What is Comprehensive Integrated Circuits - Global Market?

Comprehensive Integrated Circuits (ICs) are the backbone of modern electronics, playing a crucial role in the global market. These tiny chips are found in almost every electronic device, from smartphones and computers to cars and industrial machines. The global market for these circuits is vast and continually expanding, driven by the increasing demand for advanced technology and connectivity. Integrated circuits are essential for processing information, storing data, and managing power in electronic devices. They are made up of millions of tiny components, such as transistors and capacitors, all integrated onto a single chip. This integration allows for more efficient and compact designs, which is why ICs are so prevalent in today's technology. The global market for integrated circuits is highly competitive, with numerous companies vying for a share of the market. As technology continues to advance, the demand for more powerful and efficient integrated circuits is expected to grow, driving further innovation and development in this field.

Advanced Process, Non-Advanced Process in the Comprehensive Integrated Circuits - Global Market:

In the realm of Comprehensive Integrated Circuits, the distinction between Advanced Process and Non-Advanced Process is pivotal in understanding the global market dynamics. Advanced Process ICs are manufactured using cutting-edge technology, often involving smaller node sizes, such as 7nm, 5nm, or even 3nm. These smaller nodes allow for more transistors to be packed onto a single chip, enhancing performance, reducing power consumption, and enabling more complex functionalities. This makes them ideal for high-performance applications like smartphones, high-end computing, and advanced automotive systems. The production of Advanced Process ICs requires significant investment in research and development, as well as state-of-the-art manufacturing facilities. Companies that can afford these investments often lead the market, offering products that push the boundaries of what is technologically possible. On the other hand, Non-Advanced Process ICs are manufactured using older, more established technologies. These might involve larger node sizes, such as 28nm or 45nm, which are less costly to produce and are often used in applications where cutting-edge performance is not critical. These ICs are typically found in consumer electronics, industrial applications, and other areas where cost-effectiveness is more important than having the latest technology. Despite being less advanced, these ICs still play a crucial role in the market, providing reliable and affordable solutions for a wide range of applications. The balance between Advanced and Non-Advanced Process ICs in the market is influenced by various factors, including technological advancements, consumer demand, and economic considerations. As technology continues to evolve, the line between these two categories may blur, with more applications requiring the capabilities of Advanced Process ICs. However, Non-Advanced Process ICs will likely remain relevant, especially in markets where cost and reliability are prioritized over cutting-edge performance. The global market for Comprehensive Integrated Circuits is thus a complex landscape, shaped by the interplay between these two types of processes. Companies must navigate this landscape carefully, balancing the need for innovation with the realities of production costs and market demand. As the industry moves forward, the ability to effectively leverage both Advanced and Non-Advanced Process ICs will be key to success in the global market.

Communication, Industrial, Auto Electronic, Consumer Electronic, Computer, Government and Military in the Comprehensive Integrated Circuits - Global Market:

Comprehensive Integrated Circuits are integral to various sectors, each with unique demands and applications. In communication, ICs are vital for enabling high-speed data transmission and connectivity. They are used in smartphones, routers, and other communication devices to process signals and manage data flow efficiently. The demand for faster and more reliable communication technologies drives the need for advanced ICs that can handle complex tasks with minimal power consumption. In the industrial sector, ICs are used in automation systems, sensors, and control units. They help improve efficiency and precision in manufacturing processes, enabling smart factories and the Internet of Things (IoT) applications. The robustness and reliability of ICs are crucial in this sector, where they must withstand harsh environments and operate continuously without failure. In the automotive industry, ICs are used in electronic control units, infotainment systems, and advanced driver-assistance systems (ADAS). They enable features like navigation, connectivity, and autonomous driving, making vehicles safer and more efficient. The demand for electric and hybrid vehicles further boosts the need for specialized ICs that can manage power and energy efficiently. Consumer electronics, such as televisions, gaming consoles, and home appliances, rely heavily on ICs for their functionality. These circuits enable features like high-definition displays, smart connectivity, and energy efficiency, enhancing the user experience. The constant evolution of consumer preferences drives innovation in IC design and functionality. In the computer sector, ICs are the heart of processing units, memory, and storage devices. They enable high-speed computing, data processing, and storage capabilities, supporting a wide range of applications from personal computing to data centers. The demand for more powerful and efficient computing solutions continues to drive advancements in IC technology. Government and military applications require ICs that meet stringent standards for security, reliability, and performance. These circuits are used in communication systems, surveillance equipment, and defense technologies, where they must operate flawlessly under extreme conditions. The need for secure and resilient ICs is paramount in this sector, where failure is not an option. Overall, the usage of Comprehensive Integrated Circuits across these sectors highlights their versatility and importance in modern technology. As each sector continues to evolve, the demand for more advanced and specialized ICs will drive further innovation and growth in the global market.

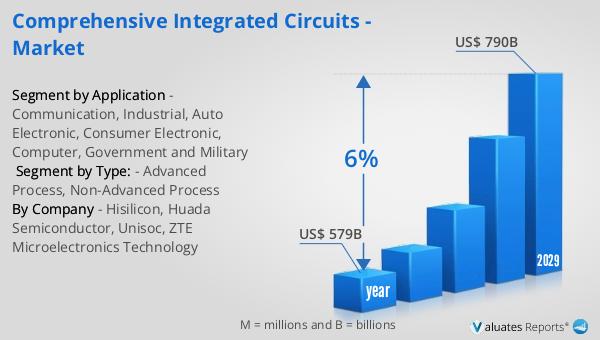

Comprehensive Integrated Circuits - Global Market Outlook:

The global semiconductor market, which includes Comprehensive Integrated Circuits, was valued at approximately $579 billion in 2022. This market is projected to grow significantly, reaching around $790 billion by 2029. This growth represents a compound annual growth rate (CAGR) of 6% over the forecast period. This expansion is driven by the increasing demand for semiconductors across various industries, including consumer electronics, automotive, industrial, and communication. The rapid advancement in technology, coupled with the growing need for connectivity and data processing, fuels this demand. As more devices become interconnected and reliant on sophisticated processing capabilities, the role of semiconductors becomes even more critical. The market's growth is also supported by the continuous innovation in semiconductor manufacturing processes, which allows for the production of more efficient and powerful integrated circuits. Companies in this market are investing heavily in research and development to stay competitive and meet the evolving needs of their customers. As a result, the global semiconductor market is poised for substantial growth, offering numerous opportunities for businesses and investors alike.

| Report Metric | Details |

| Report Name | Comprehensive Integrated Circuits - Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2024 - 2029 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Hisilicon, Huada Semiconductor, Unisoc, ZTE Microelectronics Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |