What is Global Bus and Truck Wiring Harness Market?

The Global Bus and Truck Wiring Harness Market refers to the industry that designs, manufactures, and supplies wiring harnesses specifically for buses and trucks. A wiring harness is a systematic and integrated arrangement of wires, cables, and connectors that transmit electrical power and signals to various components within a vehicle. These harnesses are crucial for the efficient functioning of electrical systems in buses and trucks, including lighting, engine management, HVAC (Heating, Ventilation, and Air Conditioning) systems, and safety features. The market encompasses a wide range of products tailored to meet the specific needs of different types of buses and trucks, from small commercial vehicles to large, heavy-duty trucks. The demand for wiring harnesses in this sector is driven by the increasing complexity of vehicle electronics, the need for enhanced safety features, and the growing adoption of electric and hybrid vehicles. As a result, manufacturers are continually innovating to produce more efficient, durable, and cost-effective wiring solutions to meet the evolving needs of the automotive industry.

Copper, Aluminum, Others in the Global Bus and Truck Wiring Harness Market:

In the Global Bus and Truck Wiring Harness Market, materials such as copper, aluminum, and others play a significant role in the construction and performance of wiring harnesses. Copper is the most commonly used material due to its excellent electrical conductivity, flexibility, and durability. It is highly efficient in transmitting electrical signals and power, making it ideal for critical applications in buses and trucks where reliability is paramount. Copper wiring harnesses are known for their ability to withstand harsh environmental conditions, including extreme temperatures and vibrations, which are common in heavy-duty vehicles. However, the high cost and weight of copper have led manufacturers to explore alternative materials. Aluminum is another material used in the production of wiring harnesses, offering a lightweight and cost-effective alternative to copper. Although aluminum has lower electrical conductivity compared to copper, it is still sufficient for many automotive applications. The reduced weight of aluminum wiring harnesses can contribute to overall vehicle weight reduction, which is beneficial for fuel efficiency and performance. Additionally, aluminum is more resistant to corrosion, making it suitable for use in environments where moisture and other corrosive elements are present. However, aluminum wiring requires special connectors and termination techniques to ensure reliable connections, which can add to the complexity and cost of manufacturing. Other materials used in the Global Bus and Truck Wiring Harness Market include various alloys and composite materials designed to enhance specific properties such as strength, flexibility, and resistance to environmental factors. For example, some wiring harnesses incorporate materials with high thermal stability to withstand the high temperatures generated by modern vehicle engines and electrical systems. Additionally, advanced insulation materials are used to protect the wires from abrasion, chemicals, and other potential sources of damage. These materials are selected based on the specific requirements of the application, ensuring that the wiring harnesses can perform reliably under a wide range of conditions. The choice of material for wiring harnesses in buses and trucks is influenced by several factors, including cost, weight, electrical performance, and environmental considerations. Manufacturers must balance these factors to produce wiring harnesses that meet the stringent demands of the automotive industry while remaining economically viable. As the industry continues to evolve, there is ongoing research and development aimed at discovering new materials and technologies that can further improve the performance and efficiency of wiring harnesses. This includes the exploration of nanomaterials, conductive polymers, and other innovative solutions that have the potential to revolutionize the market. In conclusion, the materials used in the Global Bus and Truck Wiring Harness Market, such as copper, aluminum, and others, each offer unique advantages and challenges. Copper remains the preferred choice for its superior electrical conductivity and durability, while aluminum provides a lightweight and cost-effective alternative. Other advanced materials are also being utilized to enhance specific properties and meet the diverse needs of modern vehicles. As the automotive industry continues to advance, the development of new materials and technologies will play a crucial role in shaping the future of wiring harnesses for buses and trucks.

HVAC Systems, Safety and Security Systems, Others in the Global Bus and Truck Wiring Harness Market:

The Global Bus and Truck Wiring Harness Market finds extensive usage in various areas, including HVAC systems, safety and security systems, and other applications. HVAC systems in buses and trucks rely heavily on wiring harnesses to ensure the efficient operation of heating, ventilation, and air conditioning components. These systems are essential for maintaining a comfortable environment for passengers and drivers, regardless of external weather conditions. Wiring harnesses in HVAC systems connect various sensors, actuators, and control units, enabling precise regulation of temperature, airflow, and humidity. The reliability and efficiency of these wiring harnesses are crucial for the overall performance of HVAC systems, as any failure can lead to discomfort and potential safety issues. Safety and security systems in buses and trucks are another critical area where wiring harnesses play a vital role. Modern vehicles are equipped with a wide range of safety features, including airbags, anti-lock braking systems (ABS), electronic stability control (ESC), and advanced driver-assistance systems (ADAS). These systems rely on complex networks of sensors, controllers, and actuators, all interconnected by wiring harnesses. The integrity and reliability of these harnesses are paramount, as any malfunction can compromise the safety of the vehicle and its occupants. In addition to safety features, security systems such as alarm systems, immobilizers, and GPS tracking devices also depend on robust wiring harnesses to function effectively. These systems help protect the vehicle from theft and unauthorized access, providing peace of mind to owners and operators. Beyond HVAC and safety systems, wiring harnesses are used in various other applications within buses and trucks. This includes lighting systems, engine management, infotainment systems, and power distribution. Lighting systems, both interior and exterior, rely on wiring harnesses to connect lights, switches, and control units, ensuring proper illumination and visibility. Engine management systems use wiring harnesses to connect sensors, actuators, and control units, enabling precise control of engine performance, fuel efficiency, and emissions. Infotainment systems, which provide entertainment and information to passengers, also depend on wiring harnesses to connect displays, audio systems, and control interfaces. Power distribution systems use wiring harnesses to distribute electrical power from the battery to various components, ensuring reliable operation of all electrical systems within the vehicle. The usage of wiring harnesses in these areas highlights their importance in the overall functionality and performance of buses and trucks. The complexity and integration of modern vehicle systems require wiring harnesses that are not only reliable and efficient but also capable of withstanding the harsh conditions often encountered in commercial and heavy-duty vehicles. This includes exposure to extreme temperatures, vibrations, moisture, and other environmental factors. Manufacturers must ensure that their wiring harnesses meet stringent quality and performance standards to ensure the safety, comfort, and reliability of the vehicles they are installed in. In conclusion, the Global Bus and Truck Wiring Harness Market plays a crucial role in the operation of HVAC systems, safety and security systems, and various other applications within buses and trucks. The reliability and efficiency of these wiring harnesses are essential for the overall performance and safety of the vehicle. As the complexity of vehicle systems continues to increase, the demand for high-quality wiring harnesses will continue to grow, driving innovation and development in the market.

Global Bus and Truck Wiring Harness Market Outlook:

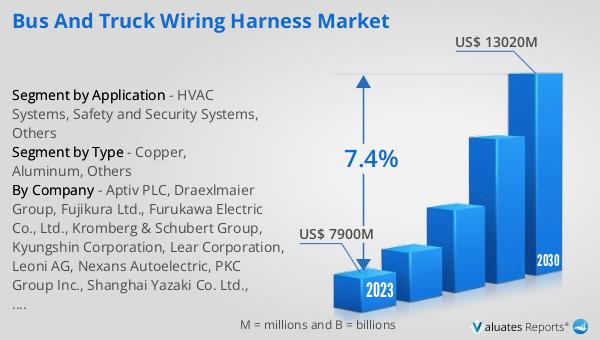

The global Bus and Truck Wiring Harness market was valued at US$ 7900 million in 2023 and is anticipated to reach US$ 13020 million by 2030, witnessing a CAGR of 7.4% during the forecast period 2024-2030. This significant growth reflects the increasing demand for advanced wiring solutions in the automotive industry, driven by the rising complexity of vehicle electronics and the growing adoption of electric and hybrid vehicles. The market's expansion is also influenced by the need for enhanced safety features and the integration of advanced technologies in modern buses and trucks. As manufacturers strive to meet these demands, they are continually innovating to produce more efficient, durable, and cost-effective wiring harnesses. This growth trajectory underscores the importance of wiring harnesses in the overall functionality and performance of commercial and heavy-duty vehicles, highlighting their critical role in ensuring the safety, comfort, and reliability of these vehicles.

| Report Metric | Details |

| Report Name | Bus and Truck Wiring Harness Market |

| Accounted market size in 2023 | US$ 7900 in million |

| Forecasted market size in 2030 | US$ 13020 million |

| CAGR | 7.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Aptiv PLC, Draexlmaier Group, Fujikura Ltd., Furukawa Electric Co., Ltd., Kromberg & Schubert Group, Kyungshin Corporation, Lear Corporation, Leoni AG, Nexans Autoelectric, PKC Group Inc., Shanghai Yazaki Co. Ltd., Sumitomo Electric Industries Ltd., THB Group, Yazaki Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |