What is Global Ultra Low Sulphur Fuel Oil (ULSFO) Market?

The Global Ultra Low Sulphur Fuel Oil (ULSFO) Market is a significant segment within the energy industry, focusing on the production and distribution of fuel oils with extremely low sulfur content. ULSFO is primarily used in maritime applications to comply with international regulations aimed at reducing sulfur emissions, which are harmful to both the environment and human health. The International Maritime Organization (IMO) has set stringent limits on sulfur content in marine fuels, prompting a shift towards ULSFO. This market is driven by the need for cleaner fuel alternatives that help shipping companies meet these regulatory requirements while also reducing their environmental footprint. ULSFO is not only beneficial for the environment but also helps in maintaining the efficiency and longevity of ship engines by reducing the buildup of sulfur-related deposits. As global trade continues to expand, the demand for ULSFO is expected to grow, making it a crucial component of the maritime fuel industry. The market is characterized by technological advancements in refining processes and a growing emphasis on sustainability, which are key factors influencing its development.

Heavy Fuel Oil, Light Fuel Oil in the Global Ultra Low Sulphur Fuel Oil (ULSFO) Market:

Heavy Fuel Oil (HFO) and Light Fuel Oil (LFO) are two distinct types of fuel oils that have traditionally been used in maritime and industrial applications. In the context of the Global Ultra Low Sulphur Fuel Oil (ULSFO) Market, these fuels are undergoing significant transformations. HFO is a dense, viscous fuel that contains higher levels of sulfur and other impurities. It has been widely used in large ships and industrial boilers due to its cost-effectiveness. However, the high sulfur content of HFO poses environmental challenges, contributing to air pollution and acid rain. In response to international regulations, the use of HFO is being phased out in favor of cleaner alternatives like ULSFO. The transition from HFO to ULSFO involves significant changes in fuel handling and storage systems, as ULSFO requires different temperature and viscosity management. On the other hand, Light Fuel Oil (LFO) is a more refined product with lower sulfur content compared to HFO. It is used in smaller vessels and industrial applications where cleaner combustion is required. LFO is more expensive than HFO but offers better environmental performance. In the ULSFO market, LFO serves as a transitional fuel, bridging the gap between traditional high-sulfur fuels and the new generation of ultra-low sulfur options. The shift towards ULSFO is driven by the need to comply with the International Maritime Organization's (IMO) sulfur cap regulations, which limit sulfur content in marine fuels to 0.5% m/m (mass by mass) as of January 2020. This regulatory change has accelerated the adoption of ULSFO, as it offers a viable solution for ship operators seeking to meet compliance without investing in costly exhaust gas cleaning systems, also known as scrubbers. The refining process for ULSFO involves advanced techniques to remove sulfur and other impurities, resulting in a cleaner-burning fuel that reduces emissions of sulfur oxides (SOx) and particulate matter. This not only helps in meeting regulatory requirements but also contributes to improved air quality and reduced health risks associated with air pollution. The transition from HFO and LFO to ULSFO is not without challenges. Ship operators must adapt to new fuel handling procedures, as ULSFO has different storage and temperature requirements compared to traditional fuels. Additionally, the cost of ULSFO is generally higher than that of HFO, which can impact operational budgets. However, the long-term benefits of using ULSFO, including compliance with environmental regulations and potential savings from avoiding penalties, make it an attractive option for the maritime industry. The ULSFO market is also influenced by technological advancements in refining processes, which are aimed at improving fuel quality and reducing production costs. Innovations in catalyst technology and hydrodesulfurization processes are enabling refineries to produce ULSFO more efficiently, thereby increasing its availability and affordability. As the global shipping industry continues to evolve, the demand for ULSFO is expected to grow, driven by the need for cleaner, more sustainable fuel options. The transition from traditional high-sulfur fuels to ULSFO represents a significant shift in the maritime fuel landscape, with implications for ship operators, fuel suppliers, and regulatory bodies. As the industry adapts to these changes, the ULSFO market will play a crucial role in shaping the future of maritime fuel consumption.

Small Oceangoing Ships, Medium Oceangoing Ships, Large and Very Large Oceangoing Ships in the Global Ultra Low Sulphur Fuel Oil (ULSFO) Market:

The usage of Global Ultra Low Sulphur Fuel Oil (ULSFO) varies across different types of oceangoing ships, each with its own set of requirements and challenges. For small oceangoing ships, which typically include vessels like fishing boats, small cargo ships, and ferries, ULSFO offers a practical solution for meeting environmental regulations without the need for extensive modifications to existing engines. These ships often operate in coastal areas where air quality regulations are more stringent, making the use of low-sulfur fuels essential. ULSFO provides a cleaner-burning alternative that helps reduce emissions of sulfur oxides (SOx) and particulate matter, contributing to improved air quality and compliance with local and international regulations. Medium oceangoing ships, such as container ships and bulk carriers, also benefit from the use of ULSFO. These vessels often travel long distances and operate in international waters, where compliance with the International Maritime Organization's (IMO) sulfur cap regulations is mandatory. ULSFO offers a cost-effective solution for these ships, allowing them to meet regulatory requirements without the need for expensive exhaust gas cleaning systems, also known as scrubbers. The use of ULSFO in medium-sized ships helps reduce the environmental impact of shipping operations, contributing to global efforts to combat air pollution and climate change. Large and very large oceangoing ships, including tankers and cruise ships, face unique challenges when it comes to fuel selection. These vessels require significant amounts of fuel to operate, making the cost and availability of ULSFO critical considerations. While the transition to ULSFO may involve higher fuel costs compared to traditional high-sulfur fuels, the long-term benefits of compliance with environmental regulations and the avoidance of potential penalties make it an attractive option. Additionally, the use of ULSFO in large ships helps reduce the risk of sulfur-related engine deposits, which can lead to maintenance issues and reduced engine efficiency. The adoption of ULSFO across different types of oceangoing ships is driven by the need to comply with international regulations and reduce the environmental impact of shipping operations. The transition to ULSFO involves changes in fuel handling and storage procedures, as well as potential modifications to existing engines to accommodate the different properties of low-sulfur fuels. Despite these challenges, the use of ULSFO offers significant benefits, including improved air quality, reduced health risks associated with air pollution, and compliance with regulatory requirements. As the global shipping industry continues to evolve, the demand for ULSFO is expected to grow, driven by the need for cleaner, more sustainable fuel options. The transition from traditional high-sulfur fuels to ULSFO represents a significant shift in the maritime fuel landscape, with implications for ship operators, fuel suppliers, and regulatory bodies. As the industry adapts to these changes, the ULSFO market will play a crucial role in shaping the future of maritime fuel consumption.

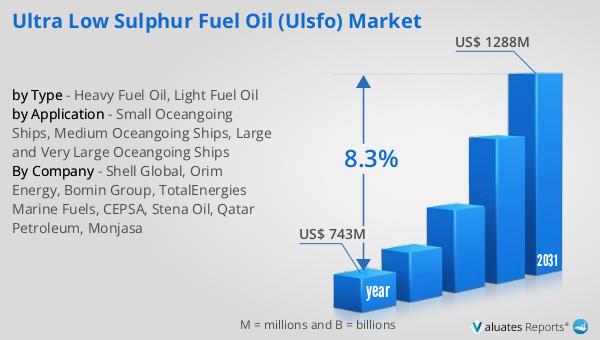

Global Ultra Low Sulphur Fuel Oil (ULSFO) Market Outlook:

In 2024, the global market for Ultra Low Sulphur Fuel Oil (ULSFO) was valued at approximately $743 million. This market is anticipated to expand significantly, reaching an estimated size of $1,288 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 8.3% over the forecast period. The increasing demand for ULSFO is largely driven by stringent environmental regulations aimed at reducing sulfur emissions from maritime vessels. As the shipping industry seeks to comply with these regulations, the adoption of ULSFO is becoming more widespread. This shift is not only a response to regulatory pressures but also a reflection of the industry's commitment to sustainability and environmental responsibility. The transition to ULSFO involves significant changes in fuel handling and storage procedures, as well as potential modifications to existing engines to accommodate the different properties of low-sulfur fuels. Despite these challenges, the use of ULSFO offers significant benefits, including improved air quality, reduced health risks associated with air pollution, and compliance with regulatory requirements. As the global shipping industry continues to evolve, the demand for ULSFO is expected to grow, driven by the need for cleaner, more sustainable fuel options. The transition from traditional high-sulfur fuels to ULSFO represents a significant shift in the maritime fuel landscape, with implications for ship operators, fuel suppliers, and regulatory bodies. As the industry adapts to these changes, the ULSFO market will play a crucial role in shaping the future of maritime fuel consumption.

| Report Metric | Details |

| Report Name | Ultra Low Sulphur Fuel Oil (ULSFO) Market |

| Accounted market size in year | US$ 743 million |

| Forecasted market size in 2031 | US$ 1288 million |

| CAGR | 8.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Shell Global, Orim Energy, Bomin Group, TotalEnergies Marine Fuels, CEPSA, Stena Oil, Qatar Petroleum, Monjasa |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |