What is Nylon Engineering Plastics - Global Market?

Nylon engineering plastics are a significant segment within the global plastics market, known for their exceptional mechanical properties and versatility. These materials are primarily composed of polyamide resins, which are synthesized through the polymerization of caprolactam or hexamethylene diamine with adipic acid. Nylon engineering plastics are renowned for their high strength, durability, and resistance to wear and chemicals, making them ideal for a wide range of applications. They are used extensively in industries such as automotive, electrical and electronics, and consumer goods, where their ability to withstand high temperatures and mechanical stress is highly valued. The global market for nylon engineering plastics is driven by the increasing demand for lightweight and high-performance materials that can replace metals in various applications, contributing to energy efficiency and cost savings. As industries continue to innovate and seek sustainable solutions, the demand for nylon engineering plastics is expected to grow, supported by advancements in manufacturing technologies and the development of new formulations that enhance their properties and expand their application scope.

PA6, PA66, Others in the Nylon Engineering Plastics - Global Market:

Nylon engineering plastics are categorized into several types, with PA6 and PA66 being the most prominent, alongside other variants. PA6, or Polyamide 6, is known for its excellent balance of strength, toughness, and flexibility. It is produced through the polymerization of caprolactam and is widely used in applications requiring high impact resistance and fatigue endurance. PA6 is favored in the automotive industry for components like gears, bearings, and under-the-hood parts due to its ability to withstand harsh environments and mechanical stress. Additionally, PA6 is used in the production of industrial machinery and consumer goods, where its properties contribute to product longevity and performance. On the other hand, PA66, or Polyamide 66, is synthesized from hexamethylene diamine and adipic acid, offering superior mechanical strength and thermal stability compared to PA6. This makes PA66 ideal for applications that demand high load-bearing capacity and resistance to high temperatures, such as in the manufacturing of engine components, electrical connectors, and structural parts. PA66's rigidity and dimensional stability also make it suitable for precision engineering applications. Beyond PA6 and PA66, other nylon variants like PA11 and PA12 are gaining attention for their unique properties. PA11, derived from renewable sources, offers excellent chemical resistance and flexibility, making it suitable for applications in the automotive and oil and gas industries. PA12, known for its low moisture absorption and high impact resistance, is used in the production of flexible tubing, cable sheathing, and sports equipment. The diversity of nylon engineering plastics allows manufacturers to select the most appropriate material based on specific application requirements, balancing factors such as cost, performance, and environmental impact. As the global market for nylon engineering plastics evolves, innovations in polymer chemistry and processing technologies are expected to enhance the properties of these materials, further expanding their application potential across various industries.

Automobile Industry, Electrical & Electronics, Appliances, Mechanical Equipment, Others in the Nylon Engineering Plastics - Global Market:

Nylon engineering plastics play a crucial role in several industries due to their unique properties and versatility. In the automobile industry, these materials are used extensively to manufacture components that require high strength, durability, and resistance to wear and heat. Nylon engineering plastics are employed in the production of engine parts, fuel system components, and interior and exterior trims, contributing to vehicle weight reduction and improved fuel efficiency. Their ability to withstand high temperatures and mechanical stress makes them ideal for under-the-hood applications, where they replace traditional metal parts, offering cost savings and enhanced performance. In the electrical and electronics sector, nylon engineering plastics are used to produce connectors, switches, and housings, where their insulating properties and resistance to electrical arcing are highly valued. These materials ensure the safety and reliability of electronic devices, contributing to the miniaturization and efficiency of modern electronics. In the appliances industry, nylon engineering plastics are used in the production of components such as gears, bearings, and housings, where their strength and resistance to wear and chemicals enhance the durability and performance of household appliances. In mechanical equipment, nylon engineering plastics are used to manufacture parts that require high mechanical strength and resistance to wear, such as gears, bearings, and bushings. Their ability to reduce friction and wear extends the lifespan of machinery and reduces maintenance costs. Beyond these industries, nylon engineering plastics find applications in various other sectors, including consumer goods, sports equipment, and medical devices, where their properties contribute to product innovation and performance. As industries continue to seek lightweight, durable, and cost-effective materials, the demand for nylon engineering plastics is expected to grow, driven by advancements in material science and processing technologies that enhance their properties and expand their application scope.

Nylon Engineering Plastics - Global Market Outlook:

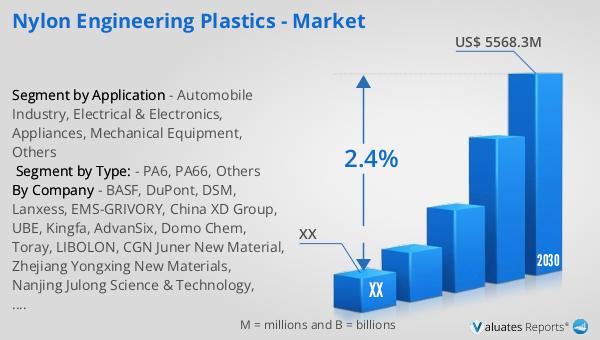

The global market for nylon engineering plastics was valued at approximately $4.7 billion in 2023, with projections indicating a growth to around $5.57 billion by 2030, reflecting a compound annual growth rate (CAGR) of 2.4% from 2024 to 2030. This growth is driven by the increasing demand for high-performance materials across various industries, including automotive, electrical and electronics, and consumer goods. Key players in the PA66 engineering plastics market include prominent companies such as Akro-plastic GmbH, Asahi Kasei, Ascend, BASF, and Celanese, which are at the forefront of innovation and development in this sector. North America holds the largest market share, accounting for approximately 50% of the global market, followed by Europe with a 30% share. This regional dominance is attributed to the strong presence of automotive and electronics industries in these regions, which are major consumers of nylon engineering plastics. The market's growth is further supported by advancements in manufacturing technologies and the development of new formulations that enhance the properties of nylon engineering plastics, making them suitable for a wider range of applications. As industries continue to innovate and seek sustainable solutions, the demand for nylon engineering plastics is expected to grow, driven by their ability to replace traditional materials and contribute to energy efficiency and cost savings.

| Report Metric | Details |

| Report Name | Nylon Engineering Plastics - Market |

| Forecasted market size in 2030 | US$ 5568.3 million |

| CAGR | 2.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | BASF, DuPont, DSM, Lanxess, EMS-GRIVORY, China XD Group, UBE, Kingfa, AdvanSix, Domo Chem, Toray, LIBOLON, CGN Juner New Material, Zhejiang Yongxing New Materials, Nanjing Julong Science & Technology, Nytex, Nanjing DELLON |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |