What is Global Business Car Insurance Market?

The Global Business Car Insurance Market refers to the worldwide industry that provides insurance coverage specifically tailored for vehicles used in business operations. This market encompasses a wide range of insurance products designed to protect businesses from financial losses associated with vehicle-related incidents. These incidents can include accidents, theft, or damage to vehicles that are used for business purposes. The market is driven by the increasing number of businesses that rely on vehicles for their operations, such as delivery services, transportation companies, and sales teams. As businesses expand globally, the demand for comprehensive car insurance solutions that offer protection across different regions and comply with various regulatory requirements is growing. This market is characterized by a diverse range of insurance providers, including traditional insurance companies, specialized business insurers, and emerging insurtech firms that leverage technology to offer innovative insurance solutions. The Global Business Car Insurance Market is expected to continue evolving as businesses seek more customized and flexible insurance options to meet their unique needs and mitigate risks associated with their vehicle fleets.

Standard Full Car Insurance, Business Full Car Insurance in the Global Business Car Insurance Market:

Standard Full Car Insurance and Business Full Car Insurance are two distinct types of coverage within the Global Business Car Insurance Market, each catering to different needs and circumstances. Standard Full Car Insurance is typically designed for individual vehicle owners and provides comprehensive coverage that includes protection against a wide range of risks such as accidents, theft, fire, and natural disasters. This type of insurance is ideal for personal vehicle owners who want to ensure that they are financially protected in the event of unforeseen incidents. It usually covers the cost of repairs or replacement of the vehicle, medical expenses for injuries sustained in an accident, and liability for damages caused to other parties. On the other hand, Business Full Car Insurance is specifically tailored for businesses that use vehicles as part of their operations. This type of insurance offers coverage for a fleet of vehicles, providing protection against similar risks as standard insurance but with additional features that cater to the unique needs of businesses. For instance, Business Full Car Insurance often includes coverage for loss of income due to vehicle downtime, protection for goods being transported, and liability coverage for employees driving company vehicles. This insurance is crucial for businesses that rely heavily on their vehicles, as it helps mitigate financial losses and ensures business continuity in the event of vehicle-related incidents. The Global Business Car Insurance Market is witnessing a growing demand for Business Full Car Insurance as more companies recognize the importance of safeguarding their assets and operations. Insurance providers in this market are continuously innovating to offer more comprehensive and flexible solutions that address the evolving needs of businesses. This includes offering customizable policies that allow businesses to choose the level of coverage that best suits their operations, as well as leveraging technology to streamline the claims process and enhance customer experience. As businesses continue to expand and operate in diverse environments, the need for robust Business Full Car Insurance solutions will remain a key driver of growth in the Global Business Car Insurance Market.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Business Car Insurance Market:

The Global Business Car Insurance Market plays a crucial role in various sectors, including Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, and others. Insurance Intermediaries act as a bridge between insurance providers and businesses seeking coverage. They help businesses navigate the complex landscape of car insurance by offering expert advice and assistance in selecting the most suitable policies. These intermediaries are essential in the Global Business Car Insurance Market as they facilitate the distribution of insurance products and ensure that businesses have access to the coverage they need. Insurance Companies are the primary providers of car insurance products in this market. They design and offer a wide range of policies that cater to the diverse needs of businesses. These companies invest in research and development to create innovative insurance solutions that address emerging risks and challenges faced by businesses. In the Global Business Car Insurance Market, insurance companies play a pivotal role in driving growth by continuously enhancing their product offerings and expanding their reach to new markets. Banks also participate in the Global Business Car Insurance Market by offering insurance products as part of their financial services portfolio. Many banks have established partnerships with insurance companies to provide bundled financial solutions that include car insurance coverage. This integration allows businesses to access comprehensive financial services under one roof, simplifying the process of managing their insurance needs. Insurance Brokers are independent professionals who work on behalf of businesses to find the best insurance solutions available in the market. They leverage their expertise and industry knowledge to negotiate favorable terms and conditions for their clients. In the Global Business Car Insurance Market, brokers play a vital role in ensuring that businesses receive competitive rates and comprehensive coverage that aligns with their specific requirements. Other stakeholders in this market include technology providers and regulatory bodies that influence the development and implementation of car insurance products. Technology providers offer innovative solutions that enhance the efficiency and effectiveness of insurance processes, such as digital platforms for policy management and claims processing. Regulatory bodies establish the legal framework within which the Global Business Car Insurance Market operates, ensuring that insurance providers adhere to industry standards and protect the interests of businesses. Overall, the Global Business Car Insurance Market is a dynamic ecosystem that involves multiple stakeholders working together to deliver comprehensive insurance solutions that meet the evolving needs of businesses worldwide.

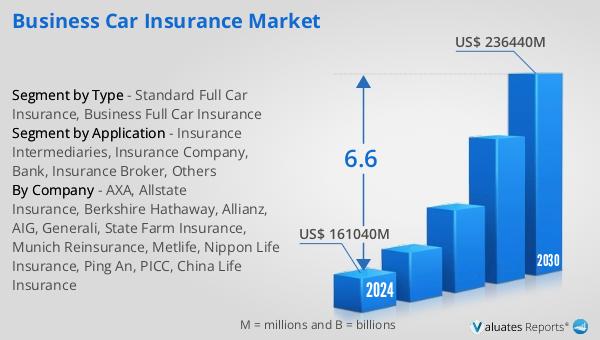

Global Business Car Insurance Market Outlook:

The outlook for the Global Business Car Insurance Market indicates a promising trajectory of growth over the coming years. According to projections, the market is expected to expand from a valuation of US$ 161,040 million in 2024 to US$ 236,440 million by 2030. This growth is anticipated to occur at a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period. This upward trend reflects the increasing demand for business car insurance solutions as companies continue to recognize the importance of protecting their vehicle assets and ensuring operational continuity. The projected growth in the Global Business Car Insurance Market can be attributed to several factors. Firstly, the rising number of businesses that rely on vehicles for their operations is driving the demand for comprehensive insurance coverage. As companies expand their fleets and operate in diverse environments, the need for robust insurance solutions becomes more critical. Additionally, advancements in technology are enabling insurance providers to offer more innovative and tailored products that cater to the specific needs of businesses. This includes the use of telematics and data analytics to assess risk more accurately and provide personalized coverage options. Furthermore, the increasing awareness of the financial risks associated with vehicle-related incidents is prompting businesses to invest in comprehensive insurance solutions. This growing awareness is driving the demand for Business Full Car Insurance, which offers coverage for a range of risks and ensures that businesses can continue their operations without significant financial disruptions. As the Global Business Car Insurance Market continues to evolve, insurance providers are expected to focus on enhancing their product offerings and expanding their reach to new markets. This includes developing more flexible and customizable policies that address the unique needs of businesses and leveraging technology to streamline the claims process and improve customer experience. Overall, the outlook for the Global Business Car Insurance Market is positive, with significant growth opportunities on the horizon as businesses increasingly prioritize the protection of their vehicle assets.

| Report Metric | Details |

| Report Name | Business Car Insurance Market |

| Accounted market size in 2024 | US$ 161040 in million |

| Forecasted market size in 2030 | US$ 236440 million |

| CAGR | 6.6 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA, Allstate Insurance, Berkshire Hathaway, Allianz, AIG, Generali, State Farm Insurance, Munich Reinsurance, Metlife, Nippon Life Insurance, Ping An, PICC, China Life Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |