What is Health and Medical Reinsurance - Global Market?

Health and medical reinsurance is a specialized segment of the insurance industry that provides a safety net for insurance companies by covering risks associated with health and medical claims. This global market plays a crucial role in stabilizing the financial health of primary insurers by allowing them to transfer portions of their risk portfolios to reinsurers. By doing so, primary insurers can manage their exposure to large claims, such as those arising from catastrophic health events or unexpected surges in medical costs. Reinsurance helps maintain the solvency and operational stability of insurance companies, ensuring they can meet their policyholders' needs even in challenging circumstances. The global market for health and medical reinsurance is driven by factors such as increasing healthcare costs, the rising prevalence of chronic diseases, and the need for insurers to manage their risk exposure effectively. As healthcare systems worldwide continue to evolve, the demand for reinsurance solutions is expected to grow, providing insurers with the necessary tools to navigate the complexities of the modern healthcare landscape. This market is characterized by a diverse range of products and services tailored to meet the specific needs of insurers, including excess of loss and quota share arrangements.

Excess of Loss, Quota Share in the Health and Medical Reinsurance - Global Market:

Excess of loss and quota share are two fundamental types of reinsurance arrangements that play a pivotal role in the health and medical reinsurance global market. Excess of loss reinsurance is designed to protect insurers from significant losses by covering claims that exceed a specified threshold. This type of reinsurance is particularly beneficial for insurers facing the risk of large, unpredictable claims, such as those resulting from catastrophic health events or high-cost medical treatments. By setting a predetermined limit, insurers can cap their potential losses, ensuring financial stability and protecting their capital reserves. Excess of loss reinsurance is typically structured on a per-risk or per-event basis, allowing insurers to tailor their coverage to specific needs and risk profiles. On the other hand, quota share reinsurance involves the proportional sharing of premiums and losses between the primary insurer and the reinsurer. In this arrangement, the reinsurer agrees to cover a fixed percentage of all claims, regardless of their size, in exchange for a corresponding share of the premiums. This type of reinsurance is particularly useful for insurers looking to manage their overall risk exposure and improve their capital efficiency. By sharing both the risks and rewards with a reinsurer, primary insurers can enhance their underwriting capacity and expand their market reach. Quota share reinsurance is often used in conjunction with excess of loss arrangements to provide comprehensive risk management solutions. Together, these reinsurance structures enable insurers to navigate the complexities of the health and medical insurance market, ensuring they can meet the needs of their policyholders while maintaining financial stability. The global market for health and medical reinsurance is characterized by a diverse range of products and services, each tailored to meet the specific needs of insurers. As healthcare systems worldwide continue to evolve, the demand for innovative reinsurance solutions is expected to grow, providing insurers with the necessary tools to navigate the complexities of the modern healthcare landscape. By leveraging the expertise and resources of reinsurers, primary insurers can effectively manage their risk exposure, ensuring they can meet the needs of their policyholders even in challenging circumstances. This collaborative approach to risk management is essential for maintaining the solvency and operational stability of insurance companies, ensuring they can continue to provide essential coverage to individuals and families around the world.

Children, Adults, Senior Citizens in the Health and Medical Reinsurance - Global Market:

Health and medical reinsurance plays a vital role in providing coverage across different age groups, including children, adults, and senior citizens. For children, reinsurance helps insurers manage the risks associated with pediatric care, which can include a wide range of medical conditions and treatments. Children often require specialized care, including vaccinations, routine check-ups, and treatment for common childhood illnesses. In some cases, children may also need care for more serious conditions, such as congenital disorders or chronic illnesses. Reinsurance allows insurers to offer comprehensive coverage for these needs, ensuring that families have access to the necessary medical services without facing financial hardship. For adults, health and medical reinsurance is crucial in managing the risks associated with a broad spectrum of health issues, from routine medical care to more complex conditions. Adults may require coverage for preventive care, such as screenings and vaccinations, as well as treatment for acute and chronic illnesses. Reinsurance helps insurers provide a wide range of coverage options, ensuring that individuals have access to the care they need at every stage of life. This is particularly important as adults face increasing healthcare costs and the potential for unexpected medical expenses. For senior citizens, reinsurance is essential in managing the risks associated with aging and the increased likelihood of chronic health conditions. Seniors often require more frequent medical care, including regular check-ups, prescription medications, and treatment for age-related illnesses. Reinsurance allows insurers to offer comprehensive coverage for these needs, ensuring that seniors have access to the necessary medical services without facing financial hardship. This is particularly important as the global population continues to age, with more individuals living longer and requiring ongoing medical care. By providing a safety net for insurers, reinsurance helps ensure that individuals of all ages have access to the healthcare services they need, regardless of their financial situation. This is essential for maintaining the overall health and well-being of populations worldwide, as well as for supporting the financial stability of insurance companies.

Health and Medical Reinsurance - Global Market Outlook:

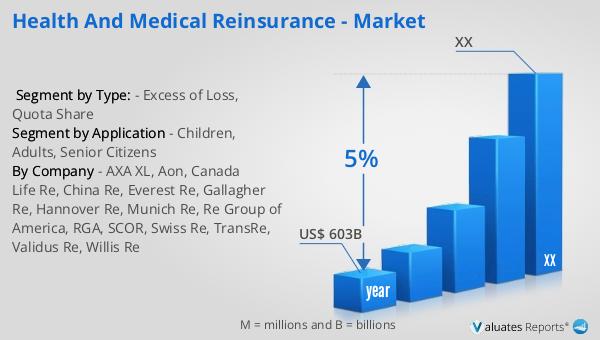

According to our research, the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth trajectory underscores the increasing demand for medical devices driven by advancements in technology, rising healthcare needs, and the expanding global population. The medical device industry encompasses a wide range of products, from simple instruments like thermometers to complex machinery such as MRI scanners. This diverse market is fueled by continuous innovation and the need for improved healthcare solutions. As healthcare systems worldwide strive to enhance patient care and outcomes, the demand for cutting-edge medical devices is expected to rise. Factors such as the aging population, the prevalence of chronic diseases, and the need for efficient healthcare delivery systems contribute to the market's expansion. Additionally, the integration of digital technologies and the growing emphasis on personalized medicine are driving the development of new and advanced medical devices. As a result, companies operating in this sector are investing heavily in research and development to meet the evolving needs of healthcare providers and patients. The projected growth of the medical device market highlights the critical role these products play in modern healthcare and their potential to transform the industry in the coming years.

| Report Metric | Details |

| Report Name | Health and Medical Reinsurance - Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA XL, Aon, Canada Life Re, China Re, Everest Re, Gallagher Re, Hannover Re, Munich Re, Re Group of America, RGA, SCOR, Swiss Re, TransRe, Validus Re, Willis Re |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |