What is Global Debt Management and Collections Systems Market?

Global Debt Management and Collections Systems Market refers to the comprehensive range of software solutions and services designed to streamline and enhance the process of managing and collecting debts across various sectors. These systems are crucial for organizations that deal with large volumes of outstanding debts, as they help automate and optimize the entire debt recovery process. By leveraging advanced technologies, these systems enable businesses to efficiently track, manage, and recover debts, thereby improving cash flow and reducing the risk of bad debts. The market encompasses a variety of solutions, including cloud-based and on-premises systems, each offering unique benefits tailored to different organizational needs. As businesses continue to face challenges related to debt recovery, the demand for sophisticated debt management and collections systems is on the rise. These systems not only facilitate better communication and negotiation with debtors but also ensure compliance with regulatory requirements, making them indispensable tools for modern financial management. The global market for these systems is expanding rapidly, driven by the increasing need for efficient debt recovery solutions in an ever-evolving economic landscape.

Cloud-Based, On-Premises in the Global Debt Management and Collections Systems Market:

In the realm of Global Debt Management and Collections Systems Market, two primary deployment models stand out: cloud-based and on-premises solutions. Cloud-based systems are hosted on remote servers and accessed via the internet, offering flexibility and scalability that are particularly beneficial for organizations with fluctuating needs. These systems allow businesses to access their debt management tools from anywhere, at any time, which is a significant advantage in today's increasingly mobile and remote work environments. Cloud-based solutions often come with lower upfront costs, as they eliminate the need for extensive hardware investments and ongoing maintenance. This model is particularly appealing to small and medium-sized enterprises (SMEs) that may not have the resources to invest in extensive IT infrastructure. Additionally, cloud-based systems are typically updated automatically, ensuring that users always have access to the latest features and security enhancements. On the other hand, on-premises solutions are installed directly on a company's local servers and computers. This model offers greater control over data and system configurations, which can be crucial for organizations with stringent data security and compliance requirements. On-premises systems may require a larger initial investment in hardware and IT resources, but they provide a level of customization and integration that some businesses find indispensable. These systems are often preferred by larger enterprises with the capacity to manage and maintain their own IT infrastructure. Both deployment models have their own set of advantages and challenges, and the choice between them often depends on an organization's specific needs, budget, and strategic goals. As the Global Debt Management and Collections Systems Market continues to evolve, businesses must carefully evaluate their options to select the solution that best aligns with their operational requirements and long-term objectives.

Collection Agencies, Finance Companies, Retail Firms, Law Firms, Others in the Global Debt Management and Collections Systems Market:

The Global Debt Management and Collections Systems Market plays a pivotal role in various sectors, including collection agencies, finance companies, retail firms, law firms, and others. Collection agencies, for instance, rely heavily on these systems to streamline their operations and improve recovery rates. By automating routine tasks such as sending reminders and tracking payments, these systems enable agencies to focus on more strategic activities, such as negotiating settlements and developing customized repayment plans. For finance companies, debt management systems are essential tools for maintaining healthy cash flow and minimizing the risk of bad debts. These systems provide comprehensive insights into customer payment behaviors, allowing finance companies to make informed decisions about credit extensions and risk management. Retail firms also benefit from these systems, as they often deal with a high volume of consumer credit transactions. By leveraging debt management solutions, retail firms can efficiently manage customer accounts, reduce delinquency rates, and enhance customer relationships through personalized communication strategies. Law firms, on the other hand, use these systems to manage legal collections and ensure compliance with regulatory requirements. By integrating debt management tools into their practice management systems, law firms can streamline case management, improve client communication, and enhance overall efficiency. Other sectors, such as healthcare and utilities, also utilize debt management and collections systems to manage outstanding payments and improve financial performance. These systems provide a centralized platform for tracking and managing debts, enabling organizations to optimize their recovery processes and achieve better financial outcomes. As the demand for efficient debt management solutions continues to grow, the Global Debt Management and Collections Systems Market is poised to play an increasingly important role in helping organizations across various sectors achieve their financial objectives.

Global Debt Management and Collections Systems Market Outlook:

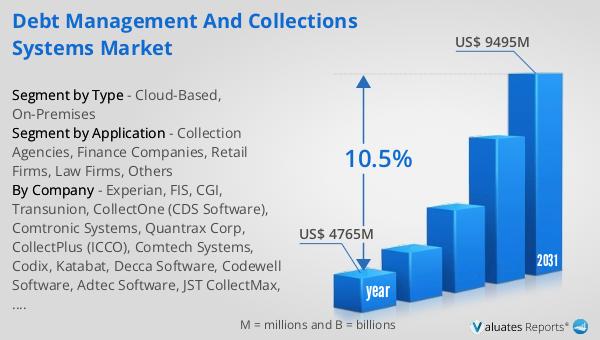

The worldwide market for Debt Management and Collections Systems was estimated to be worth $4,765 million in 2024. It is anticipated to expand to a revised size of $9,495 million by 2031, reflecting a compound annual growth rate (CAGR) of 10.5% over the forecast period. This growth trajectory underscores the increasing demand for efficient debt management solutions across various industries. As organizations strive to optimize their financial operations and improve cash flow, the adoption of advanced debt management systems is becoming more prevalent. These systems offer a range of benefits, including enhanced automation, improved data analytics, and better compliance with regulatory standards. The projected growth in the market is driven by several factors, including the rising volume of consumer and corporate debt, the need for more sophisticated debt recovery strategies, and the increasing emphasis on customer-centric approaches to debt management. As businesses continue to navigate the complexities of the global economic landscape, the demand for robust debt management and collections systems is expected to remain strong. This market outlook highlights the significant opportunities for growth and innovation in the debt management sector, as organizations seek to leverage technology to enhance their financial performance and achieve sustainable success.

| Report Metric | Details |

| Report Name | Debt Management and Collections Systems Market |

| Accounted market size in year | US$ 4765 million |

| Forecasted market size in 2031 | US$ 9495 million |

| CAGR | 10.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Experian, FIS, CGI, Transunion, CollectOne (CDS Software), Comtronic Systems, Quantrax Corp, CollectPlus (ICCO), Comtech Systems, Codix, Katabat, Decca Software, Codewell Software, Adtec Software, JST CollectMax, Indigo Cloud, Pamar Systems, TrioSoft, InterProse, Cogent (AgreeYa), Kuhlekt, Lariat Software, Case Master, Chetu, Qualco, EXUS, FlexysSolutions, Tietoevry, Banqsoft (KMD), Telrock Systems, Spyrosoft, Visma, Ferber-Software, TDX Group (Equifax) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |