What is Global Financial Cloud Solutions Market?

The Global Financial Cloud Solutions Market refers to the sector that provides cloud-based services specifically tailored for financial institutions. These solutions enable banks, insurance companies, securities firms, and other financial entities to store, manage, and process data on remote servers accessed via the internet. This market encompasses a variety of services, including data storage, computing power, and software applications, all delivered through the cloud. The primary benefits of these solutions include cost savings, scalability, enhanced security, and improved efficiency. Financial institutions can leverage these cloud services to streamline operations, reduce IT infrastructure costs, and enhance their ability to innovate and respond to market changes quickly. As the financial industry continues to evolve, the demand for robust, secure, and flexible cloud solutions is expected to grow, driving further advancements and adoption in this market.

Software As A Service, Infrastructure As A Service, Platform As A Service in the Global Financial Cloud Solutions Market:

Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS) are three key components of the Global Financial Cloud Solutions Market. SaaS involves delivering software applications over the internet, eliminating the need for financial institutions to install and maintain software on their own servers. This model allows banks, insurance companies, and securities firms to access a wide range of applications, such as customer relationship management (CRM), enterprise resource planning (ERP), and financial analytics tools, on a subscription basis. SaaS offers the advantage of regular updates, scalability, and reduced upfront costs, making it an attractive option for financial institutions looking to enhance their operational efficiency and customer service. IaaS, on the other hand, provides virtualized computing resources over the internet. This includes servers, storage, and networking capabilities that financial institutions can use to build and manage their IT infrastructure. By leveraging IaaS, banks and other financial entities can avoid the high costs associated with purchasing and maintaining physical hardware. Instead, they can scale their infrastructure up or down based on demand, ensuring they have the necessary resources to handle peak loads and support business growth. IaaS also offers enhanced security features, disaster recovery options, and compliance with regulatory requirements, making it a reliable choice for financial institutions. PaaS provides a platform that allows financial institutions to develop, run, and manage applications without the complexity of building and maintaining the underlying infrastructure. This service includes development tools, database management systems, and middleware, enabling financial firms to focus on creating innovative applications and services. PaaS supports the rapid development and deployment of applications, helping financial institutions to respond quickly to market changes and customer needs. It also facilitates collaboration among development teams, improves productivity, and reduces time-to-market for new financial products and services. In summary, SaaS, IaaS, and PaaS each play a crucial role in the Global Financial Cloud Solutions Market by offering different levels of service and flexibility to financial institutions. SaaS provides ready-to-use applications, IaaS offers scalable infrastructure, and PaaS enables efficient application development and deployment. Together, these cloud services help financial institutions to reduce costs, enhance security, improve operational efficiency, and drive innovation in a rapidly changing market.

Bank, Securities Company, Insurance Company, Others in the Global Financial Cloud Solutions Market:

The usage of Global Financial Cloud Solutions Market in various areas such as banks, securities companies, insurance companies, and others is transforming the financial industry. In banks, cloud solutions are used to enhance customer experience, streamline operations, and improve data management. Banks can leverage cloud-based CRM systems to gain insights into customer behavior, preferences, and needs, enabling them to offer personalized services and improve customer satisfaction. Additionally, cloud solutions help banks to manage large volumes of data efficiently, ensuring data integrity and security. By adopting cloud-based financial analytics tools, banks can also gain real-time insights into their financial performance, identify trends, and make informed decisions. Securities companies use cloud solutions to enhance trading operations, manage risks, and comply with regulatory requirements. Cloud-based trading platforms enable securities firms to execute trades quickly and efficiently, reducing latency and improving market access. These platforms also provide advanced analytics and risk management tools, helping securities firms to monitor market conditions, assess risks, and make data-driven decisions. Furthermore, cloud solutions support regulatory compliance by providing secure data storage, audit trails, and reporting capabilities, ensuring that securities firms adhere to industry standards and regulations. Insurance companies benefit from cloud solutions by improving customer service, streamlining claims processing, and enhancing risk management. Cloud-based CRM systems enable insurance companies to manage customer interactions, track policy information, and offer personalized services. By using cloud-based claims management systems, insurance companies can automate and expedite the claims process, reducing processing times and improving customer satisfaction. Additionally, cloud solutions provide advanced analytics tools that help insurance companies to assess risks, identify fraud, and optimize pricing strategies. These tools enable insurance companies to make data-driven decisions, improve operational efficiency, and enhance their competitive advantage. Other financial institutions, such as credit unions, investment firms, and fintech companies, also leverage cloud solutions to improve their operations and services. Credit unions use cloud-based systems to manage member information, process transactions, and offer online banking services. Investment firms benefit from cloud-based portfolio management systems that provide real-time insights into investment performance, risk assessment, and asset allocation. Fintech companies use cloud solutions to develop innovative financial products and services, such as digital wallets, peer-to-peer lending platforms, and robo-advisors. By adopting cloud solutions, these financial institutions can enhance their operational efficiency, reduce costs, and offer better services to their customers. In conclusion, the Global Financial Cloud Solutions Market is transforming the financial industry by providing banks, securities companies, insurance companies, and other financial institutions with the tools they need to improve their operations, enhance customer service, and drive innovation. By leveraging cloud solutions, these institutions can gain real-time insights, streamline processes, and ensure regulatory compliance, ultimately improving their competitive advantage in a rapidly changing market.

Global Financial Cloud Solutions Market Outlook:

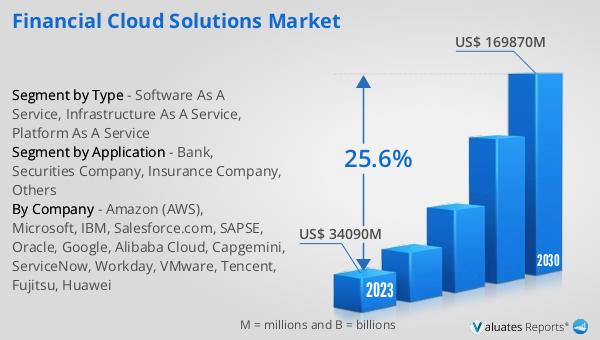

The global Financial Cloud Solutions market was valued at US$ 34,090 million in 2023 and is anticipated to reach US$ 169,870 million by 2030, witnessing a compound annual growth rate (CAGR) of 25.6% during the forecast period from 2024 to 2030. This significant growth reflects the increasing adoption of cloud solutions by financial institutions worldwide. As financial entities seek to enhance their operational efficiency, reduce costs, and improve customer service, the demand for cloud-based services continues to rise. The market's robust growth is driven by the need for scalable, secure, and flexible solutions that can support the evolving needs of the financial industry. Cloud solutions offer numerous benefits, including cost savings, enhanced security, and the ability to innovate and respond to market changes quickly. As a result, financial institutions are increasingly turning to cloud services to gain a competitive edge and drive business growth. The projected growth of the Financial Cloud Solutions market underscores the importance of cloud technology in shaping the future of the financial industry.

| Report Metric | Details |

| Report Name | Financial Cloud Solutions Market |

| Accounted market size in 2023 | US$ 34090 million |

| Forecasted market size in 2030 | US$ 169870 million |

| CAGR | 25.6% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Amazon (AWS), Microsoft, IBM, Salesforce.com, SAPSE, Oracle, Google, Alibaba Cloud, Capgemini, ServiceNow, Workday, VMware, Tencent, Fujitsu, Huawei |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |