What is Global Food Grade Neotame Market?

The Global Food Grade Neotame Market refers to the worldwide industry focused on the production, distribution, and utilization of neotame, a high-intensity sweetener used in various food and beverage applications. Neotame is a derivative of aspartame and is known for its exceptional sweetness, being approximately 7,000 to 13,000 times sweeter than sucrose (table sugar). This makes it an attractive option for manufacturers looking to reduce sugar content in their products without compromising on taste. The market encompasses various stakeholders, including raw material suppliers, manufacturers, distributors, and end-users such as food and beverage companies. The demand for neotame is driven by the increasing consumer preference for low-calorie and sugar-free products, as well as regulatory approvals in multiple regions that deem it safe for consumption. The market is also influenced by trends in health and wellness, as more consumers seek to manage their sugar intake due to concerns about obesity, diabetes, and other health issues. Overall, the Global Food Grade Neotame Market is a dynamic and growing sector, reflecting broader shifts in consumer behavior and regulatory landscapes.

0.99, 0.98, Others in the Global Food Grade Neotame Market:

In the Global Food Grade Neotame Market, neotame is available in different purity levels, primarily 0.99, 0.98, and other grades. The 0.99 purity level signifies that the neotame is 99% pure, making it the highest grade available. This level of purity is often preferred for applications that require stringent quality standards, such as pharmaceuticals and high-end food products. The 0.99 grade ensures minimal impurities, which is crucial for maintaining the desired taste and safety profile of the end product. On the other hand, the 0.98 purity level, while slightly lower, is still considered high-quality and is commonly used in a wide range of food and beverage applications. This grade offers a balance between cost and quality, making it a popular choice for manufacturers looking to optimize their production costs without significantly compromising on product quality. Other grades of neotame, which may have lower purity levels, are typically used in applications where the highest purity is not as critical. These could include certain industrial applications or products where the presence of minor impurities does not affect the overall performance or safety of the product. The choice of purity level depends on various factors, including the specific requirements of the application, regulatory standards, and cost considerations. For instance, in regions with stringent food safety regulations, higher purity levels may be mandated, thereby influencing the demand for 0.99 grade neotame. Conversely, in markets where cost is a more significant concern, lower purity levels may be more prevalent. Additionally, the production process and raw material quality can also impact the purity levels of neotame. Advanced manufacturing techniques and high-quality raw materials are essential for achieving higher purity levels, which in turn can affect the pricing and availability of different grades. Overall, the availability of multiple purity levels in the Global Food Grade Neotame Market allows manufacturers to choose the most suitable grade for their specific needs, balancing quality, cost, and regulatory compliance.

Food, Drinks, Others in the Global Food Grade Neotame Market:

The usage of Global Food Grade Neotame Market spans across various sectors, including food, drinks, and other applications. In the food industry, neotame is widely used as a sugar substitute in products such as baked goods, dairy products, and confectioneries. Its high sweetness intensity allows manufacturers to use very small quantities to achieve the desired sweetness, thereby reducing the overall calorie content of the product. This is particularly beneficial for consumers looking to manage their weight or reduce their sugar intake due to health concerns such as diabetes. In baked goods, neotame helps maintain the texture and taste of the product without the need for additional sugar, making it an ideal ingredient for low-calorie or sugar-free options. In the drinks sector, neotame is used in a variety of beverages, including soft drinks, fruit juices, and energy drinks. Its stability under different pH levels and temperatures makes it suitable for both carbonated and non-carbonated beverages. Neotame's ability to blend well with other sweeteners and flavorings also enhances the overall taste profile of the drink, providing a satisfying experience for consumers. Additionally, its low-calorie content aligns with the growing demand for healthier beverage options. Beyond food and drinks, neotame finds applications in other areas such as pharmaceuticals and animal feed. In pharmaceuticals, it is used to mask the bitter taste of certain medications, making them more palatable for patients. Its high sweetness intensity means that only a small amount is needed, which is advantageous in maintaining the efficacy and stability of the medication. In animal feed, neotame is used to improve the palatability of feed, encouraging better intake and growth in livestock. This is particularly important in the agricultural sector, where feed efficiency directly impacts productivity and profitability. Overall, the versatility of neotame in various applications underscores its importance in the Global Food Grade Neotame Market, catering to diverse consumer needs and industry requirements.

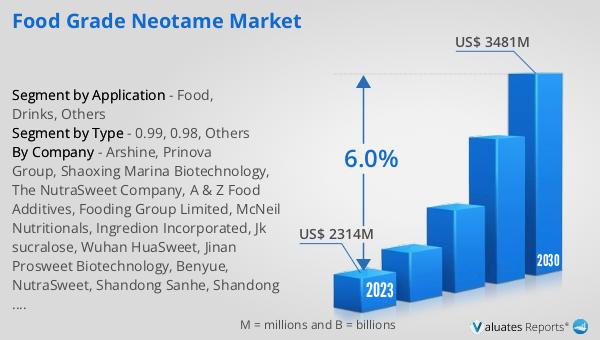

Global Food Grade Neotame Market Outlook:

The global Food Grade Neotame market was valued at US$ 2314 million in 2023 and is anticipated to reach US$ 3481 million by 2030, witnessing a CAGR of 6.0% during the forecast period 2024-2030. This significant growth reflects the increasing demand for low-calorie and sugar-free products across various sectors, including food, beverages, pharmaceuticals, and animal feed. The rising awareness about health and wellness, coupled with regulatory approvals in multiple regions, has further fueled the market's expansion. Manufacturers are increasingly adopting neotame due to its high sweetness intensity, cost-effectiveness, and versatility in different applications. The market's growth trajectory indicates a robust future, driven by evolving consumer preferences and industry trends.

| Report Metric | Details |

| Report Name | Food Grade Neotame Market |

| Accounted market size in 2023 | US$ 2314 million |

| Forecasted market size in 2030 | US$ 3481 million |

| CAGR | 6.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Arshine, Prinova Group, Shaoxing Marina Biotechnology, The NutraSweet Company, A & Z Food Additives, Fooding Group Limited, McNeil Nutritionals, Ingredion Incorporated, Jk sucralose, Wuhan HuaSweet, Jinan Prosweet Biotechnology, Benyue, NutraSweet, Shandong Sanhe, Shandong Chenghui, MarkNature |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |