What is Soybean Food and Beverage Product - Global Market?

Soybean food and beverage products have become a significant part of the global market due to their versatility and nutritional benefits. These products are derived from soybeans, which are a rich source of protein, fiber, and essential nutrients. They are used in a variety of foods and beverages, including soy milk, tofu, tempeh, soy sauce, and soy-based snacks. The global market for these products is driven by increasing consumer awareness about health and wellness, as well as the growing demand for plant-based diets. Soybean products are popular among vegetarians and vegans as they provide a complete protein source. Additionally, they are often used as meat substitutes, making them appealing to those looking to reduce their meat consumption. The market is also influenced by the rising trend of lactose intolerance and dairy allergies, which has led to a surge in demand for soy-based dairy alternatives. As a result, the soybean food and beverage market is expected to continue its growth trajectory, driven by innovation and expanding consumer preferences.

GMO, Non-GMO in the Soybean Food and Beverage Product - Global Market:

The global market for soybean food and beverage products is characterized by the presence of both GMO (genetically modified organisms) and non-GMO products. GMO soybeans have been genetically engineered to enhance certain traits, such as resistance to pests and herbicides, which can lead to higher yields and reduced agricultural costs. These modifications can make GMO soybeans more appealing to farmers and producers, as they can potentially increase profitability and efficiency. However, the use of GMO soybeans in food and beverage products has been a topic of debate among consumers and health advocates. Some consumers are concerned about the potential health and environmental impacts of genetically modified crops, leading to a growing demand for non-GMO soybean products. Non-GMO soybeans are cultivated without genetic modification, and they are often perceived as more natural and safer by consumers who are wary of GMOs. This perception has led to an increase in the availability and popularity of non-GMO soybean products in the market. The demand for non-GMO products is particularly strong in regions where consumers are more health-conscious and environmentally aware. In response to this demand, many companies have started to label their products as non-GMO, providing transparency and assurance to consumers. The distinction between GMO and non-GMO soybean products also plays a significant role in international trade. Some countries have strict regulations regarding the import and sale of GMO products, which can impact the global distribution of soybean food and beverage products. As a result, producers and exporters must navigate these regulatory landscapes to ensure compliance and market access. The choice between GMO and non-GMO soybeans can also affect the pricing and marketing strategies of companies. Non-GMO products often command a premium price due to their perceived health benefits and the additional costs associated with non-GMO certification and segregation during production. Companies may use this premium pricing to target niche markets and differentiate their products from competitors. Overall, the global market for soybean food and beverage products is shaped by the ongoing debate and consumer preferences regarding GMO and non-GMO products. As awareness and demand for non-GMO options continue to grow, companies are likely to invest in research and development to meet these consumer needs while balancing the economic advantages of GMO soybeans. This dynamic market landscape presents both challenges and opportunities for stakeholders in the soybean food and beverage industry.

Online Sales, Offline Sales in the Soybean Food and Beverage Product - Global Market:

The usage of soybean food and beverage products in the global market is influenced by both online and offline sales channels. Online sales have become increasingly important in recent years, driven by the growth of e-commerce and changing consumer shopping habits. The convenience of online shopping allows consumers to easily access a wide range of soybean products from the comfort of their homes. Online platforms offer detailed product information, customer reviews, and competitive pricing, making it easier for consumers to make informed purchasing decisions. Additionally, online sales channels provide opportunities for niche and specialty soybean products to reach a broader audience, as they are not limited by the physical constraints of traditional retail stores. This has led to an increase in the availability and diversity of soybean food and beverage products in the online market. On the other hand, offline sales channels, such as supermarkets, health food stores, and specialty shops, continue to play a crucial role in the distribution of soybean products. These physical retail locations offer consumers the opportunity to see, touch, and taste products before purchasing, which can be an important factor for many buyers. Offline sales channels also benefit from impulse purchases and the ability to provide personalized customer service and product recommendations. In-store promotions, sampling events, and educational displays can further enhance the consumer experience and drive sales of soybean food and beverage products. The integration of online and offline sales strategies, known as omnichannel retailing, is becoming increasingly common in the soybean market. Companies are leveraging both channels to create a seamless shopping experience for consumers, allowing them to research products online and purchase them in-store, or vice versa. This approach helps to maximize market reach and cater to the diverse preferences of modern consumers. As technology continues to evolve, the use of digital tools and platforms in the marketing and sales of soybean food and beverage products is expected to grow. Social media, mobile apps, and online marketplaces are becoming essential components of marketing strategies, enabling companies to engage with consumers and build brand loyalty. Overall, the usage of soybean food and beverage products in the global market is shaped by the interplay between online and offline sales channels, with each offering unique advantages and opportunities for growth.

Soybean Food and Beverage Product - Global Market Outlook:

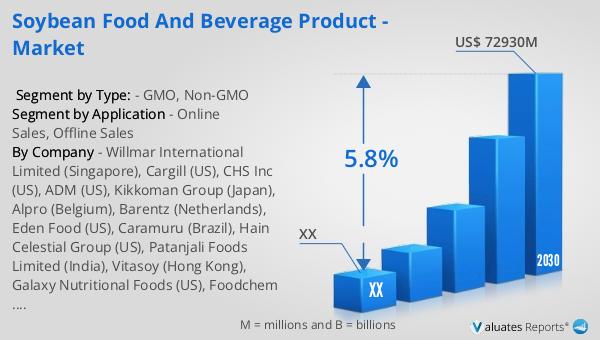

The global market for soybean food and beverage products was valued at approximately $51 billion in 2023. It is projected to grow to a revised size of around $72.93 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2024 to 2030. This growth is indicative of the increasing demand for soybean-based products, driven by factors such as rising health consciousness, the popularity of plant-based diets, and the need for sustainable food sources. In North America, the market for soybean food and beverage products is also experiencing growth, although specific figures for this region were not provided. The market dynamics in North America are influenced by similar trends, including the shift towards healthier eating habits and the growing interest in non-GMO and organic products. The forecasted growth in the global and North American markets highlights the potential for innovation and expansion in the soybean food and beverage industry. Companies operating in this sector are likely to focus on product development, marketing strategies, and supply chain optimization to capitalize on the growing demand and maintain a competitive edge. As consumer preferences continue to evolve, the soybean market is poised for significant growth and transformation in the coming years.

| Report Metric | Details |

| Report Name | Soybean Food and Beverage Product - Market |

| Forecasted market size in 2030 | US$ 72930 million |

| CAGR | 5.8% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Willmar International Limited (Singapore), Cargill (US), CHS Inc (US), ADM (US), Kikkoman Group (Japan), Alpro (Belgium), Barentz (Netherlands), Eden Food (US), Caramuru (Brazil), Hain Celestial Group (US), Patanjali Foods Limited (India), Vitasoy (Hong Kong), Galaxy Nutritional Foods (US), Foodchem International Corporation (China), Crown Soya Protein Group (China), The Scoular Company (US), Northern Soy (US), Solbar Ltd (China), Farbest Tallman Foods Corporation (US), Perdue Agribusiness (US), Sotexpro (France), Bermil Group (Brazil), Rio Pardo Potential Vegetal S.A. (Brazil), Good Catch Foods (Pennsylvania), Living Foods (India) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |