends on the specific requirements of the application, such as the level of precision needed, the cost constraints, and the desired optical performance. As technology advances, the capabilities of both types of microlens arrays are expected to improve, offering even more options for industries looking to optimize their optical systems.

Telecommunications and IT, Automotive Industry, Solar Modules, Medical Industry, Others in the Global Microlens Arrays Market:

The Global Microlens Arrays Market finds extensive usage across various sectors, each benefiting from the unique properties of these optical components. In the telecommunications and IT industry, microlens arrays are crucial for enhancing the performance of optical communication systems. They help in efficiently coupling light into optical fibers, improving signal quality and transmission speed. This is particularly important in the era of high-speed internet and data transfer, where even minor improvements in optical efficiency can lead to significant performance gains. In the automotive industry, microlens arrays are used in advanced driver-assistance systems (ADAS) and head-up displays (HUDs), where they enhance the clarity and brightness of the projected images. This contributes to improved safety and user experience, as drivers can receive critical information without taking their eyes off the road. Solar modules also benefit from microlens arrays, which are used to concentrate sunlight onto photovoltaic cells, increasing their efficiency and energy output. This is a key factor in the push towards renewable energy sources, as more efficient solar panels can lead to greater adoption and reduced reliance on fossil fuels. In the medical industry, microlens arrays are used in imaging systems and diagnostic equipment, where they improve the resolution and accuracy of the images captured. This is vital for accurate diagnosis and treatment planning, as high-quality images can provide more detailed information about a patient's condition. Other industries, such as consumer electronics and manufacturing, also utilize microlens arrays to enhance the performance of their optical systems, demonstrating the versatility and importance of these components in modern technology.

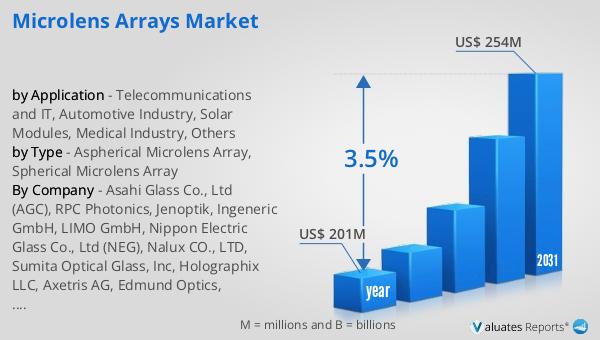

Global Microlens Arrays Market Outlook:

The global market for microlens arrays was valued at $201 million in 2024 and is anticipated to grow to a revised size of $254 million by 2031, reflecting a compound annual growth rate (CAGR) of 3.5% during the forecast period. The top three manufacturers in this market hold a combined share of 25%, indicating a moderately competitive landscape. The Asia-Pacific region emerges as the largest market, accounting for approximately 40% of the global share, followed by Europe and North America, each with a share of about 25%. This regional distribution highlights the significant demand for microlens arrays in Asia-Pacific, driven by the rapid industrialization and technological advancements in countries like China, Japan, and South Korea. In terms of product segmentation, aspherical microlens arrays dominate the market with a share exceeding 60%. This preference for aspherical microlens arrays can be attributed to their superior optical performance and ability to reduce aberrations, making them ideal for high-precision applications. As industries continue to seek advanced optical solutions, the demand for microlens arrays, particularly aspherical ones, is expected to remain strong, supporting the overall growth of the market.

| Report Metric | Details |

| Report Name | Microlens Arrays Market |

| Accounted market size in year | US$ 201 million |

| Forecasted market size in 2031 | US$ 254 million |

| CAGR | 3.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Asahi Glass Co., Ltd (AGC), RPC Photonics, Jenoptik, Ingeneric GmbH, LIMO GmbH, Nippon Electric Glass Co., Ltd (NEG), Nalux CO., LTD, Sumita Optical Glass, Inc, Holographix LLC, Axetris AG, Edmund Optics, PowerPhotonic, Newport Corporation (MKS Instruments) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |