What is Digital Payment And Security - Global Market?

Digital payment and security refer to the systems and technologies that facilitate electronic transactions and protect these transactions from fraud and unauthorized access. The global market for digital payment and security is rapidly expanding as more consumers and businesses shift towards cashless transactions. This market encompasses a wide range of solutions, including mobile payments, online banking, e-wallets, and secure payment gateways. The growth of this market is driven by the increasing adoption of smartphones, the proliferation of the internet, and the demand for convenient and secure payment methods. Additionally, advancements in technology, such as blockchain and artificial intelligence, are enhancing the security and efficiency of digital payment systems. As businesses and consumers become more aware of the benefits of digital payments, such as speed, convenience, and enhanced security, the demand for these solutions is expected to continue rising. The market is also influenced by regulatory frameworks and standards that aim to protect consumer data and ensure secure transactions. Overall, the digital payment and security market is a dynamic and evolving sector that plays a crucial role in the global economy.

Mobile-based, Web-based in the Digital Payment And Security - Global Market:

Mobile-based and web-based digital payment solutions are integral components of the digital payment and security global market. Mobile-based payments refer to transactions conducted via mobile devices, such as smartphones and tablets. These payments can be made through various methods, including mobile wallets, mobile banking apps, and contactless payment systems like NFC (Near Field Communication). The convenience of mobile payments lies in their accessibility; users can make transactions anytime and anywhere, provided they have an internet connection. Mobile payments are particularly popular in regions with high smartphone penetration and are often used for peer-to-peer transfers, bill payments, and in-store purchases. Security in mobile payments is enhanced through technologies like biometric authentication, tokenization, and encryption, which protect user data and prevent unauthorized access. On the other hand, web-based payments involve transactions conducted over the internet using a computer or mobile device. These payments are typically made through online banking, e-commerce platforms, or payment gateways. Web-based payments offer the advantage of being able to conduct transactions from the comfort of one's home or office. They are widely used for online shopping, subscription services, and bill payments. Security measures for web-based payments include SSL (Secure Socket Layer) encryption, two-factor authentication, and fraud detection systems. These measures ensure that sensitive information, such as credit card details and personal data, is protected during online transactions. Both mobile-based and web-based payment solutions are essential for the growth of the digital payment and security market. They cater to different consumer preferences and needs, providing flexibility and convenience. As technology continues to evolve, these payment methods are becoming more sophisticated, with enhanced security features and improved user experiences. For instance, the integration of artificial intelligence and machine learning in payment systems is helping to detect and prevent fraudulent activities in real-time. Additionally, the use of blockchain technology is providing a decentralized and secure platform for conducting digital transactions. The global market for digital payment and security is also influenced by regulatory frameworks and standards that aim to protect consumer data and ensure secure transactions. Governments and regulatory bodies worldwide are implementing policies to enhance the security of digital payments and protect consumers from fraud. These regulations often require payment service providers to comply with strict security standards and undergo regular audits. Compliance with these regulations is crucial for gaining consumer trust and ensuring the long-term success of digital payment solutions. In conclusion, mobile-based and web-based payment solutions are driving the growth of the digital payment and security global market. They offer convenience, flexibility, and enhanced security, making them popular choices for consumers and businesses alike. As technology continues to advance, these payment methods are expected to become even more secure and user-friendly, further fueling the growth of the digital payment and security market.

BFSI, Retail, IT and Telecom, Travel and Hospitality, Other in the Digital Payment And Security - Global Market:

The usage of digital payment and security solutions spans across various industries, including BFSI (Banking, Financial Services, and Insurance), retail, IT and telecom, travel and hospitality, and others. In the BFSI sector, digital payment solutions are transforming the way financial transactions are conducted. Banks and financial institutions are increasingly adopting digital payment systems to offer their customers a seamless and secure banking experience. Mobile banking apps, online banking platforms, and digital wallets are some of the popular digital payment solutions used in this sector. These solutions enable customers to perform transactions, such as fund transfers, bill payments, and account management, with ease and convenience. Security is a top priority in the BFSI sector, and digital payment solutions are equipped with advanced security features, such as encryption, biometric authentication, and fraud detection systems, to protect customer data and prevent unauthorized access. In the retail industry, digital payment solutions are revolutionizing the way consumers shop and pay for goods and services. E-commerce platforms, mobile payment apps, and contactless payment systems are widely used in this sector to provide customers with a convenient and secure shopping experience. Digital payment solutions enable retailers to offer multiple payment options, such as credit/debit cards, digital wallets, and buy-now-pay-later services, to cater to different customer preferences. Security is a critical aspect of digital payments in the retail sector, and retailers are implementing robust security measures, such as tokenization and encryption, to protect customer data and prevent fraud. The IT and telecom industry is also leveraging digital payment solutions to enhance customer experience and streamline billing processes. Telecom companies are adopting digital payment systems to offer their customers a convenient way to pay for services, such as mobile recharges, bill payments, and subscription services. Digital payment solutions enable telecom companies to offer flexible payment options and improve customer satisfaction. Security is a key concern in this industry, and digital payment solutions are equipped with advanced security features to protect customer data and prevent unauthorized access. In the travel and hospitality industry, digital payment solutions are enhancing the way customers book and pay for travel services. Online travel agencies, airlines, and hotels are adopting digital payment systems to offer their customers a seamless booking and payment experience. Digital payment solutions enable customers to book flights, hotels, and other travel services with ease and convenience. Security is a top priority in this industry, and digital payment solutions are equipped with advanced security features to protect customer data and prevent fraud. Other industries, such as healthcare, education, and entertainment, are also adopting digital payment solutions to enhance customer experience and streamline payment processes. Digital payment solutions enable these industries to offer their customers a convenient and secure way to pay for services, such as medical bills, tuition fees, and entertainment subscriptions. Security is a critical aspect of digital payments in these industries, and digital payment solutions are equipped with advanced security features to protect customer data and prevent unauthorized access. In conclusion, digital payment and security solutions are transforming various industries by offering convenient, secure, and flexible payment options. As technology continues to evolve, these solutions are expected to become even more sophisticated, further enhancing the way businesses and consumers conduct transactions.

Digital Payment And Security - Global Market Outlook:

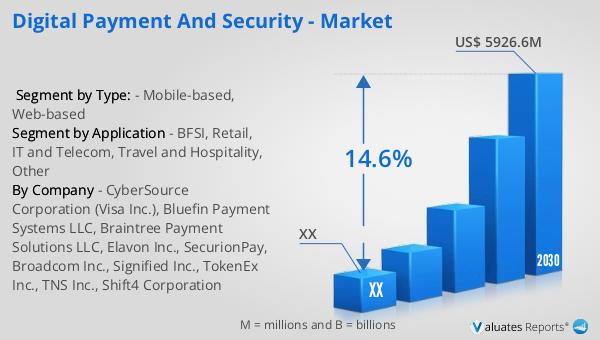

The global digital payment and security market was valued at approximately $2,315 million in 2023. It is projected to grow significantly, reaching an estimated size of $5,926.6 million by 2030. This growth is expected to occur at a compound annual growth rate (CAGR) of 14.6% during the forecast period from 2024 to 2030. The North American segment of this market also shows promising growth potential. Although specific figures for the North American market in 2023 and 2030 are not provided, it is anticipated to experience a similar upward trend during the same forecast period. The increasing adoption of digital payment solutions, driven by technological advancements and the demand for secure and convenient payment methods, is a key factor contributing to this growth. Additionally, regulatory frameworks and standards aimed at enhancing the security of digital payments are expected to further boost market expansion. As businesses and consumers continue to embrace digital payment solutions, the global market for digital payment and security is poised for substantial growth in the coming years. This growth will likely be characterized by the development of more advanced and secure payment technologies, catering to the evolving needs of consumers and businesses worldwide.

| Report Metric | Details |

| Report Name | Digital Payment And Security - Market |

| Forecasted market size in 2030 | US$ 5926.6 million |

| CAGR | 14.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | CyberSource Corporation (Visa Inc.), Bluefin Payment Systems LLC, Braintree Payment Solutions LLC, Elavon Inc., SecurionPay, Broadcom Inc., Signified Inc., TokenEx Inc., TNS Inc., Shift4 Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |