What is Offshore Aquaculture - Global Market?

Offshore aquaculture, also known as open ocean aquaculture, refers to the practice of cultivating marine organisms in the open sea, away from the coast. This method of aquaculture is gaining traction globally due to its potential to meet the rising demand for seafood without overburdening coastal ecosystems. Offshore aquaculture involves the use of advanced technologies and structures to withstand harsh ocean conditions, allowing for the farming of species such as fish, shellfish, and seaweed in deeper and less sheltered waters. The global market for offshore aquaculture is driven by the increasing need for sustainable seafood production, as traditional fishing methods and coastal aquaculture face limitations due to environmental concerns and space constraints. By moving operations offshore, aquaculture can potentially reduce the environmental impact on coastal areas and provide a more stable environment for fish farming, leading to higher yields and better quality produce. This market is also influenced by technological advancements in cage design, feeding systems, and monitoring equipment, which enhance the efficiency and sustainability of offshore operations. As the global population continues to grow, the demand for seafood is expected to rise, making offshore aquaculture a crucial component of the future food supply chain.

Floating Type, Submersible Type in the Offshore Aquaculture - Global Market:

Offshore aquaculture can be broadly categorized into two main types based on the technology and structures used: floating type and submersible type. The floating type of offshore aquaculture involves the use of cages or pens that float on the ocean surface. These structures are anchored to the seabed and are designed to withstand the dynamic conditions of the open sea, such as strong currents and waves. Floating cages are typically made from durable materials like high-density polyethylene, which can endure the harsh marine environment. This type of aquaculture is advantageous because it allows for easy access to the farmed species for feeding, monitoring, and harvesting. However, it also poses challenges, such as vulnerability to storms and the need for regular maintenance to prevent biofouling and structural damage. On the other hand, submersible type offshore aquaculture involves cages that can be submerged below the ocean surface. These cages are designed to be lowered into deeper waters, providing a more stable environment for the farmed species. Submersible cages are often used in areas with extreme weather conditions, as they can be submerged to avoid damage from storms and high waves. This type of aquaculture requires advanced technology for submersion and resurfacing, as well as remote monitoring systems to ensure the health and growth of the farmed species. Submersible cages offer several benefits, including reduced visual impact on the seascape, lower risk of escape for farmed species, and protection from surface-level predators. However, they also present challenges, such as higher initial costs and the need for specialized equipment and expertise for operation and maintenance. Both floating and submersible types of offshore aquaculture have their own set of advantages and challenges, and the choice between them depends on factors such as the species being farmed, the environmental conditions of the site, and the available resources and technology. As the global market for offshore aquaculture continues to grow, innovations in cage design, materials, and monitoring systems are expected to enhance the efficiency and sustainability of both floating and submersible aquaculture operations.

Personal, Commercial in the Offshore Aquaculture - Global Market:

Offshore aquaculture has diverse applications in both personal and commercial contexts, contributing significantly to the global seafood supply chain. In personal contexts, offshore aquaculture can be seen as a means for individuals or small communities to engage in sustainable seafood production. This approach allows for the cultivation of fish, shellfish, and seaweed in offshore environments, providing a reliable source of protein and other nutrients for personal consumption. By utilizing offshore aquaculture, individuals can reduce their reliance on wild-caught seafood, which is often subject to overfishing and environmental degradation. Additionally, personal offshore aquaculture initiatives can promote local food security and self-sufficiency, particularly in coastal communities where access to fresh seafood is limited. On a commercial scale, offshore aquaculture plays a crucial role in meeting the growing global demand for seafood. Commercial offshore aquaculture operations are typically large-scale and involve the farming of high-value species such as salmon, tuna, and shrimp. These operations are designed to maximize production efficiency and profitability while minimizing environmental impact. By moving aquaculture operations offshore, commercial producers can access larger areas of ocean space, reducing competition for coastal resources and minimizing conflicts with other marine activities. Offshore aquaculture also allows for the cultivation of species that are not well-suited to traditional coastal farming methods, expanding the range of available seafood products. Furthermore, commercial offshore aquaculture can contribute to economic development by creating jobs and supporting local economies. The industry requires a skilled workforce for tasks such as cage maintenance, feeding, monitoring, and harvesting, providing employment opportunities in coastal and rural areas. As the global market for seafood continues to expand, offshore aquaculture is expected to play an increasingly important role in ensuring a sustainable and secure food supply. By balancing personal and commercial interests, offshore aquaculture can contribute to a more resilient and sustainable global food system.

Offshore Aquaculture - Global Market Outlook:

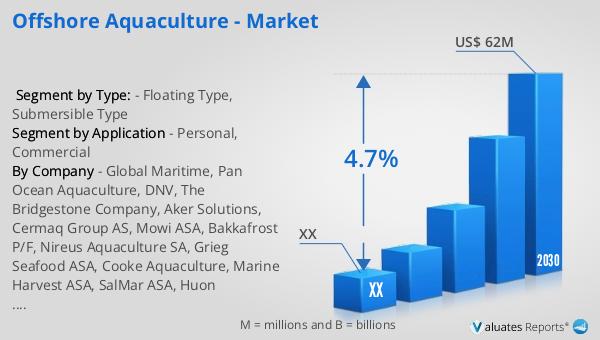

The global market for offshore aquaculture was valued at approximately $45 million in 2023. This market is projected to experience growth, reaching an estimated value of $62 million by the year 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 4.7% over the forecast period from 2024 to 2030. The anticipated expansion of the offshore aquaculture market can be attributed to several factors, including the increasing demand for sustainable seafood production and the advancements in aquaculture technologies. As traditional fishing methods face challenges such as overfishing and environmental concerns, offshore aquaculture offers a viable solution for meeting the rising global demand for seafood. The market's growth is also supported by the development of innovative cage designs, feeding systems, and monitoring technologies that enhance the efficiency and sustainability of offshore operations. Additionally, the growing awareness of the environmental benefits of offshore aquaculture, such as reduced impact on coastal ecosystems and improved water quality, is expected to drive market growth. As the global population continues to increase, the demand for seafood is projected to rise, further fueling the expansion of the offshore aquaculture market. This market outlook highlights the potential for offshore aquaculture to play a significant role in the future of sustainable seafood production.

| Report Metric | Details |

| Report Name | Offshore Aquaculture - Market |

| Forecasted market size in 2030 | US$ 62 million |

| CAGR | 4.7% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Global Maritime, Pan Ocean Aquaculture, DNV, The Bridgestone Company, Aker Solutions, Cermaq Group AS, Mowi ASA, Bakkafrost P/F, Nireus Aquaculture SA, Grieg Seafood ASA, Cooke Aquaculture, Marine Harvest ASA, SalMar ASA, Huon Aquaculture Group, Open Blue, The Kingfish Company, Ocean Farm Technologies, Oceanus Group Limited, Blue Ridge Aquaculture, Australis Aquaculture |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |