What is Global Personal Finance Management Software Market?

The Global Personal Finance Management Software Market refers to the industry focused on developing and distributing software solutions that help individuals and businesses manage their financial activities more effectively. These software tools are designed to assist users in tracking their income, expenses, budgets, and investments, providing a comprehensive overview of their financial health. The market has seen significant growth due to the increasing need for financial literacy and the desire for better financial planning among consumers. With the rise of digital technology, these software solutions have become more accessible, offering features such as automated transaction tracking, personalized financial advice, and integration with various financial institutions. The market caters to a wide range of users, from individual consumers looking to manage their personal finances to businesses seeking to streamline their financial operations. As financial management becomes increasingly complex, the demand for sophisticated yet user-friendly software continues to rise, driving innovation and competition within the market. The Global Personal Finance Management Software Market is poised for continued expansion as more people recognize the importance of financial planning in achieving their long-term goals.

Web-based Software, Mobile-based Software in the Global Personal Finance Management Software Market:

Web-based software and mobile-based software are two primary categories within the Global Personal Finance Management Software Market, each offering distinct advantages and features tailored to different user needs. Web-based software refers to applications that are hosted on remote servers and accessed through a web browser. This type of software is particularly appealing to users who prefer not to install applications on their devices, as it allows for easy access from any device with an internet connection. Web-based personal finance management tools often provide robust features such as real-time data synchronization, multi-user access, and seamless integration with various financial institutions. These tools are ideal for users who require comprehensive financial management capabilities and the flexibility to access their financial data from multiple locations. On the other hand, mobile-based software is designed specifically for use on smartphones and tablets, offering a more portable and convenient solution for managing finances on the go. Mobile apps are typically optimized for smaller screens and touch interfaces, providing a user-friendly experience that allows users to quickly check their financial status, track expenses, and receive notifications about important financial events. Many mobile-based personal finance management apps also offer features such as receipt scanning, location-based expense tracking, and personalized financial insights, making them a popular choice for tech-savvy users who value convenience and accessibility. Both web-based and mobile-based software solutions have their unique strengths, and the choice between them often depends on the user's specific needs and preferences. For instance, businesses may prefer web-based solutions for their scalability and collaborative features, while individual consumers might lean towards mobile apps for their ease of use and portability. As the Global Personal Finance Management Software Market continues to evolve, developers are increasingly focusing on creating hybrid solutions that combine the best of both worlds, offering users the flexibility to manage their finances seamlessly across different platforms. This trend reflects the growing demand for integrated financial management solutions that cater to the diverse needs of modern users. Ultimately, whether through web-based or mobile-based software, the goal of personal finance management tools is to empower users with the knowledge and tools they need to make informed financial decisions and achieve their financial goals.

Businesses Users, Individual Consumers in the Global Personal Finance Management Software Market:

The usage of Global Personal Finance Management Software Market extends to both business users and individual consumers, each benefiting from the unique features and capabilities these tools offer. For business users, personal finance management software provides a comprehensive solution for managing company finances, streamlining accounting processes, and ensuring financial compliance. Businesses can leverage these tools to automate routine financial tasks such as invoicing, payroll, and expense tracking, freeing up valuable time and resources for more strategic activities. Additionally, personal finance management software can help businesses gain deeper insights into their financial performance through advanced analytics and reporting features, enabling them to make data-driven decisions that drive growth and profitability. For individual consumers, personal finance management software serves as a valuable tool for managing personal finances, budgeting, and planning for the future. These tools allow users to track their income and expenses, set financial goals, and monitor their progress over time. By providing a clear and detailed overview of their financial situation, personal finance management software empowers individuals to make informed decisions about their spending, saving, and investing habits. Many software solutions also offer personalized financial advice and recommendations, helping users optimize their financial strategies and achieve their long-term goals. The accessibility and convenience of personal finance management software make it an attractive option for consumers of all ages and financial backgrounds, from young professionals looking to build their savings to retirees seeking to manage their retirement funds. As financial literacy becomes increasingly important in today's complex economic landscape, the demand for user-friendly and effective personal finance management tools continues to grow. Both businesses and individual consumers stand to benefit from the enhanced financial control and visibility that these software solutions provide, ultimately leading to better financial outcomes and greater peace of mind.

Global Personal Finance Management Software Market Outlook:

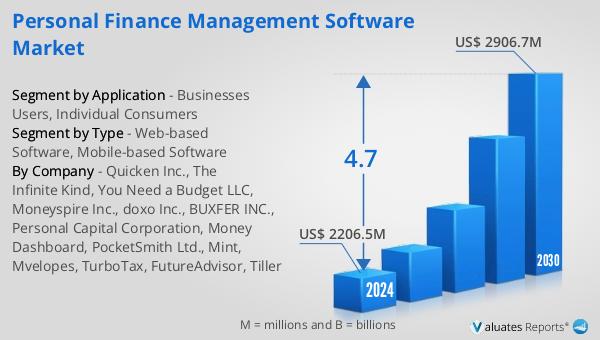

The outlook for the Global Personal Finance Management Software Market is promising, with projections indicating significant growth in the coming years. According to market analysis, the market is expected to expand from $2,206.5 million in 2024 to $2,906.7 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.7% during the forecast period. This growth can be attributed to several factors, including the increasing demand for financial literacy and the rising adoption of digital financial tools among consumers and businesses alike. As more people recognize the importance of effective financial management in achieving their personal and professional goals, the demand for sophisticated yet user-friendly software solutions continues to rise. The market is also benefiting from advancements in technology, which have made it easier for developers to create innovative and feature-rich personal finance management tools that cater to the diverse needs of modern users. As a result, the Global Personal Finance Management Software Market is poised for continued expansion, driven by the growing awareness of the importance of financial planning and the increasing availability of digital solutions that make managing finances more accessible and efficient.

| Report Metric | Details |

| Report Name | Personal Finance Management Software Market |

| Accounted market size in 2024 | US$ 2206.5 million |

| Forecasted market size in 2030 | US$ 2906.7 million |

| CAGR | 4.7 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Quicken Inc., The Infinite Kind, You Need a Budget LLC, Moneyspire Inc., doxo Inc., BUXFER INC., Personal Capital Corporation, Money Dashboard, PocketSmith Ltd., Mint, Mvelopes, TurboTax, FutureAdvisor, Tiller |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |