What is Global Smartphone Image Sensors Market?

The Global Smartphone Image Sensors Market refers to the industry that produces and sells image sensors specifically designed for smartphones. Image sensors are crucial components in smartphones as they convert light into electronic signals, enabling the capture of photos and videos. These sensors are responsible for the quality of the images and videos that smartphones can produce. The market for these sensors has been growing rapidly due to the increasing demand for high-quality cameras in smartphones. As consumers continue to seek better camera performance for photography, social media, and video recording, manufacturers are investing heavily in advanced image sensor technologies. This market encompasses various types of image sensors, including CMOS (Complementary Metal-Oxide-Semiconductor) and CCD (Charge-Coupled Device) sensors, each with its own set of advantages and applications. The growth of this market is driven by technological advancements, increasing smartphone penetration, and the rising popularity of mobile photography.

CMOS, CCD in the Global Smartphone Image Sensors Market:

CMOS (Complementary Metal-Oxide-Semiconductor) and CCD (Charge-Coupled Device) are two primary types of image sensors used in the Global Smartphone Image Sensors Market. CMOS sensors are widely favored in the smartphone industry due to their lower power consumption, faster processing speeds, and cost-effectiveness. These sensors integrate amplifiers and noise-correction circuits directly onto the chip, allowing for quicker image processing and reduced power usage, which is crucial for battery-operated devices like smartphones. CMOS sensors also offer high-speed image capture, making them ideal for applications requiring rapid image processing, such as burst photography and video recording. On the other hand, CCD sensors are known for their superior image quality and low noise levels. They excel in capturing high-resolution images with excellent color accuracy and dynamic range. However, CCD sensors consume more power and are generally more expensive to produce compared to CMOS sensors. This makes them less common in smartphones, where battery life and cost are significant considerations. Despite this, some high-end smartphones may still use CCD sensors for specific applications where image quality is paramount. Both CMOS and CCD sensors have their unique advantages and are chosen based on the specific requirements of the smartphone camera. The continuous advancements in sensor technology are pushing the boundaries of what these sensors can achieve, leading to better image quality, enhanced low-light performance, and more sophisticated camera features in smartphones.

Android, iPhone in the Global Smartphone Image Sensors Market:

The usage of Global Smartphone Image Sensors Market in Android and iPhone devices is extensive and varied, reflecting the diverse needs and preferences of consumers. In Android smartphones, image sensors are used across a wide range of devices, from budget-friendly models to high-end flagship phones. Manufacturers like Samsung, Google, and OnePlus leverage advanced CMOS sensors to deliver exceptional camera performance. These sensors enable features such as high-resolution photography, 4K video recording, and advanced computational photography techniques like HDR (High Dynamic Range) and Night Mode. Android devices often emphasize versatility, offering multiple camera setups with wide-angle, telephoto, and macro lenses, all powered by sophisticated image sensors. On the other hand, iPhones, known for their consistent and high-quality camera performance, also rely heavily on advanced image sensors. Apple uses custom-designed CMOS sensors in its iPhones, optimized for seamless integration with its proprietary image processing algorithms. This synergy between hardware and software results in stunning image quality, accurate color reproduction, and excellent low-light performance. Features like Portrait Mode, Deep Fusion, and Smart HDR are made possible by these advanced sensors. Both Android and iPhone devices continue to push the envelope in mobile photography, driven by the relentless innovation in image sensor technology. As a result, consumers can enjoy increasingly better camera capabilities, making smartphones a preferred choice for capturing life's moments.

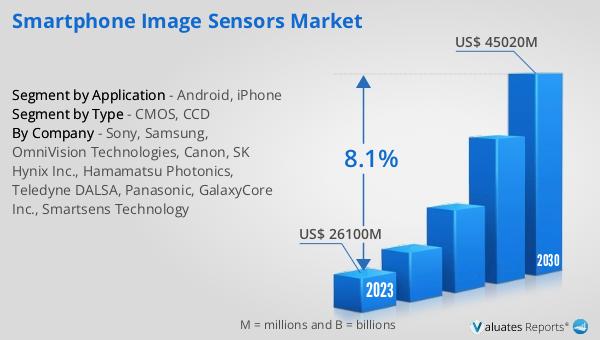

Global Smartphone Image Sensors Market Outlook:

The global market for smartphone image sensors was valued at approximately $26.1 billion in 2023. Projections indicate that this market is expected to grow significantly, reaching around $45.02 billion by 2030. This growth is anticipated to occur at a compound annual growth rate (CAGR) of 8.1% during the forecast period from 2024 to 2030. This robust growth can be attributed to several factors, including the increasing demand for high-quality cameras in smartphones, continuous technological advancements in image sensor technology, and the rising popularity of mobile photography. As consumers continue to seek better camera performance for various applications such as social media, video recording, and professional photography, manufacturers are investing heavily in developing advanced image sensors. This investment is driving the market forward, resulting in improved image quality, enhanced low-light performance, and more sophisticated camera features in smartphones. The future of the Global Smartphone Image Sensors Market looks promising, with significant growth opportunities on the horizon.

| Report Metric | Details |

| Report Name | Smartphone Image Sensors Market |

| Accounted market size in 2023 | US$ 26100 million |

| Forecasted market size in 2030 | US$ 45020 million |

| CAGR | 8.1% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Sony, Samsung, OmniVision Technologies, Canon, SK Hynix Inc., Hamamatsu Photonics, Teledyne DALSA, Panasonic, GalaxyCore Inc., Smartsens Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |