What is Pharmaceutical Butyl Rubber Stoppers - Global Market?

Pharmaceutical butyl rubber stoppers are essential components in the packaging of various medical and pharmaceutical products. These stoppers are primarily used to seal vials, bottles, and other containers that hold medications, ensuring the contents remain sterile and uncontaminated. The global market for pharmaceutical butyl rubber stoppers is driven by the increasing demand for safe and effective drug delivery systems. Butyl rubber, known for its excellent impermeability and resistance to chemicals, is the material of choice for these stoppers. It provides a reliable barrier against moisture, air, and other contaminants, which is crucial for maintaining the integrity and efficacy of pharmaceutical products. The market is witnessing growth due to the rising prevalence of chronic diseases, which necessitates the use of injectable drugs and vaccines. Additionally, advancements in drug formulations and the development of new biologics are further propelling the demand for high-quality butyl rubber stoppers. As pharmaceutical companies continue to innovate and expand their product offerings, the need for robust and reliable packaging solutions like butyl rubber stoppers is expected to increase, making it a vital component of the global pharmaceutical packaging industry.

Bromobutyl Rubber Stoppers, Chlorobutyl Rubber Stoppers in the Pharmaceutical Butyl Rubber Stoppers - Global Market:

Bromobutyl and chlorobutyl rubber stoppers are specialized types of pharmaceutical butyl rubber stoppers, each offering unique properties that cater to specific needs within the pharmaceutical industry. Bromobutyl rubber stoppers are made by incorporating bromine into the butyl rubber polymer, enhancing its chemical resistance and reducing permeability to gases and moisture. This makes bromobutyl stoppers particularly suitable for sensitive medications that require a high level of protection from environmental factors. They are often used in the packaging of vaccines and biologics, where maintaining sterility and stability is paramount. On the other hand, chlorobutyl rubber stoppers are produced by adding chlorine to the butyl rubber, which improves its heat resistance and mechanical strength. Chlorobutyl stoppers are commonly used in applications where the drug product undergoes sterilization processes that involve high temperatures, such as autoclaving. Both bromobutyl and chlorobutyl stoppers offer excellent resealability, ensuring that the container remains airtight even after multiple punctures by a syringe needle. This feature is crucial for multi-dose vials, where maintaining the sterility of the remaining contents is essential. The choice between bromobutyl and chlorobutyl stoppers depends on the specific requirements of the pharmaceutical product, including its chemical composition, storage conditions, and intended use. As the pharmaceutical industry continues to evolve, the demand for these specialized rubber stoppers is expected to grow, driven by the need for more sophisticated and reliable packaging solutions. The global market for bromobutyl and chlorobutyl rubber stoppers is characterized by a high level of competition, with numerous manufacturers striving to develop innovative products that meet the stringent quality standards set by regulatory authorities. Companies are investing in research and development to enhance the performance of these stoppers, focusing on improving their barrier properties, reducing extractables and leachables, and ensuring compatibility with a wide range of drug formulations. As a result, pharmaceutical companies have access to a diverse array of stoppers that can be tailored to meet the specific needs of their products, ensuring the safety and efficacy of the medications they deliver to patients worldwide.

Big Infusion, Antibiotic, Freeze-Dried in the Pharmaceutical Butyl Rubber Stoppers - Global Market:

Pharmaceutical butyl rubber stoppers play a crucial role in various medical applications, including big infusion, antibiotic, and freeze-dried products. In the context of big infusion, these stoppers are used to seal large-volume parenteral solutions, which are administered intravenously to patients. The stoppers must provide an airtight seal to prevent contamination and ensure the sterility of the solution throughout its shelf life. Butyl rubber's excellent impermeability to gases and moisture makes it an ideal material for this purpose, as it helps maintain the stability and efficacy of the infusion solution. In the case of antibiotics, butyl rubber stoppers are used to seal vials containing powdered or liquid formulations. These medications often require reconstitution before administration, and the stoppers must allow for easy access while maintaining the sterility of the contents. Butyl rubber's resealability ensures that the vial remains airtight even after multiple punctures, which is essential for multi-dose antibiotic vials. Additionally, the chemical resistance of butyl rubber prevents interactions between the stopper and the antibiotic, preserving the drug's potency and safety. For freeze-dried products, also known as lyophilized drugs, butyl rubber stoppers are used to seal vials during the freeze-drying process and subsequent storage. These products are highly sensitive to moisture, and the stoppers must provide an effective barrier to protect the drug from degradation. Butyl rubber's low permeability to water vapor makes it an excellent choice for freeze-dried applications, ensuring the long-term stability and efficacy of the product. Furthermore, the stoppers must withstand the extreme temperatures involved in the freeze-drying process without compromising their integrity or performance. Overall, pharmaceutical butyl rubber stoppers are indispensable in ensuring the safety, efficacy, and stability of a wide range of medical products, making them a critical component of the global pharmaceutical packaging market.

Pharmaceutical Butyl Rubber Stoppers - Global Market Outlook:

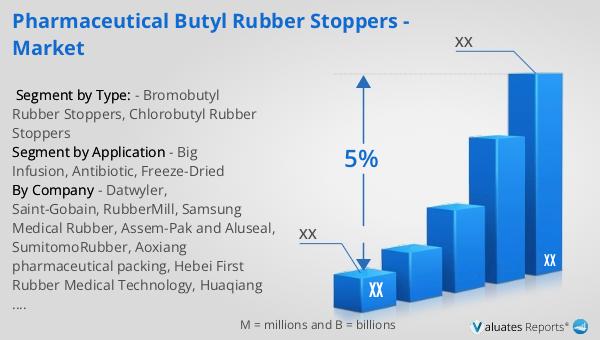

The global pharmaceutical market was valued at approximately 1,475 billion USD in 2022, with projections indicating a steady growth rate of 5% annually over the next six years. This growth is driven by various factors, including the increasing prevalence of chronic diseases, advancements in drug development, and the rising demand for innovative therapies. In comparison, the chemical drug market has also shown significant growth, expanding from 1,005 billion USD in 2018 to an estimated 1,094 billion USD in 2022. This increase reflects the ongoing demand for chemical-based medications, which continue to play a vital role in treating a wide range of health conditions. The pharmaceutical industry's growth is further supported by the expansion of healthcare infrastructure, increased access to healthcare services, and the growing emphasis on personalized medicine. As the market continues to evolve, pharmaceutical companies are investing in research and development to create new and improved drug formulations, driving the demand for high-quality packaging solutions like butyl rubber stoppers. These stoppers are essential for maintaining the integrity and safety of pharmaceutical products, ensuring that patients receive effective and reliable treatments. The global market for pharmaceutical butyl rubber stoppers is expected to benefit from these trends, as the need for secure and efficient drug delivery systems becomes increasingly important in the healthcare landscape.

| Report Metric | Details |

| Report Name | Pharmaceutical Butyl Rubber Stoppers - Market |

| CAGR | 5% |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Datwyler, Saint-Gobain, RubberMill, Samsung Medical Rubber, Assem-Pak and Aluseal, SumitomoRubber, Aoxiang pharmaceutical packing, Hebei First Rubber Medical Technology, Huaqiang High-Tech, Best New Medical Material, Hualan New Pharmaceutical Material, Shandong Pharmaceutical Glass, Huaneng Medical Rubber Products, Geili Packaging Material, Aido Medicinal Glass, Aobo Glass Products, Shandong Guohui New Material, Huaren Pharmaceutical |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |