What is Global Termite Control Products Market?

The Global Termite Control Products Market is a specialized segment within the pest control industry that focuses on products designed to manage and eliminate termite infestations. Termites are small, wood-eating insects that can cause significant structural damage to buildings and other wooden structures if left unchecked. The market for termite control products includes a variety of solutions such as liquid termiticides, termite baits, and other innovative technologies aimed at preventing and controlling termite populations. These products are used by both professional pest control companies and individual consumers to protect residential, commercial, and industrial properties from termite damage. The demand for termite control products is driven by factors such as increasing awareness about the economic impact of termite damage, advancements in pest control technologies, and the growing construction industry, which requires effective termite management solutions to ensure the longevity and safety of structures. As urbanization continues to expand, the need for effective termite control measures becomes even more critical, making this market an essential component of the broader pest control industry.

Termite Spray, Termite Powder, Termite Baits in the Global Termite Control Products Market:

Termite control products come in various forms, each with its unique application method and effectiveness. Termite sprays are one of the most common forms of termite control products. These sprays are typically liquid termiticides that are applied directly to the soil around a building's foundation or onto wooden structures to create a chemical barrier that repels or kills termites. The active ingredients in these sprays are designed to be long-lasting, providing ongoing protection against termite infestations. Termite sprays are often used as a preventive measure, especially in areas known for high termite activity. On the other hand, termite powders are another form of termite control product. These powders are usually applied to areas where termites are active, such as cracks, crevices, and other entry points. The powder adheres to the termites' bodies and is carried back to the colony, where it spreads and eventually eliminates the entire colony. Termite powders are particularly effective in treating localized infestations and are often used in conjunction with other termite control methods for comprehensive protection. Termite baits represent a more strategic approach to termite control. These baits consist of a cellulose-based material that is laced with a slow-acting insecticide. The baits are placed in stations around the perimeter of a building, attracting termites that feed on the bait and carry the insecticide back to the colony. Over time, the insecticide disrupts the termites' growth and reproduction, leading to the gradual elimination of the colony. Termite baits are considered an environmentally friendly option as they target only termites and have minimal impact on non-target species. The choice between sprays, powders, and baits depends on various factors, including the severity of the infestation, the location of the termites, and the specific needs of the property owner. Each method has its advantages and limitations, and often, a combination of these products is used to achieve the best results. As the Global Termite Control Products Market continues to evolve, manufacturers are constantly developing new formulations and delivery systems to enhance the effectiveness and safety of these products, ensuring that they meet the diverse needs of consumers worldwide.

Commercial & Industrial, Residential, Livestock Farms, Others in the Global Termite Control Products Market:

The usage of termite control products spans across various sectors, each with its unique requirements and challenges. In commercial and industrial settings, termite control is crucial to protect large-scale structures and facilities from the costly damage that termites can inflict. These environments often require robust and long-lasting termite control solutions due to the size and complexity of the buildings involved. Termite control products used in these settings are typically applied by professional pest control services that have the expertise and equipment necessary to handle large-scale applications. In residential areas, termite control products are essential for safeguarding homes from termite infestations that can compromise the structural integrity of the property. Homeowners often use a combination of termite sprays, powders, and baits to protect their homes, with many opting for professional pest control services to ensure comprehensive coverage and peace of mind. The residential market for termite control products is driven by the need for effective, easy-to-use solutions that can be applied by homeowners themselves or by professionals. Livestock farms also benefit from termite control products, as termites can damage wooden structures such as barns, fences, and storage facilities. Protecting these structures is vital to maintaining the safety and efficiency of farm operations. Termite control products used in livestock farms must be safe for use around animals and effective in preventing termite damage in outdoor environments. Other areas where termite control products are used include public buildings, historical sites, and recreational facilities. These locations often have unique preservation needs, requiring termite control solutions that are both effective and minimally invasive. In all these areas, the choice of termite control products depends on factors such as the type of structure, the level of termite activity, and environmental considerations. As the Global Termite Control Products Market continues to grow, the development of innovative products and application methods will play a crucial role in meeting the diverse needs of these sectors, ensuring that structures remain protected from the destructive impact of termites.

Global Termite Control Products Market Outlook:

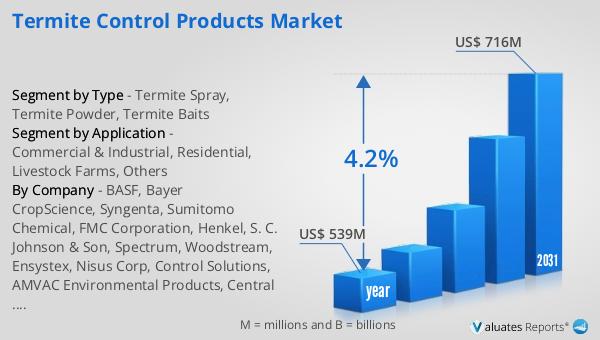

The global market for termite control products has shown significant growth over the years, reflecting the increasing demand for effective solutions to combat termite infestations. In 2024, the market was valued at approximately 539 million US dollars, indicating a robust demand for these products across various sectors. This market is projected to expand further, reaching an estimated size of 716 million US dollars by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 4.2% during the forecast period. This steady growth rate underscores the importance of termite control products in protecting structures from termite damage, which can lead to substantial economic losses if not addressed promptly. The projected increase in market size is driven by several factors, including advancements in termite control technologies, increased awareness of the economic impact of termite damage, and the expansion of the construction industry, which necessitates effective termite management solutions. As the market continues to evolve, manufacturers are likely to focus on developing innovative products that offer enhanced effectiveness, safety, and ease of use, catering to the diverse needs of consumers worldwide. The growth of the Global Termite Control Products Market highlights the critical role these products play in safeguarding structures from the destructive impact of termites, ensuring the longevity and safety of buildings across various sectors.

| Report Metric | Details |

| Report Name | Termite Control Products Market |

| Accounted market size in year | US$ 539 million |

| Forecasted market size in 2031 | US$ 716 million |

| CAGR | 4.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | BASF, Bayer CropScience, Syngenta, Sumitomo Chemical, FMC Corporation, Henkel, S. C. Johnson & Son, Spectrum, Woodstream, Ensystex, Nisus Corp, Control Solutions, AMVAC Environmental Products, Central Life Sciences |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |