What is Global B2B Remittances Market?

The Global B2B Remittances Market refers to the international transfer of funds between businesses. Unlike consumer remittances, which involve individuals sending money to family or friends, B2B remittances are transactions between companies. These transactions are crucial for global trade, enabling businesses to pay for goods and services across borders. The market encompasses various methods of transferring money, including bank transfers, money transfer operators, and online platforms. The efficiency and security of these transactions are paramount, as they often involve large sums of money and are subject to regulatory scrutiny. The market is growing due to the increasing globalization of businesses and the need for efficient cross-border payment solutions. Technological advancements and the rise of digital platforms are also contributing to the market's expansion, making it easier and faster for businesses to conduct international transactions.

Bank Transfer, Money Transfer Operators, Online Platforms, Others in the Global B2B Remittances Market:

Bank transfers are one of the most traditional and widely used methods in the Global B2B Remittances Market. They involve transferring money directly from one bank account to another. This method is highly secure and reliable, but it can be slow and expensive, especially for international transactions. Banks often charge high fees and offer less favorable exchange rates compared to other methods. Money Transfer Operators (MTOs) like Western Union and MoneyGram provide an alternative to traditional bank transfers. They offer faster services and can be more cost-effective, especially for smaller transactions. MTOs have a wide network of agents and branches, making it convenient for businesses to send and receive money. However, they may not be suitable for very large transactions due to limits on the amount that can be transferred. Online platforms have revolutionized the B2B remittances market by offering fast, low-cost, and convenient services. Companies like PayPal, TransferWise, and Payoneer allow businesses to transfer money internationally with just a few clicks. These platforms often offer better exchange rates and lower fees compared to banks and MTOs. They also provide additional features like real-time tracking and automated payments, which can be particularly useful for businesses. However, the security of online platforms can be a concern, and businesses need to ensure they are using reputable services. Other methods in the B2B remittances market include mobile money and cryptocurrency. Mobile money services, popular in regions like Africa, allow businesses to transfer money using mobile phones. This method is fast and convenient but may be limited by the availability of mobile money services in different countries. Cryptocurrency offers a new and innovative way to transfer money internationally. It can be very fast and low-cost, but it is also highly volatile and not widely accepted. Businesses using cryptocurrency for remittances need to be aware of the risks and regulatory issues involved. Each method in the Global B2B Remittances Market has its advantages and disadvantages, and businesses need to choose the one that best suits their needs.

Large Corporation, SMEs in the Global B2B Remittances Market:

The usage of the Global B2B Remittances Market varies significantly between large corporations and SMEs (Small and Medium-sized Enterprises). Large corporations often have complex and extensive international operations, requiring them to make frequent and substantial cross-border payments. They typically use a combination of bank transfers, MTOs, and online platforms to manage their remittances. Bank transfers are often preferred for very large transactions due to their security and reliability, despite the higher costs and slower processing times. Large corporations may also negotiate better terms with banks, such as lower fees and better exchange rates, due to the volume of their transactions. MTOs and online platforms are used for smaller or more urgent payments, offering faster and more cost-effective solutions. Large corporations also benefit from the additional features offered by online platforms, such as real-time tracking and automated payments, which help streamline their payment processes. SMEs, on the other hand, often face different challenges and have different needs when it comes to B2B remittances. They may not have the same level of access to banking services or the ability to negotiate better terms with banks. As a result, SMEs are more likely to use MTOs and online platforms for their international payments. These methods offer lower costs, faster processing times, and greater convenience, which are crucial for smaller businesses with limited resources. Online platforms, in particular, have become increasingly popular among SMEs due to their ease of use and additional features. SMEs can benefit from the better exchange rates and lower fees offered by these platforms, as well as the ability to track payments in real-time and automate recurring payments. However, SMEs also need to be cautious about the security of online platforms and ensure they are using reputable services. In summary, while both large corporations and SMEs use the Global B2B Remittances Market to facilitate their international payments, their usage patterns and preferences differ based on their specific needs and challenges.

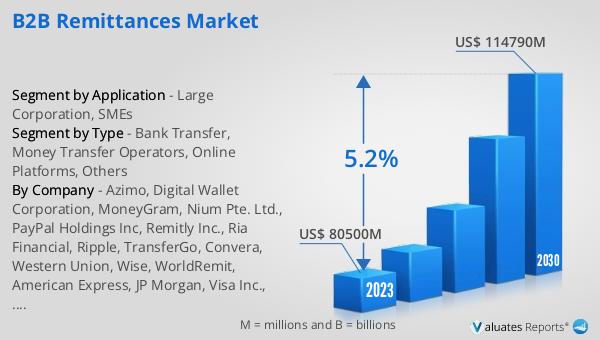

Global B2B Remittances Market Outlook:

The global B2B Remittances market was valued at US$ 80,500 million in 2023 and is expected to grow to US$ 114,790 million by 2030, reflecting a compound annual growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2030. According to the National Bureau of Statistics, China emerged as the largest online retail market in 2022, with online retail sales reaching 13.79 trillion yuan, marking a year-on-year increase of 4%. This significant growth in online retail sales highlights the increasing importance of efficient and reliable B2B remittance solutions to support the expanding global trade and e-commerce activities. As businesses continue to expand their operations across borders, the demand for secure, fast, and cost-effective remittance services is expected to rise, driving the growth of the global B2B remittances market. The market's growth is further supported by technological advancements and the increasing adoption of digital platforms, which offer enhanced features and greater convenience for businesses.

| Report Metric | Details |

| Report Name | B2B Remittances Market |

| Accounted market size in 2023 | US$ 80500 million |

| Forecasted market size in 2030 | US$ 114790 million |

| CAGR | 5.2% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Azimo, Digital Wallet Corporation, MoneyGram, Nium Pte. Ltd., PayPal Holdings Inc, Remitly Inc., Ria Financial, Ripple, TransferGo, Convera, Western Union, Wise, WorldRemit, American Express, JP Morgan, Visa Inc., Mastercard, Stripe, Paystand, Grab Inc., Gcash, TrueMoney Co.Ltd |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |