What is Global Learner Driver Insurance Market?

The Global Learner Driver Insurance Market is a specialized segment within the broader insurance industry, focusing on providing coverage for individuals who are in the process of learning to drive. This market caters to the unique needs of learner drivers, who often require temporary and flexible insurance solutions that differ from standard auto insurance policies. Learner driver insurance is designed to offer short-term coverage, typically ranging from a few hours to several months, allowing learners to practice driving under supervision without the need for a full annual policy. This type of insurance is particularly beneficial for young drivers or those who are new to driving, as it provides an affordable and accessible way to gain driving experience. The market is driven by factors such as the increasing number of new drivers, the rising awareness of the importance of insurance coverage, and the growing demand for flexible insurance options. As more people seek to obtain their driver's licenses, the demand for learner driver insurance is expected to continue to grow, offering opportunities for insurers to develop innovative products tailored to this specific demographic.

Own Car, Someone else's Car in the Global Learner Driver Insurance Market:

In the context of the Global Learner Driver Insurance Market, the terms "Own Car" and "Someone else's Car" refer to the different scenarios in which learner drivers may require insurance coverage. When a learner driver practices in their own car, they need a policy that covers them specifically as a learner, often with the option to add a supervising driver. This type of insurance is crucial because it ensures that the learner is protected while they are gaining experience on the road. The policy typically includes coverage for accidents, damage to the vehicle, and liability for any harm caused to others. On the other hand, when a learner driver practices in someone else's car, the insurance requirements can be different. In many cases, the car owner's existing insurance policy may not automatically cover a learner driver, necessitating additional coverage. This is where learner driver insurance comes into play, providing a temporary solution that allows the learner to drive another person's car legally and safely. This type of insurance is particularly useful for learners who do not own a car or who prefer to practice in a vehicle that is not theirs. It offers flexibility and peace of mind for both the learner and the car owner, ensuring that all parties are adequately protected. The Global Learner Driver Insurance Market addresses these needs by offering a range of products that cater to both scenarios, allowing learners to choose the coverage that best suits their situation. Whether practicing in their own car or someone else's, learner drivers can find insurance solutions that provide the necessary protection and support as they work towards obtaining their driver's license. The market's growth is fueled by the increasing number of learner drivers worldwide, as well as the rising awareness of the importance of having appropriate insurance coverage during the learning process. As more people recognize the benefits of learner driver insurance, the demand for these products is expected to continue to rise, creating opportunities for insurers to expand their offerings and reach a broader audience. By providing tailored insurance solutions for both own car and someone else's car scenarios, the Global Learner Driver Insurance Market plays a crucial role in supporting learner drivers on their journey to becoming licensed drivers.

Insurance Intermediaries, Insurance Company, Bank, Insurance Broker, Others in the Global Learner Driver Insurance Market:

The usage of the Global Learner Driver Insurance Market extends across various sectors, including insurance intermediaries, insurance companies, banks, insurance brokers, and others. Insurance intermediaries play a vital role in connecting learner drivers with suitable insurance products. They act as a bridge between the insurers and the customers, helping learners navigate the complexities of insurance policies and find the best coverage options for their needs. By offering personalized advice and support, intermediaries ensure that learner drivers have access to the right insurance solutions, enhancing their overall experience. Insurance companies, on the other hand, are the primary providers of learner driver insurance products. They develop and offer a range of policies tailored to the unique needs of learner drivers, focusing on flexibility, affordability, and comprehensive coverage. These companies invest in research and development to create innovative products that cater to the evolving demands of the market, ensuring that they remain competitive and relevant. Banks also play a role in the Global Learner Driver Insurance Market by offering insurance products as part of their financial services portfolio. By partnering with insurance companies, banks can provide their customers with convenient access to learner driver insurance, often bundling it with other financial products to offer added value. This approach not only benefits the customers but also helps banks diversify their offerings and strengthen their customer relationships. Insurance brokers are another key player in the market, providing expert advice and guidance to learner drivers seeking insurance coverage. Brokers have in-depth knowledge of the insurance industry and can offer valuable insights into the best products available, helping learners make informed decisions. They work closely with both insurers and customers to ensure that the policies offered meet the specific needs of learner drivers, providing a personalized and tailored service. Finally, other stakeholders, such as driving schools and automotive associations, also contribute to the Global Learner Driver Insurance Market by promoting the importance of insurance coverage for learner drivers. These organizations often collaborate with insurers to offer exclusive deals and discounts to their members, encouraging more learners to take up insurance and practice driving safely. By working together, these various sectors help to create a supportive ecosystem for learner drivers, ensuring that they have access to the necessary resources and protection as they embark on their journey to becoming licensed drivers.

Global Learner Driver Insurance Market Outlook:

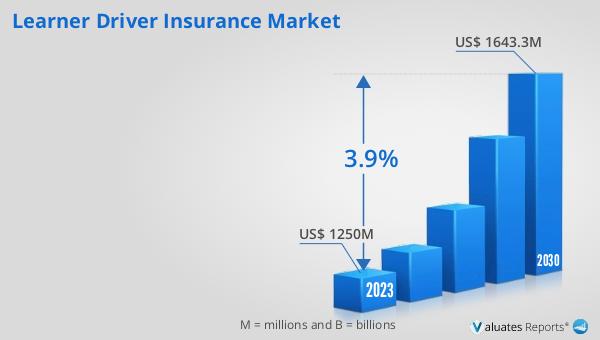

The outlook for the Global Learner Driver Insurance Market indicates a steady growth trajectory over the coming years. The market is anticipated to expand from a valuation of US$ 1310 million in 2024 to approximately US$ 1643.3 million by 2030. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 3.9% throughout the forecast period. This positive outlook is driven by several factors, including the increasing number of new drivers entering the market, the rising awareness of the importance of having appropriate insurance coverage, and the growing demand for flexible and affordable insurance solutions. As more individuals seek to obtain their driver's licenses, the need for learner driver insurance is likely to increase, providing opportunities for insurers to develop innovative products that cater to this specific demographic. Additionally, advancements in technology and the increasing use of digital platforms are expected to further drive the market's growth, making it easier for learners to access and purchase insurance products online. As the market continues to evolve, insurers will need to adapt to changing consumer preferences and expectations, offering products that are not only comprehensive and affordable but also convenient and easy to understand. By doing so, they can capitalize on the growing demand for learner driver insurance and secure a strong position in this expanding market.

| Report Metric | Details |

| Report Name | Learner Driver Insurance Market |

| Accounted market size in 2024 | US$ 1310 million |

| Forecasted market size in 2030 | US$ 1643.3 million |

| CAGR | 3.9 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA, Allstate Insurance, Berkshire Hathaway, Allianz, AIG, Generali, State Farm Insurance, Munich Reinsurance, Metlife, Nippon Life Insurance, Ping An, PICC, China Life Insurance, Collingwood Insurance Services |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |