What is Global Customer Due Diligence Service Market?

The Global Customer Due Diligence Service Market is a specialized sector that focuses on providing comprehensive background checks and assessments of customers for businesses worldwide. This market is crucial for companies that need to verify the identity and assess the risk associated with their customers, ensuring compliance with international regulations and standards. Customer due diligence involves gathering and evaluating information about customers to prevent illegal activities such as money laundering, fraud, and terrorist financing. The service is essential for financial institutions, legal entities, and other businesses that require a thorough understanding of their customer base to mitigate risks and make informed decisions. By employing advanced technologies and methodologies, the Global Customer Due Diligence Service Market helps organizations maintain transparency, build trust with their clients, and protect their reputation in an increasingly complex global environment. The market is driven by the growing need for regulatory compliance, the rise in financial crimes, and the increasing demand for secure and reliable customer verification processes. As businesses continue to expand globally, the importance of customer due diligence services is expected to grow, providing significant opportunities for service providers in this field.

Financial Due Diligence, Legal Due Diligence, Tax Due Diligence, Operational Due Diligence, Others in the Global Customer Due Diligence Service Market:

Financial Due Diligence is a critical component of the Global Customer Due Diligence Service Market, focusing on the financial aspects of a business or individual. This process involves a thorough examination of financial statements, cash flow, and other financial metrics to assess the financial health and stability of a customer. It helps businesses identify potential financial risks and opportunities, ensuring that they make informed decisions when engaging with new clients or partners. Legal Due Diligence, on the other hand, involves a comprehensive review of legal documents and contracts to ensure compliance with applicable laws and regulations. This process helps businesses identify any legal risks or liabilities associated with a customer, enabling them to take appropriate measures to mitigate these risks. Tax Due Diligence is another crucial aspect, focusing on the tax obligations and liabilities of a customer. This process involves a detailed analysis of tax records and filings to ensure compliance with tax laws and regulations, helping businesses avoid potential tax-related issues. Operational Due Diligence examines the operational aspects of a business, including its processes, systems, and infrastructure. This process helps businesses identify any operational risks or inefficiencies that could impact their relationship with a customer. Other types of due diligence services may include environmental, social, and governance (ESG) assessments, which evaluate a customer's commitment to sustainable and ethical practices. These various types of due diligence services are essential for businesses to gain a comprehensive understanding of their customers, enabling them to make informed decisions and manage risks effectively.

Financial, Retail, Industrial, Manufacturing, Real Estate, Others in the Global Customer Due Diligence Service Market:

The Global Customer Due Diligence Service Market plays a vital role in various industries, including financial, retail, industrial, manufacturing, real estate, and others. In the financial sector, due diligence services are crucial for banks, insurance companies, and other financial institutions to verify the identity of their customers and assess their risk profile. This helps prevent financial crimes such as money laundering and fraud, ensuring compliance with regulatory requirements. In the retail industry, customer due diligence services help businesses understand their customer base, enabling them to tailor their products and services to meet customer needs and preferences. This can lead to increased customer satisfaction and loyalty, driving business growth. In the industrial and manufacturing sectors, due diligence services are essential for assessing the reliability and credibility of suppliers and partners. This helps businesses mitigate risks associated with supply chain disruptions and ensure the quality and safety of their products. In the real estate industry, due diligence services are used to verify the identity and financial stability of buyers and sellers, ensuring smooth and secure transactions. Other industries, such as healthcare and technology, also benefit from customer due diligence services by ensuring compliance with industry-specific regulations and standards. Overall, the Global Customer Due Diligence Service Market provides valuable insights and risk management solutions for businesses across various sectors, helping them build trust with their customers and protect their reputation.

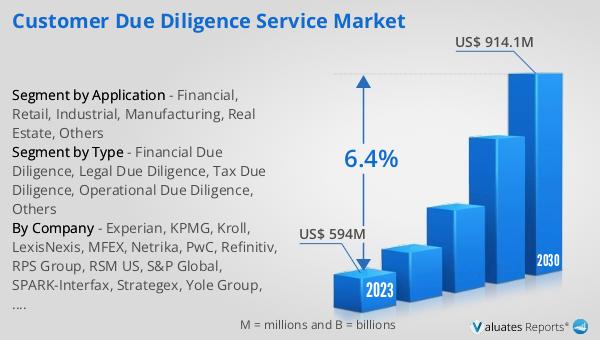

Global Customer Due Diligence Service Market Outlook:

The global market for Customer Due Diligence Service was valued at $666 million in 2024, and it is anticipated to expand to a revised size of $1,022 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.4% during the forecast period. This growth trajectory underscores the increasing importance of customer due diligence services in today's business environment. As companies continue to navigate complex regulatory landscapes and face growing threats from financial crimes, the demand for robust due diligence solutions is expected to rise. The market's expansion is driven by the need for businesses to ensure compliance with international standards, protect their reputation, and build trust with their customers. By leveraging advanced technologies and methodologies, service providers in this market are well-positioned to meet the evolving needs of businesses across various industries. The projected growth of the Global Customer Due Diligence Service Market highlights the critical role these services play in helping organizations manage risks, make informed decisions, and maintain transparency in their operations. As the market continues to evolve, businesses that invest in comprehensive due diligence solutions will be better equipped to navigate the challenges and opportunities of the global marketplace.

| Report Metric | Details |

| Report Name | Customer Due Diligence Service Market |

| Accounted market size in year | US$ 666 million |

| Forecasted market size in 2031 | US$ 1022 million |

| CAGR | 6.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Experian, KPMG, Kroll, LexisNexis, MFEX, Netrika, PwC, Refinitiv, RPS Group, RSM US, S&P Global, SPARK-Interfax, Strategex, Yole Group, Zeidler Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |