What is Global Residential Energy Storage Deployment Systems Market?

The Global Residential Energy Storage Deployment Systems Market is a rapidly evolving sector that focuses on the development and implementation of energy storage solutions for residential use. These systems are designed to store energy generated from renewable sources like solar panels, allowing homeowners to use this stored energy during peak demand times or when renewable energy generation is low. This market is driven by the increasing demand for sustainable and efficient energy solutions, as well as the growing awareness of the environmental impact of traditional energy sources. The systems not only help in reducing electricity bills but also provide a reliable backup during power outages. With advancements in technology, these storage systems are becoming more affordable and efficient, making them accessible to a broader range of consumers. The market is witnessing significant growth due to supportive government policies and incentives aimed at promoting renewable energy adoption. As more countries commit to reducing carbon emissions, the demand for residential energy storage systems is expected to rise, making it a crucial component of the global energy transition.

Li-Ion, Lead-Acid in the Global Residential Energy Storage Deployment Systems Market:

In the Global Residential Energy Storage Deployment Systems Market, two prominent types of battery technologies are widely used: Lithium-Ion (Li-Ion) and Lead-Acid batteries. Li-Ion batteries are known for their high energy density, long lifespan, and efficiency, making them a popular choice for residential energy storage. They are lightweight and compact, which allows for easy installation in homes with limited space. Li-Ion batteries have a high charge and discharge efficiency, meaning they can store and release energy with minimal losses. This efficiency is crucial for maximizing the use of stored renewable energy. Additionally, Li-Ion batteries have a longer cycle life compared to Lead-Acid batteries, which means they can be charged and discharged more times before their performance degrades. This longevity makes them a cost-effective option in the long run, despite their higher initial cost. On the other hand, Lead-Acid batteries have been used for decades and are known for their reliability and low cost. They are more affordable upfront, making them an attractive option for homeowners with budget constraints. However, Lead-Acid batteries have a lower energy density compared to Li-Ion batteries, which means they require more space to store the same amount of energy. They also have a shorter lifespan and lower efficiency, which can result in higher long-term costs. Despite these drawbacks, Lead-Acid batteries are still widely used due to their proven track record and lower initial investment. In the context of the Global Residential Energy Storage Deployment Systems Market, the choice between Li-Ion and Lead-Acid batteries often depends on the specific needs and budget of the homeowner. For those looking for a long-term, efficient solution with minimal maintenance, Li-Ion batteries are the preferred choice. However, for those who prioritize upfront cost savings and are willing to compromise on efficiency and lifespan, Lead-Acid batteries remain a viable option. As technology continues to advance, the gap between these two types of batteries is expected to narrow, with improvements in both efficiency and cost-effectiveness. This ongoing development is likely to influence the dynamics of the market, as consumers weigh the benefits and drawbacks of each technology in their decision-making process.

Collective House, Detached House in the Global Residential Energy Storage Deployment Systems Market:

The usage of Global Residential Energy Storage Deployment Systems Market in collective houses and detached houses varies based on the specific energy needs and structural characteristics of these housing types. In collective houses, which include apartment complexes and multi-family residences, energy storage systems are often implemented to manage the collective energy consumption of the entire building. These systems can store excess energy generated from shared renewable sources, such as rooftop solar panels, and distribute it to individual units as needed. This collective approach not only helps in reducing the overall energy costs for residents but also enhances the building's energy efficiency and sustainability. The integration of energy storage systems in collective houses can also provide a reliable backup power source during outages, ensuring that essential services and common areas remain operational. In detached houses, which are standalone residential units, energy storage systems are typically installed to meet the specific energy needs of the individual household. Homeowners can use these systems to store energy generated from personal renewable sources, such as solar panels, and use it during peak demand times or when the grid supply is interrupted. This autonomy allows homeowners to reduce their reliance on the grid, lower their electricity bills, and contribute to a more sustainable energy future. The flexibility of energy storage systems in detached houses also enables homeowners to customize their energy usage based on their lifestyle and preferences. Whether in collective or detached houses, the adoption of residential energy storage systems is driven by the desire for energy independence, cost savings, and environmental sustainability. As the Global Residential Energy Storage Deployment Systems Market continues to grow, more homeowners and building managers are recognizing the benefits of integrating these systems into their energy management strategies. This trend is expected to accelerate as technology advances and the cost of energy storage systems continues to decrease, making them more accessible to a wider range of consumers.

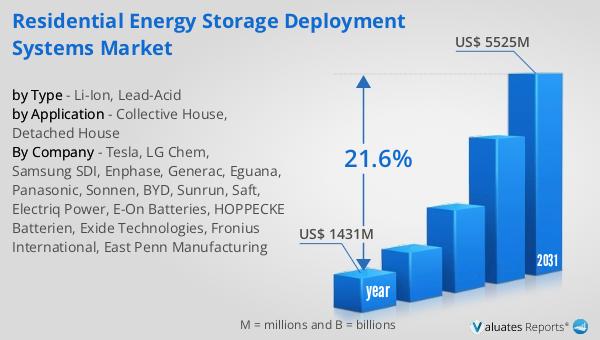

Global Residential Energy Storage Deployment Systems Market Outlook:

The global market for Residential Energy Storage Deployment Systems was valued at $1,431 million in 2024 and is anticipated to expand to a revised size of $5,525 million by 2031, reflecting a robust compound annual growth rate (CAGR) of 21.6% over the forecast period. China, Europe, and the United States are at the forefront of this market's development, collectively accounting for a significant 86% of the global market share. According to statistics from the China Energy Storage Alliance (CNESA), by the end of 2022, the total installed capacity of power energy storage projects operational in China reached 59.8 gigawatts (GW), representing 25% of the total global market scale and showcasing an impressive annual growth rate of 38%. This rapid growth is indicative of the increasing demand for energy storage solutions as countries strive to enhance their energy security and transition towards more sustainable energy systems. The substantial market share held by China, Europe, and the United States underscores their commitment to advancing energy storage technologies and integrating them into their energy infrastructure. As these regions continue to invest in and develop their energy storage capabilities, they are setting a precedent for other countries to follow, driving the global market forward.

| Report Metric | Details |

| Report Name | Residential Energy Storage Deployment Systems Market |

| Accounted market size in year | US$ 1431 million |

| Forecasted market size in 2031 | US$ 5525 million |

| CAGR | 21.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Tesla, LG Chem, Samsung SDI, Enphase, Generac, Eguana, Panasonic, Sonnen, BYD, Sunrun, Saft, Electriq Power, E-On Batteries, HOPPECKE Batterien, Exide Technologies, Fronius International, East Penn Manufacturing |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |