What is Global Fraud and Risk Management Platform Market?

The Global Fraud and Risk Management Platform Market is a rapidly evolving sector that focuses on providing solutions to detect, prevent, and manage fraudulent activities and associated risks across various industries. These platforms utilize advanced technologies such as artificial intelligence, machine learning, and big data analytics to identify suspicious patterns and behaviors that could indicate fraud. They offer a comprehensive suite of tools that include real-time monitoring, risk assessment, and automated decision-making processes to enhance security measures. The primary goal of these platforms is to minimize financial losses, protect sensitive information, and ensure regulatory compliance. As businesses increasingly move towards digital operations, the demand for robust fraud and risk management solutions has surged, making this market a critical component of modern business infrastructure. The platforms are designed to be scalable and adaptable, catering to the needs of small enterprises as well as large corporations. They are also essential in maintaining customer trust and safeguarding the integrity of financial transactions. With the continuous advancements in technology, the Global Fraud and Risk Management Platform Market is poised for significant growth, driven by the increasing complexity of cyber threats and the need for more sophisticated security measures.

Cloud Based, On-Premise in the Global Fraud and Risk Management Platform Market:

Cloud-based and on-premise solutions are two primary deployment models in the Global Fraud and Risk Management Platform Market, each offering distinct advantages and challenges. Cloud-based solutions are hosted on remote servers and accessed via the internet, providing flexibility, scalability, and cost-effectiveness. These solutions are particularly beneficial for organizations that require quick deployment and the ability to scale resources up or down based on demand. Cloud-based platforms often come with automatic updates and maintenance, reducing the burden on internal IT teams. They also offer enhanced collaboration capabilities, as users can access the platform from any location with an internet connection. However, concerns about data security and compliance with regulatory standards can be a drawback for some organizations considering cloud-based solutions. On the other hand, on-premise solutions are installed and run on the organization's own servers and infrastructure. This model offers greater control over data security and customization, allowing organizations to tailor the platform to their specific needs. On-premise solutions are often preferred by industries with stringent regulatory requirements, such as banking and healthcare, where data privacy is paramount. However, the initial setup costs and ongoing maintenance can be higher compared to cloud-based solutions. Additionally, on-premise platforms may require more significant IT resources and expertise to manage effectively. Despite these challenges, some organizations opt for on-premise solutions to maintain complete control over their data and infrastructure. Both deployment models have their unique benefits and limitations, and the choice between cloud-based and on-premise solutions often depends on the organization's specific needs, budget, and regulatory environment. As technology continues to evolve, hybrid models that combine elements of both cloud-based and on-premise solutions are also emerging, offering a balanced approach to fraud and risk management. These hybrid models aim to provide the flexibility and scalability of the cloud while retaining the control and security of on-premise solutions. Ultimately, the decision on which deployment model to choose should be based on a thorough assessment of the organization's requirements, resources, and long-term strategic goals.

BFSI, Government, Retail, Healthcare, IT&Telecommunication, Other in the Global Fraud and Risk Management Platform Market:

The Global Fraud and Risk Management Platform Market finds extensive usage across various sectors, including BFSI (Banking, Financial Services, and Insurance), government, retail, healthcare, IT & telecommunication, and others. In the BFSI sector, these platforms are crucial for detecting and preventing fraudulent transactions, ensuring compliance with regulatory standards, and safeguarding sensitive financial data. They help financial institutions monitor real-time transactions, identify suspicious activities, and mitigate risks associated with money laundering, identity theft, and cyber-attacks. In the government sector, fraud and risk management platforms are used to protect public funds, prevent corruption, and ensure the integrity of public services. They assist in monitoring financial transactions, detecting fraudulent claims, and maintaining transparency in government operations. In the retail sector, these platforms help businesses detect and prevent fraudulent activities such as payment fraud, return fraud, and account takeover. They enable retailers to monitor transactions, identify suspicious behaviors, and protect customer data. In the healthcare sector, fraud and risk management platforms are essential for preventing fraudulent claims, protecting patient data, and ensuring compliance with healthcare regulations. They help healthcare providers detect billing fraud, identify suspicious activities, and safeguard sensitive patient information. In the IT & telecommunication sector, these platforms are used to protect against cyber threats, ensure data security, and maintain the integrity of communication networks. They assist in monitoring network activities, detecting anomalies, and mitigating risks associated with cyber-attacks. Other sectors, such as manufacturing, education, and transportation, also benefit from fraud and risk management platforms by protecting their operations, ensuring compliance with industry standards, and safeguarding sensitive information. Overall, the usage of fraud and risk management platforms across various sectors highlights their importance in maintaining security, protecting sensitive data, and ensuring regulatory compliance.

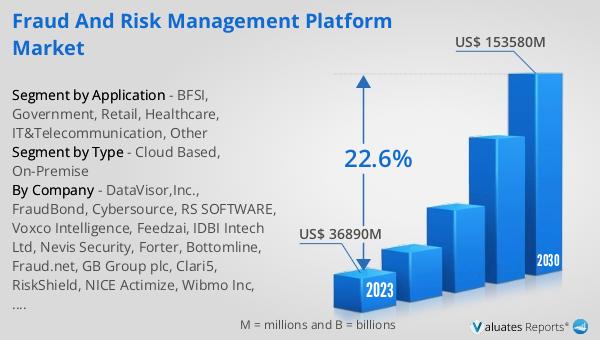

Global Fraud and Risk Management Platform Market Outlook:

The global Fraud and Risk Management Platform market was valued at US$ 36,890 million in 2023 and is anticipated to reach US$ 153,580 million by 2030, witnessing a CAGR of 22.6% during the forecast period from 2024 to 2030. This significant growth underscores the increasing importance of robust fraud and risk management solutions in today's digital landscape. As businesses and organizations continue to digitize their operations, the need for advanced platforms that can effectively detect, prevent, and manage fraudulent activities and associated risks has become paramount. The projected growth of the market reflects the rising demand for these solutions across various industries, including BFSI, government, retail, healthcare, IT & telecommunication, and others. The adoption of fraud and risk management platforms is driven by the need to protect sensitive information, ensure regulatory compliance, and minimize financial losses. With the continuous advancements in technology, these platforms are becoming more sophisticated, offering enhanced capabilities such as real-time monitoring, automated decision-making, and advanced analytics. The market's growth trajectory indicates a strong emphasis on security and risk management as critical components of modern business infrastructure. As cyber threats become more complex and pervasive, the demand for comprehensive fraud and risk management solutions is expected to continue to rise, driving further innovation and development in this market.

| Report Metric | Details |

| Report Name | Fraud and Risk Management Platform Market |

| Accounted market size in 2023 | US$ 36890 in million |

| Forecasted market size in 2030 | US$ 153580 million |

| CAGR | 22.6% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | DataVisor,Inc., FraudBond, Cybersource, RS SOFTWARE, Voxco Intelligence, Feedzai, IDBI Intech Ltd, Nevis Security, Forter, Bottomline, Fraud.net, GB Group plc, Clari5, RiskShield, NICE Actimize, Wibmo Inc, SEON Technologies Ltd |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |