What is Global Fintech Technologies Market?

The Global Fintech Technologies Market refers to the worldwide industry that focuses on the integration of technology into financial services. This market encompasses a wide range of innovations aimed at enhancing and automating the delivery and use of financial services. Fintech, short for financial technology, includes everything from mobile banking and insurance to cryptocurrency and investment apps. The market is driven by the increasing demand for digital financial solutions, which offer convenience, speed, and accessibility to users. As traditional financial institutions face competition from tech-savvy startups, they are compelled to adopt fintech solutions to stay relevant. The global fintech market is characterized by rapid technological advancements, regulatory changes, and evolving consumer expectations. It plays a crucial role in financial inclusion, providing access to financial services for unbanked and underbanked populations. The market is also marked by significant investments and partnerships, as companies strive to innovate and capture market share. Overall, the Global Fintech Technologies Market is a dynamic and rapidly evolving sector that is reshaping the financial landscape by leveraging technology to meet the needs of modern consumers.

Mobile Based, Web Based in the Global Fintech Technologies Market:

In the Global Fintech Technologies Market, mobile-based and web-based platforms are pivotal in delivering financial services to consumers and businesses alike. Mobile-based fintech solutions primarily focus on leveraging smartphones and tablets to provide financial services. These solutions include mobile banking apps, digital wallets, and peer-to-peer payment systems. The convenience of accessing financial services on-the-go has led to a surge in the adoption of mobile-based fintech solutions. Users can perform a wide range of financial activities, such as transferring money, paying bills, and managing investments, all from their mobile devices. The integration of biometric authentication and advanced encryption technologies ensures the security of transactions, fostering trust among users. On the other hand, web-based fintech solutions are accessed through internet browsers on desktops and laptops. These platforms offer a comprehensive suite of financial services, including online banking, investment management, and financial planning tools. Web-based solutions are particularly popular among businesses and individuals who require more detailed financial analysis and management capabilities. They often provide a more extensive range of features compared to mobile apps, catering to users who prefer a more in-depth financial management experience. Both mobile-based and web-based fintech solutions are integral to the Global Fintech Technologies Market, as they cater to different user preferences and needs. The seamless integration of these platforms with traditional financial systems has enabled a more inclusive and efficient financial ecosystem. As technology continues to evolve, the distinction between mobile and web-based solutions is becoming increasingly blurred, with many fintech companies offering cross-platform services that provide a consistent user experience across devices. This convergence is driving innovation and competition in the market, as companies strive to offer the most user-friendly and feature-rich solutions. The rise of mobile and web-based fintech solutions has also led to increased financial literacy, as users gain access to a wealth of information and tools that empower them to make informed financial decisions. Overall, the Global Fintech Technologies Market is witnessing a transformation driven by mobile and web-based solutions, which are reshaping the way financial services are delivered and consumed.

Security Solutions, Payment Solutions, Wealth Management, Insurance, Others in the Global Fintech Technologies Market:

The Global Fintech Technologies Market is revolutionizing various areas of financial services, including security solutions, payment solutions, wealth management, insurance, and others. In the realm of security solutions, fintech technologies are enhancing the protection of financial data and transactions. Advanced encryption, biometric authentication, and blockchain technology are being employed to safeguard sensitive information and prevent fraud. These innovations are crucial in building trust among users and ensuring the integrity of financial systems. Payment solutions are another key area where fintech is making a significant impact. Digital wallets, contactless payments, and peer-to-peer transfer apps are streamlining the payment process, making it faster and more convenient for consumers and businesses. These solutions are particularly beneficial in regions with limited access to traditional banking services, as they provide an alternative means of conducting transactions. In wealth management, fintech technologies are democratizing access to investment opportunities. Robo-advisors and online trading platforms are enabling individuals to manage their investments with ease and at a lower cost compared to traditional financial advisors. These tools provide personalized investment advice and portfolio management, empowering users to make informed decisions about their financial future. The insurance sector is also experiencing a transformation due to fintech innovations. Insurtech solutions are leveraging data analytics and artificial intelligence to offer personalized insurance products and streamline the claims process. This not only enhances the customer experience but also improves the efficiency of insurance providers. Beyond these areas, fintech technologies are being applied in various other sectors, such as lending, crowdfunding, and regulatory compliance. Peer-to-peer lending platforms are providing alternative financing options for individuals and small businesses, while crowdfunding platforms are enabling entrepreneurs to raise capital for their ventures. Regtech solutions are helping financial institutions comply with regulatory requirements more efficiently, reducing the risk of non-compliance and associated penalties. Overall, the Global Fintech Technologies Market is driving significant changes across the financial services industry, offering innovative solutions that enhance efficiency, accessibility, and user experience.

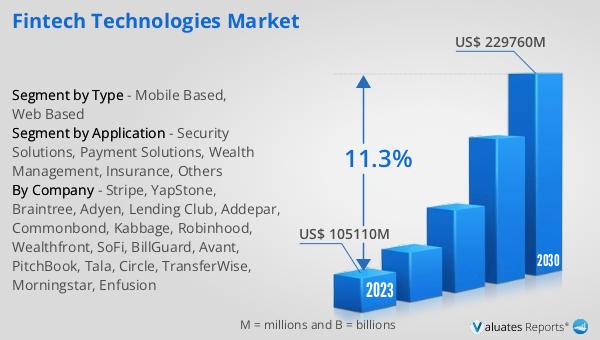

Global Fintech Technologies Market Outlook:

The outlook for the Global Fintech Technologies Market indicates a promising future, with substantial growth anticipated over the coming years. According to market analysis, the global fintech market is expected to expand from $120,860 million in 2024 to $229,760 million by 2030. This growth represents a compound annual growth rate (CAGR) of 11.3% during the forecast period. This impressive growth trajectory is driven by several factors, including the increasing adoption of digital financial services, technological advancements, and the growing demand for convenient and efficient financial solutions. As consumers and businesses continue to embrace digital transformation, the fintech market is poised to capitalize on this trend by offering innovative products and services that cater to evolving needs. The market's expansion is also supported by the rising investments in fintech startups and the strategic partnerships between traditional financial institutions and technology companies. These collaborations are fostering innovation and enabling the development of cutting-edge solutions that enhance the delivery of financial services. Furthermore, the global fintech market is benefiting from the increasing focus on financial inclusion, as fintech solutions provide access to financial services for underserved populations. Overall, the Global Fintech Technologies Market is set to experience robust growth, driven by the convergence of technology and finance, and the continuous evolution of consumer expectations.

| Report Metric | Details |

| Report Name | Fintech Technologies Market |

| Accounted market size in 2024 | US$ 120860 million |

| Forecasted market size in 2030 | US$ 229760 million |

| CAGR | 11.3 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Stripe, YapStone, Braintree, Adyen, Lending Club, Addepar, Commonbond, Kabbage, Robinhood, Wealthfront, SoFi, BillGuard, Avant, PitchBook, Tala, Circle, TransferWise, Morningstar, Enfusion |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |