What is Global High Frequency Trading Model Systems (Strategic) Market?

Global High Frequency Trading Model Systems (Strategic) Market refers to the advanced technological framework used in financial markets to execute a large number of orders at extremely high speeds. These systems leverage complex algorithms and high-speed data networks to analyze multiple markets and execute orders based on market conditions. The primary goal is to capitalize on small price discrepancies that exist for only fractions of a second. High Frequency Trading (HFT) systems are integral to modern financial markets, providing liquidity and narrowing bid-ask spreads. They are used by institutional investors, hedge funds, and proprietary trading firms to gain a competitive edge. The strategic aspect of these systems involves the development and implementation of sophisticated trading strategies that can adapt to rapidly changing market conditions. As technology continues to evolve, the capabilities of HFT systems are expected to expand, further enhancing their role in global financial markets. These systems are not without controversy, as they have been criticized for contributing to market volatility and creating an uneven playing field. However, their efficiency and speed make them indispensable tools for many market participants.

Software Program, Trading Strategy, Hardware Deployment Classes, Others in the Global High Frequency Trading Model Systems (Strategic) Market:

The Global High Frequency Trading Model Systems (Strategic) Market is composed of several key components, each playing a crucial role in the overall functionality and effectiveness of the system. The first component is the software program, which is the backbone of any HFT system. These programs are designed to process vast amounts of data in real-time, using complex algorithms to identify trading opportunities. The software must be highly efficient and capable of executing trades in milliseconds, as even the slightest delay can result in missed opportunities. The development of these programs requires a deep understanding of both financial markets and computer science, as they must be able to adapt to rapidly changing market conditions and incorporate new data as it becomes available.

Finance Industry, Scientific Research, Others in the Global High Frequency Trading Model Systems (Strategic) Market:

Trading strategy is another critical component of HFT systems. These strategies are developed based on extensive market research and analysis, and they dictate how the software program will operate. Common strategies include market making, arbitrage, and trend following, each with its own set of rules and parameters. Market making involves providing liquidity to the market by simultaneously placing buy and sell orders, while arbitrage seeks to profit from price discrepancies between different markets or instruments. Trend following, on the other hand, involves identifying and capitalizing on market trends. The success of an HFT system largely depends on the effectiveness of its trading strategy, as well as its ability to adapt to changing market conditions.

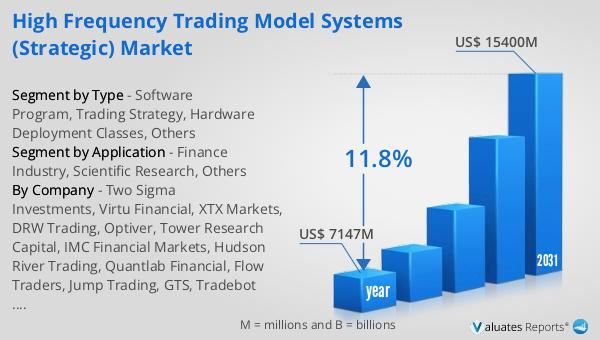

Global High Frequency Trading Model Systems (Strategic) Market Outlook:

Hardware deployment classes are also a vital aspect of HFT systems. These classes refer to the physical infrastructure required to support the software program and execute trades at high speeds. This includes high-performance servers, low-latency data networks, and co-location facilities, which allow traders to place their servers in close proximity to exchange servers to minimize latency. The hardware must be capable of handling large volumes of data and executing trades in real-time, as any delay can result in significant financial losses. As technology continues to advance, the hardware used in HFT systems is becoming increasingly sophisticated, with firms investing heavily in the latest technology to gain a competitive edge.

| Report Metric | Details |

| Report Name | High Frequency Trading Model Systems (Strategic) Market |

| Accounted market size in year | US$ 7147 million |

| Forecasted market size in 2031 | US$ 15400 million |

| CAGR | 11.8% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Two Sigma Investments, Virtu Financial, XTX Markets, DRW Trading, Optiver, Tower Research Capital, IMC Financial Markets, Hudson River Trading, Quantlab Financial, Flow Traders, Jump Trading, GTS, Tradebot Systems |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |