What is Connected Cars Insurance - Global Market?

Connected Cars Insurance is a rapidly evolving segment within the global automotive insurance market. This type of insurance leverages advanced technology embedded in modern vehicles to offer more personalized and efficient coverage options. Connected cars are equipped with internet connectivity and a range of sensors that collect data on driving behavior, vehicle usage, and even environmental conditions. This data is then used by insurance companies to tailor insurance policies more accurately to the individual driver’s risk profile. The global market for Connected Cars Insurance is gaining traction as more consumers and businesses recognize the benefits of such tailored insurance solutions. These benefits include potentially lower premiums for safe drivers, quicker claims processing, and enhanced customer service. As the automotive industry continues to innovate with smart technologies, the demand for connected car insurance is expected to grow, offering new opportunities for insurers to differentiate themselves in a competitive market. The integration of telematics and data analytics is at the core of this market, enabling insurers to offer dynamic pricing models and real-time risk assessments. This shift towards data-driven insurance solutions is transforming the traditional insurance landscape, making it more responsive and customer-centric.

Liability Coverage, Collision Coverage, Comprehensive Coverage in the Connected Cars Insurance - Global Market:

Liability Coverage, Collision Coverage, and Comprehensive Coverage are three fundamental components of Connected Cars Insurance in the global market. Liability Coverage is designed to protect the policyholder from financial losses if they are found responsible for causing injury or damage to another person or their property. In the context of connected cars, liability coverage can be more accurately assessed using data collected from the vehicle. This data can provide insights into driving habits, such as speed, braking patterns, and adherence to traffic rules, allowing insurers to better evaluate the risk associated with each driver. This personalized assessment can lead to more competitive premium rates for drivers who demonstrate safe driving behaviors. Collision Coverage, on the other hand, covers the cost of repairing or replacing the policyholder's vehicle in the event of an accident, regardless of who is at fault. Connected cars, with their advanced sensors and cameras, can provide detailed information about the circumstances of a collision, such as the speed at impact, the angle of collision, and even the weather conditions at the time. This data can help insurers process claims more efficiently and accurately, reducing the time and cost associated with traditional claims investigations. Comprehensive Coverage offers protection against non-collision-related incidents, such as theft, vandalism, or natural disasters. The connectivity features of modern vehicles can enhance this coverage by providing real-time alerts and tracking capabilities. For instance, if a connected car is stolen, its GPS system can help locate the vehicle quickly, increasing the chances of recovery and minimizing losses. Additionally, sensors can detect environmental hazards, such as hail or flooding, and alert the driver to take preventive measures, potentially reducing the likelihood of damage. Overall, the integration of connected car technology into these coverage types allows for a more tailored and efficient insurance experience, benefiting both insurers and policyholders. By leveraging real-time data and analytics, insurers can offer more accurate pricing, faster claims processing, and enhanced risk management, ultimately leading to a more sustainable and customer-focused insurance market.

Passengers Vehicles, Goods Vehicles in the Connected Cars Insurance - Global Market:

The usage of Connected Cars Insurance in passenger vehicles and goods vehicles presents unique opportunities and challenges in the global market. For passenger vehicles, connected car insurance offers a more personalized approach to coverage, taking into account individual driving behaviors and patterns. This is particularly beneficial for families and individuals who use their vehicles for daily commuting and leisure activities. The data collected from connected cars can help insurers assess the risk associated with each driver more accurately, leading to potentially lower premiums for those who demonstrate safe driving habits. Additionally, connected car technology can enhance the overall driving experience by providing real-time feedback and safety alerts, encouraging safer driving practices. For goods vehicles, such as trucks and delivery vans, connected car insurance can play a crucial role in fleet management and operational efficiency. The data collected from these vehicles can provide insights into driver performance, vehicle maintenance needs, and route optimization. This information can help fleet managers make informed decisions to improve safety, reduce fuel consumption, and minimize downtime. Moreover, connected car insurance can offer tailored coverage options that address the specific risks associated with commercial vehicle operations, such as cargo theft or damage. By leveraging the connectivity features of modern vehicles, insurers can offer more comprehensive and flexible coverage solutions that meet the unique needs of both passenger and goods vehicles. This not only enhances the value proposition for policyholders but also helps insurers differentiate themselves in a competitive market. As the adoption of connected car technology continues to grow, the global market for connected car insurance is expected to expand, offering new opportunities for innovation and collaboration between insurers, automakers, and technology providers.

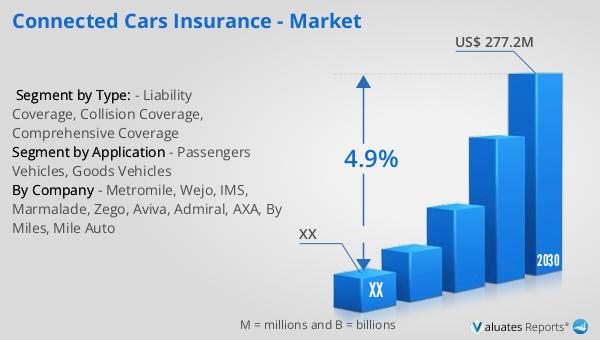

Connected Cars Insurance - Global Market Outlook:

The global market for Connected Cars Insurance was valued at approximately $100 million in 2023, with projections indicating a significant growth trajectory. By 2030, the market is expected to reach an adjusted size of $277.2 million, reflecting a compound annual growth rate (CAGR) of 4.9% during the forecast period from 2024 to 2030. This growth is driven by the increasing adoption of connected car technologies and the rising demand for personalized insurance solutions. Currently, over 90% of the world's automobiles are concentrated in Asia, Europe, and North America. Asia leads in automobile production, accounting for 56% of the global output, followed by Europe at 20% and North America at 16%. This concentration of automotive production in these regions presents a significant opportunity for the expansion of connected car insurance, as more vehicles are equipped with advanced connectivity features. The integration of telematics and data analytics into insurance offerings is transforming the traditional insurance landscape, making it more responsive and customer-centric. As the automotive industry continues to innovate with smart technologies, the demand for connected car insurance is expected to grow, offering new opportunities for insurers to differentiate themselves in a competitive market. The shift towards data-driven insurance solutions is enabling insurers to offer dynamic pricing models and real-time risk assessments, ultimately leading to a more sustainable and customer-focused insurance market.

| Report Metric | Details |

| Report Name | Connected Cars Insurance - Market |

| Forecasted market size in 2030 | US$ 277.2 million |

| CAGR | 4.9% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Metromile, Wejo, IMS, Marmalade, Zego, Aviva, Admiral, AXA, By Miles, Mile Auto |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |