What is Global Integrated Circuit Target Market?

The Global Integrated Circuit (IC) Target Market refers to the worldwide demand and supply of integrated circuits, which are essential components in virtually all electronic devices. Integrated circuits, also known as microchips or semiconductors, are used to perform a variety of functions such as processing, memory storage, and signal amplification. The market encompasses various types of ICs, including analog, digital, and mixed-signal ICs, and serves a wide range of industries such as consumer electronics, automotive, telecommunications, and healthcare. The growth of this market is driven by the increasing demand for electronic devices, advancements in technology, and the need for more efficient and powerful computing solutions. Companies in this market are constantly innovating to produce smaller, faster, and more energy-efficient ICs to meet the evolving needs of consumers and industries. The global IC target market is highly competitive, with major players investing heavily in research and development to maintain their market positions and drive future growth.

6 Inches, 8 Inches, 12 Inches in the Global Integrated Circuit Target Market:

In the Global Integrated Circuit Target Market, wafer sizes such as 6 inches, 8 inches, and 12 inches play a crucial role in the manufacturing process. A 6-inch wafer, which measures approximately 150 millimeters in diameter, was once the standard in semiconductor manufacturing. These wafers are used to produce a variety of ICs, but their smaller size limits the number of chips that can be produced from a single wafer, making them less cost-effective compared to larger wafers. Despite this, 6-inch wafers are still used in the production of certain specialized or legacy ICs where the demand does not justify the transition to larger wafers. On the other hand, 8-inch wafers, measuring about 200 millimeters in diameter, became the industry standard in the 1990s. These wafers offer a better balance between cost and production efficiency, allowing manufacturers to produce more chips per wafer while maintaining high yields. The transition to 8-inch wafers enabled significant advancements in semiconductor technology and helped drive down the cost of ICs, making electronic devices more affordable for consumers. However, as the demand for more powerful and efficient ICs continued to grow, the industry began to shift towards even larger wafers. The 12-inch wafer, or 300-millimeter wafer, represents the current standard in high-volume semiconductor manufacturing. These larger wafers allow for the production of a significantly higher number of chips per wafer, reducing the cost per chip and increasing overall production efficiency. The use of 12-inch wafers has enabled manufacturers to meet the growing demand for advanced ICs used in applications such as artificial intelligence, 5G telecommunications, and autonomous vehicles. The transition to 12-inch wafers also requires significant investments in new manufacturing equipment and facilities, which can be a barrier for smaller companies. However, the long-term benefits of increased production efficiency and reduced costs make the investment worthwhile for many manufacturers. In summary, the evolution from 6-inch to 8-inch to 12-inch wafers in the Global Integrated Circuit Target Market reflects the industry's ongoing efforts to improve production efficiency, reduce costs, and meet the growing demand for advanced electronic devices. Each wafer size has its own advantages and challenges, and the choice of wafer size depends on factors such as production volume, cost considerations, and the specific requirements of the ICs being produced.

Interconnect, Barrier layer, Contact layer, Back Metallized Layer, Others in the Global Integrated Circuit Target Market:

The Global Integrated Circuit Target Market finds extensive usage in various areas such as interconnect, barrier layer, contact layer, back metallized layer, and others. Interconnects are critical components in ICs, serving as the pathways that connect different parts of the chip, allowing for the transfer of electrical signals. The quality and efficiency of interconnects directly impact the performance and reliability of the ICs. Advanced materials and manufacturing techniques are used to create interconnects that can handle higher speeds and greater densities, which are essential for modern high-performance computing applications. The barrier layer, on the other hand, is a thin layer of material that prevents the diffusion of atoms between different layers of the IC. This layer is crucial for maintaining the integrity and performance of the IC, as it prevents unwanted chemical reactions that could degrade the chip's functionality. Materials such as titanium nitride and tantalum are commonly used for barrier layers due to their excellent diffusion barrier properties. The contact layer is another essential component of ICs, providing the electrical connection between the semiconductor material and the metal interconnects. This layer must have low resistance to ensure efficient signal transmission and is typically made from materials such as tungsten or polysilicon. The quality of the contact layer directly affects the overall performance of the IC, making it a critical area of focus in the manufacturing process. The back metallized layer is used to provide a conductive path on the backside of the wafer, which is essential for certain types of ICs such as power devices. This layer helps to improve the thermal and electrical performance of the IC, enabling it to handle higher power levels and operate more efficiently. Materials such as aluminum and copper are commonly used for back metallization due to their excellent conductivity and thermal properties. In addition to these specific areas, the Global Integrated Circuit Target Market also encompasses other components and materials that are essential for the production of high-quality ICs. These include dielectric materials, which are used to insulate different layers of the IC, and passivation layers, which protect the chip from environmental damage. The continuous development and optimization of these materials and processes are crucial for meeting the ever-increasing performance and reliability requirements of modern electronic devices.

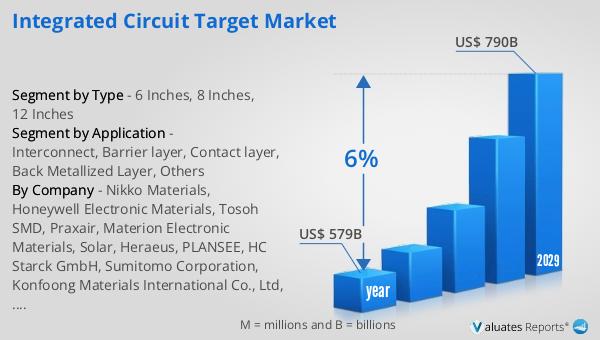

Global Integrated Circuit Target Market Outlook:

The global market for semiconductors was valued at approximately US$ 579 billion in 2022 and is anticipated to reach around US$ 790 billion by 2029, growing at a compound annual growth rate (CAGR) of 6% during the forecast period. This significant growth is driven by the increasing demand for electronic devices, advancements in technology, and the need for more efficient and powerful computing solutions. The semiconductor industry plays a vital role in the global economy, as semiconductors are essential components in a wide range of products, from smartphones and computers to automobiles and industrial machinery. The continuous innovation and development of new semiconductor technologies are crucial for driving progress in various industries and improving the performance and capabilities of electronic devices. As the demand for advanced technologies such as artificial intelligence, 5G telecommunications, and autonomous vehicles continues to grow, the semiconductor market is expected to experience sustained growth in the coming years. Companies in this market are investing heavily in research and development to stay competitive and meet the evolving needs of consumers and industries. The global semiconductor market is highly competitive, with major players constantly striving to innovate and improve their products to maintain their market positions and drive future growth.

| Report Metric | Details |

| Report Name | Integrated Circuit Target Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2024 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Nikko Materials, Honeywell Electronic Materials, Tosoh SMD, Praxair, Materion Electronic Materials, Solar, Heraeus, PLANSEE, HC Starck GmbH, Sumitomo Corporation, Konfoong Materials International Co., Ltd, Ningxia Orient Tantalum Industry Co.,Ltd, Advanced Technology & Materials Co.,Ltd, Longhua Technology Group(Luoyang)Co.,Ltd, Shenyang Dong Chuang Precious Metals Material Co.,Ltd, Fujian Acetron New Materials Co., Ltd, Grikin Advanced Materials Co., Ltd |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |