What is Commodity Trading, Transaction, and Risk Management (CTRM) Software - Global Market?

Commodity Trading, Transaction, and Risk Management (CTRM) software is a specialized tool designed to streamline and enhance the processes involved in trading commodities. Commodities, which include raw materials like oil, gas, metals, and agricultural products, are traded globally, and managing these trades can be complex. CTRM software helps traders, companies, and financial institutions manage the entire lifecycle of a commodity transaction, from initial trade to final settlement. It provides functionalities for tracking market prices, managing contracts, and assessing risks associated with trading activities. The software also aids in compliance with regulatory requirements, ensuring that all transactions are conducted within legal frameworks. By offering real-time data and analytics, CTRM software enables users to make informed decisions, optimize trading strategies, and mitigate risks. This software is crucial for businesses that deal with high volumes of commodity trades, as it helps in reducing operational costs and improving efficiency. As the global market for commodities continues to grow, the demand for robust CTRM solutions is also on the rise, making it an essential tool for modern commodity trading operations.

Cloud Based, Web Based in the Commodity Trading, Transaction, and Risk Management (CTRM) Software - Global Market:

Cloud-based and web-based CTRM software solutions have revolutionized the way commodity trading firms operate by offering flexibility, scalability, and accessibility. Cloud-based CTRM software is hosted on remote servers and accessed via the internet, allowing users to access the system from anywhere with an internet connection. This model eliminates the need for on-premises infrastructure, reducing IT costs and maintenance efforts. Cloud-based solutions are particularly beneficial for companies with multiple locations or remote teams, as they provide a centralized platform for managing trades and transactions. The scalability of cloud-based CTRM software allows businesses to easily adjust their resources based on demand, ensuring they only pay for what they use. Additionally, cloud-based solutions often come with automatic updates and security features, ensuring that the software is always up-to-date and protected against cyber threats. On the other hand, web-based CTRM software is accessed through a web browser and can be hosted either on the cloud or on local servers. This type of software offers similar benefits to cloud-based solutions, such as accessibility and ease of use, but may require more IT resources if hosted on-premises. Web-based CTRM software is ideal for companies that prefer to maintain control over their data and infrastructure while still enjoying the convenience of a web-accessible platform. Both cloud-based and web-based CTRM solutions support real-time data processing and analytics, enabling traders to make quick and informed decisions. They also facilitate collaboration among team members by providing a shared platform for communication and data sharing. As the global market for commodities becomes increasingly competitive, the adoption of cloud-based and web-based CTRM software is expected to grow, driven by the need for efficient and agile trading operations. These solutions not only enhance operational efficiency but also provide a competitive edge by enabling companies to respond swiftly to market changes and capitalize on trading opportunities. Furthermore, the integration capabilities of cloud-based and web-based CTRM software allow businesses to connect with other systems and platforms, such as ERP and CRM systems, creating a seamless flow of information across the organization. This integration is crucial for maintaining accurate and up-to-date records, improving decision-making, and ensuring compliance with industry regulations. In summary, cloud-based and web-based CTRM software solutions offer numerous advantages for commodity trading firms, including cost savings, scalability, accessibility, and enhanced collaboration. As technology continues to advance, these solutions are likely to become even more sophisticated, providing traders with the tools they need to succeed in the dynamic and fast-paced world of commodity trading.

Large Enterprises, SMEs in the Commodity Trading, Transaction, and Risk Management (CTRM) Software - Global Market:

The usage of Commodity Trading, Transaction, and Risk Management (CTRM) software in large enterprises and SMEs (Small and Medium-sized Enterprises) varies significantly due to differences in scale, resources, and operational needs. Large enterprises, which often deal with high volumes of commodity trades across multiple markets and regions, require robust CTRM solutions that can handle complex transactions and provide comprehensive risk management capabilities. For these organizations, CTRM software is essential for managing the entire trading lifecycle, from contract negotiation to settlement. It helps streamline operations by automating routine tasks, reducing manual errors, and improving data accuracy. Large enterprises benefit from the advanced analytics and reporting features of CTRM software, which provide insights into market trends, trading performance, and risk exposure. These insights enable large enterprises to optimize their trading strategies, enhance decision-making, and maintain a competitive edge in the market. Additionally, CTRM software supports compliance with regulatory requirements, ensuring that large enterprises adhere to industry standards and avoid costly penalties. On the other hand, SMEs may have different priorities when it comes to CTRM software. While they may not deal with the same volume of trades as large enterprises, SMEs still face challenges in managing their trading activities efficiently. For SMEs, CTRM software offers a cost-effective solution for streamlining operations and improving risk management. By automating processes and providing real-time data, CTRM software helps SMEs reduce operational costs and improve efficiency. The scalability of modern CTRM solutions is particularly beneficial for SMEs, as it allows them to start with a basic package and expand their capabilities as their business grows. This flexibility ensures that SMEs can access the tools they need without incurring unnecessary expenses. Furthermore, CTRM software enables SMEs to compete with larger players by providing access to the same level of data and analytics, leveling the playing field in the competitive commodity trading market. In conclusion, while the usage of CTRM software may differ between large enterprises and SMEs, both types of organizations can benefit from its capabilities. Large enterprises rely on CTRM software to manage complex trading operations and maintain compliance, while SMEs use it to streamline processes and enhance competitiveness. As the global market for commodities continues to evolve, the adoption of CTRM software is expected to increase among both large enterprises and SMEs, driven by the need for efficient and effective trading solutions.

Commodity Trading, Transaction, and Risk Management (CTRM) Software - Global Market Outlook:

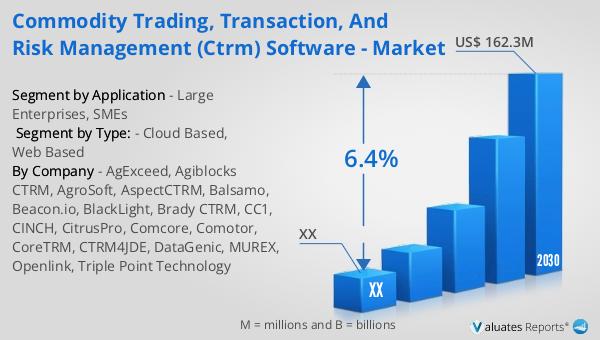

In 2023, the global market for Commodity Trading, Transaction, and Risk Management (CTRM) software was valued at approximately $104 million. Looking ahead, this market is projected to grow significantly, reaching an estimated size of $162.3 million by the year 2030. This growth represents a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2024 to 2030. The increasing demand for efficient and effective trading solutions is a key driver of this growth, as businesses seek to optimize their trading operations and manage risks more effectively. The adoption of advanced technologies, such as cloud-based and web-based CTRM solutions, is also contributing to the expansion of the market. These technologies offer numerous benefits, including cost savings, scalability, and enhanced collaboration, making them attractive options for both large enterprises and SMEs. As the global market for commodities continues to evolve, the need for robust CTRM software solutions is expected to grow, providing businesses with the tools they need to succeed in the competitive and dynamic world of commodity trading. This positive market outlook highlights the importance of CTRM software in modern trading operations and underscores its potential for continued growth in the coming years.

| Report Metric | Details |

| Report Name | Commodity Trading, Transaction, and Risk Management (CTRM) Software - Market |

| Forecasted market size in 2030 | US$ 162.3 million |

| CAGR | 6.4% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | AgExceed, Agiblocks CTRM, AgroSoft, AspectCTRM, Balsamo, Beacon.io, BlackLight, Brady CTRM, CC1, CINCH, CitrusPro, Comcore, Comotor, CoreTRM, CTRM4JDE, DataGenic, MUREX, Openlink, Triple Point Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |