What is X-ray Imaging Devices - Global Market?

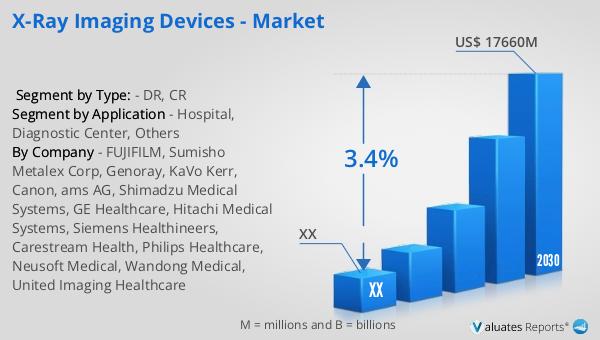

X-ray imaging devices are essential tools in the medical field, providing critical insights into the human body without invasive procedures. These devices use electromagnetic radiation to capture images of the internal structures, such as bones and organs, helping in the diagnosis and treatment of various medical conditions. The global market for X-ray imaging devices is vast and continuously evolving, driven by technological advancements and increasing demand for efficient diagnostic tools. In 2023, the market was valued at approximately US$ 13,910 million, with projections indicating a growth to US$ 17,660 million by 2030. This growth is expected to occur at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. The market is highly competitive, with the top three manufacturers holding a significant share of 45.33% in 2019, while the top five accounted for 58.8%. This competitive landscape underscores the importance of innovation and strategic positioning for companies operating in this sector. As healthcare needs continue to expand globally, the demand for advanced X-ray imaging solutions is likely to rise, making this market a critical area of focus for medical device manufacturers and healthcare providers alike.

DR, CR in the X-ray Imaging Devices - Global Market:

Digital Radiography (DR) and Computed Radiography (CR) are two prominent technologies in the X-ray imaging devices market, each offering unique advantages and applications. DR is a modern form of X-ray imaging where digital X-ray sensors are used instead of traditional photographic film. This technology provides immediate image preview and availability, eliminating the need for chemical processing. DR systems are known for their high efficiency, reduced radiation exposure, and superior image quality, making them ideal for a wide range of medical applications. The ability to quickly share and store digital images enhances workflow efficiency in medical facilities, contributing to better patient care. On the other hand, CR is a transitional technology between traditional film-based X-rays and fully digital systems. It uses a cassette-based system where the X-ray image is captured on a phosphor plate, which is then scanned to produce a digital image. While CR systems are generally more affordable than DR systems, they require additional steps for image processing, which can slow down the workflow. However, CR remains a viable option for facilities looking to upgrade from film-based systems without the higher costs associated with DR. Both DR and CR technologies are integral to the global X-ray imaging devices market, catering to different needs and budgets of healthcare providers. The choice between DR and CR often depends on factors such as budget constraints, required image quality, and workflow efficiency. As the market continues to grow, advancements in both technologies are expected to further enhance their capabilities, offering improved diagnostic accuracy and patient outcomes. The ongoing development in sensor technology, image processing software, and integration with other medical systems is likely to drive the adoption of these technologies across various healthcare settings. Additionally, the increasing focus on reducing radiation exposure and improving patient safety is pushing manufacturers to innovate and develop more advanced X-ray imaging solutions. As a result, both DR and CR are expected to play a crucial role in the future of medical imaging, providing healthcare professionals with the tools they need to deliver high-quality care.

Hospital, Diagnostic Center, Others in the X-ray Imaging Devices - Global Market:

X-ray imaging devices are extensively used in hospitals, diagnostic centers, and other healthcare facilities, each serving distinct purposes and patient needs. In hospitals, X-ray imaging is a fundamental diagnostic tool used across various departments, including emergency, orthopedics, and surgery. The ability to quickly obtain detailed images of bones, organs, and tissues allows healthcare professionals to make informed decisions about patient care. For instance, in emergency departments, X-ray imaging is crucial for diagnosing fractures, detecting foreign objects, and assessing trauma injuries. In surgical settings, X-rays are often used to guide procedures and ensure the correct placement of medical devices. The integration of advanced X-ray technologies, such as DR and CR, in hospitals enhances diagnostic accuracy and improves patient outcomes. Diagnostic centers, on the other hand, specialize in providing imaging services to patients referred by physicians for specific diagnostic purposes. These centers often have a high throughput of patients, requiring efficient and reliable imaging solutions. X-ray imaging devices in diagnostic centers are used for a wide range of examinations, from routine chest X-rays to more complex studies like mammography and dental imaging. The use of digital X-ray systems in these centers allows for quick image acquisition and processing, enabling timely diagnosis and treatment planning. The ability to store and share digital images also facilitates collaboration among healthcare providers, improving the overall quality of care. Beyond hospitals and diagnostic centers, X-ray imaging devices are also used in other settings, such as veterinary clinics, research institutions, and industrial applications. In veterinary medicine, X-ray imaging is essential for diagnosing and treating injuries and illnesses in animals. Research institutions use X-ray imaging for various scientific studies, including material analysis and biological research. In industrial applications, X-ray imaging is used for non-destructive testing and quality control, ensuring the integrity and safety of products. The versatility and wide range of applications of X-ray imaging devices make them indispensable tools in both medical and non-medical fields. As technology continues to advance, the capabilities and applications of X-ray imaging devices are expected to expand, offering new opportunities for innovation and growth in the global market.

X-ray Imaging Devices - Global Market Outlook:

The global market for X-ray imaging devices was valued at approximately US$ 13,910 million in 2023, with expectations to reach a revised size of US$ 17,660 million by 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 3.4% during the forecast period from 2024 to 2030. The market is characterized by intense competition, with the top three manufacturers accounting for a significant 45.33% of the market share in 2019. Meanwhile, the top five manufacturers collectively held 58.8% of the market share. This competitive landscape highlights the importance of innovation and strategic positioning for companies operating in this sector. As the demand for advanced diagnostic tools continues to rise, driven by factors such as an aging population and increasing prevalence of chronic diseases, the market for X-ray imaging devices is poised for significant growth. Companies that can offer cutting-edge technology, superior image quality, and efficient workflow solutions are likely to gain a competitive edge in this dynamic market. The ongoing advancements in digital radiography and computed radiography, along with the integration of artificial intelligence and machine learning, are expected to further enhance the capabilities of X-ray imaging devices, driving their adoption across various healthcare settings. As a result, the global market for X-ray imaging devices presents significant opportunities for growth and innovation, making it a critical area of focus for medical device manufacturers and healthcare providers alike.

| Report Metric | Details |

| Report Name | X-ray Imaging Devices - Market |

| Forecasted market size in 2030 | US$ 17660 million |

| CAGR | 3.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | FUJIFILM, Sumisho Metalex Corp, Genoray, KaVo Kerr, Canon, ams AG, Shimadzu Medical Systems, GE Healthcare, Hitachi Medical Systems, Siemens Healthineers, Carestream Health, Philips Healthcare, Neusoft Medical, Wandong Medical, United Imaging Healthcare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |