What is Global Family Travel Insurance Market?

The Global Family Travel Insurance Market is a specialized segment of the insurance industry that caters to families traveling domestically and internationally. This market provides coverage for unforeseen events that can occur during travel, such as medical emergencies, trip cancellations, lost luggage, and other travel-related issues. Family travel insurance is designed to offer peace of mind to families by ensuring that they are financially protected against unexpected incidents that could disrupt their travel plans. The market has seen growth due to the increasing number of families opting for vacations and the rising awareness of the importance of travel insurance. With the globalization of travel and the ease of booking trips online, more families are seeking comprehensive insurance packages that cover all members, including children and elderly relatives. This market is characterized by a variety of insurance products tailored to meet the diverse needs of families, ranging from single-trip coverage to annual multi-trip policies. As travel becomes more accessible and affordable, the demand for family travel insurance is expected to continue its upward trajectory, providing a safety net for families exploring new destinations.

Single Trip Coverage, Annual Multi Trip Coverage, Other in the Global Family Travel Insurance Market:

Single Trip Coverage in the Global Family Travel Insurance Market is a popular option for families planning a one-time vacation or trip. This type of coverage is ideal for families who do not travel frequently but want to ensure they are protected during their journey. Single trip coverage typically includes benefits such as medical expenses, trip cancellation, lost or delayed baggage, and personal liability. It is designed to cover the duration of a specific trip, from the start date to the end date, providing peace of mind for families who may encounter unexpected events during their travels. This coverage is often customizable, allowing families to select the level of protection that best suits their needs and budget. On the other hand, Annual Multi Trip Coverage is tailored for families who travel multiple times within a year. This type of policy offers the convenience of not having to purchase insurance for each trip, as it covers all trips taken within a 12-month period. Annual multi-trip coverage is cost-effective for frequent travelers and provides comprehensive protection similar to single trip coverage, including medical emergencies, trip cancellations, and baggage issues. Families who travel often find this option appealing as it saves time and money while ensuring continuous coverage. Other types of coverage in the Global Family Travel Insurance Market may include specialized policies for adventure travel, winter sports, or cruises. These policies are designed to address the unique risks associated with specific types of travel activities. For instance, adventure travel insurance may cover activities such as hiking, skiing, or scuba diving, which are not typically included in standard travel insurance policies. Similarly, cruise insurance may offer additional benefits such as missed port departure or cabin confinement due to illness. These specialized policies provide families with the flexibility to choose coverage that aligns with their travel plans and activities. Overall, the Global Family Travel Insurance Market offers a wide range of coverage options to meet the diverse needs of families, ensuring they can travel with confidence and security.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Family Travel Insurance Market:

The usage of the Global Family Travel Insurance Market extends across various sectors, including Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and Others. Insurance Intermediaries play a crucial role in connecting families with suitable travel insurance products. They act as a bridge between insurance providers and consumers, offering expert advice and assistance in selecting the right policy. Intermediaries help families navigate the complexities of insurance terms and conditions, ensuring they understand the coverage they are purchasing. Insurance Companies are the primary providers of family travel insurance policies. They design and underwrite insurance products, setting the terms, conditions, and pricing. These companies invest in research and development to create innovative insurance solutions that cater to the evolving needs of families. They also handle claims processing, providing support to families in the event of an incident during their travels. Banks often partner with insurance companies to offer travel insurance as part of their financial services portfolio. Many banks provide travel insurance as an add-on to credit card holders, offering convenience and added value to their customers. This partnership allows banks to enhance their service offerings while providing families with easy access to travel insurance. Insurance Brokers are independent agents who work on behalf of families to find the best travel insurance policies. They have access to a wide range of insurance products from different providers, allowing them to compare and recommend the most suitable options for their clients. Brokers offer personalized service, taking into account the specific needs and preferences of each family. Other entities involved in the Global Family Travel Insurance Market may include travel agencies, online platforms, and affinity groups. Travel agencies often bundle travel insurance with vacation packages, providing a one-stop solution for families planning their trips. Online platforms offer a convenient way for families to compare and purchase travel insurance policies from the comfort of their homes. Affinity groups, such as alumni associations or professional organizations, may offer group travel insurance plans to their members, providing additional benefits and discounts. Overall, the Global Family Travel Insurance Market is supported by a diverse network of stakeholders, each playing a vital role in ensuring families have access to reliable and comprehensive travel insurance coverage.

Global Family Travel Insurance Market Outlook:

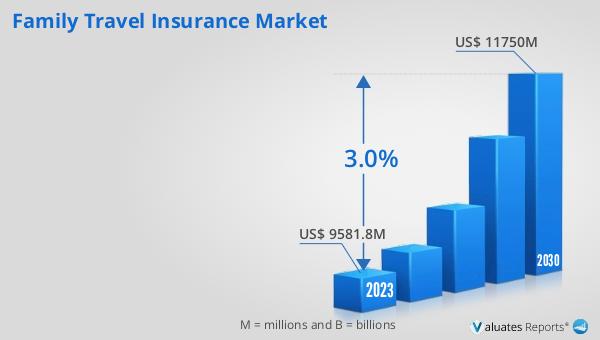

The outlook for the Global Family Travel Insurance Market indicates a steady growth trajectory over the coming years. The market is anticipated to expand from a valuation of approximately $9,840.5 million in 2024 to around $11,750 million by 2030. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 3.0% during the forecast period. This upward trend can be attributed to several factors, including the increasing awareness of the importance of travel insurance among families, the rising number of family vacations, and the growing accessibility of international travel. As more families recognize the potential risks associated with travel, the demand for comprehensive insurance coverage is likely to increase. Additionally, advancements in technology and the proliferation of online platforms have made it easier for families to research and purchase travel insurance, further driving market growth. Insurance providers are also continuously innovating their product offerings to cater to the diverse needs of families, introducing new coverage options and benefits. This dynamic market environment is expected to foster competition among insurance companies, leading to improved services and competitive pricing for consumers. Overall, the Global Family Travel Insurance Market is poised for growth, providing families with the protection and peace of mind they need to enjoy their travel experiences.

| Report Metric | Details |

| Report Name | Family Travel Insurance Market |

| Accounted market size in 2024 | US$ 9840.5 million |

| Forecasted market size in 2030 | US$ 11750 million |

| CAGR | 3.0 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, Munich RE, Generali, Tokio Marine, Sompo Japan, CSA Travel Protection, AXA, Pingan Baoxian, Mapfre Asistencia, USI Affinity, Seven Corners, Hanse Merkur, MH Ross, STARR |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |