What is Global Open Banking API Market?

The global Open Banking API market is a rapidly evolving sector that leverages technology to facilitate secure and efficient financial transactions and data sharing between banks, third-party service providers, and consumers. Open Banking APIs (Application Programming Interfaces) allow different financial institutions to communicate and share data seamlessly, fostering innovation and enhancing customer experiences. This market is driven by regulatory mandates, such as the PSD2 directive in Europe, which requires banks to open their payment services and customer data to third-party providers with customer consent. The primary goal is to increase competition, improve financial services, and provide consumers with more choices. As a result, the global Open Banking API market is witnessing significant growth, with numerous financial institutions and fintech companies adopting these APIs to offer innovative services, such as personalized financial management tools, faster payment solutions, and enhanced security measures. The market's expansion is further fueled by the increasing demand for digital banking solutions and the growing adoption of smartphones and internet services worldwide.

Payment Initiation Sevice API, Account Information Service API, Others in the Global Open Banking API Market:

Payment Initiation Service APIs (PIS APIs) are a crucial component of the global Open Banking API market, enabling third-party providers to initiate payments directly from a consumer's bank account with their consent. This service streamlines the payment process, reducing the need for intermediaries and lowering transaction costs. PIS APIs are particularly beneficial for e-commerce platforms, as they allow for instant payments, enhancing the customer experience and reducing cart abandonment rates. Additionally, these APIs provide a secure and efficient alternative to traditional payment methods, such as credit cards and bank transfers, by leveraging strong customer authentication and encryption technologies. Account Information Service APIs (AIS APIs), on the other hand, allow third-party providers to access and aggregate financial data from multiple bank accounts with the customer's permission. This service enables consumers to have a comprehensive view of their financial situation, facilitating better financial planning and management. AIS APIs are widely used by personal finance management apps, budgeting tools, and credit scoring services to provide users with personalized insights and recommendations. Other types of Open Banking APIs include those for identity verification, fraud detection, and customer onboarding. These APIs help financial institutions and fintech companies streamline their operations, enhance security, and improve customer experiences. For instance, identity verification APIs can quickly and accurately verify a customer's identity using biometric data or government-issued IDs, reducing the risk of fraud and ensuring compliance with regulatory requirements. Fraud detection APIs leverage machine learning algorithms and real-time data analysis to identify and prevent fraudulent activities, protecting both consumers and financial institutions. Customer onboarding APIs simplify the account opening process by automating data collection and verification, reducing the time and effort required for new customers to start using financial services. Overall, the global Open Banking API market is transforming the financial services industry by enabling seamless data sharing, fostering innovation, and enhancing customer experiences.

Consumer, Enterprise, Financial Institution in the Global Open Banking API Market:

The usage of the global Open Banking API market spans across various sectors, including consumers, enterprises, and financial institutions. For consumers, Open Banking APIs offer numerous benefits, such as personalized financial management tools, faster and more secure payment options, and access to a wider range of financial services. Personal finance management apps, for instance, use Account Information Service APIs to aggregate data from multiple bank accounts, providing users with a comprehensive view of their financial situation. This enables consumers to make informed decisions, set budgets, and track their spending habits more effectively. Additionally, Payment Initiation Service APIs allow consumers to make instant payments directly from their bank accounts, reducing the need for credit cards and enhancing the overall payment experience. Enterprises also benefit significantly from the global Open Banking API market. By integrating Open Banking APIs into their systems, businesses can streamline their payment processes, reduce transaction costs, and improve cash flow management. For example, e-commerce platforms can use Payment Initiation Service APIs to offer customers instant payment options, reducing cart abandonment rates and increasing sales. Moreover, enterprises can leverage Account Information Service APIs to gain insights into their financial health, monitor cash flow, and make data-driven decisions. This is particularly beneficial for small and medium-sized businesses that may not have access to sophisticated financial management tools. Financial institutions, including banks and fintech companies, are at the forefront of the Open Banking API market. By adopting these APIs, financial institutions can enhance their service offerings, improve customer experiences, and stay competitive in a rapidly evolving market. Open Banking APIs enable banks to collaborate with third-party providers, offering innovative services such as personalized financial advice, automated savings plans, and real-time fraud detection. Additionally, financial institutions can use identity verification and customer onboarding APIs to streamline their operations, reduce the risk of fraud, and ensure compliance with regulatory requirements. Overall, the global Open Banking API market is driving significant changes across various sectors, enabling consumers, enterprises, and financial institutions to benefit from enhanced financial services and improved customer experiences.

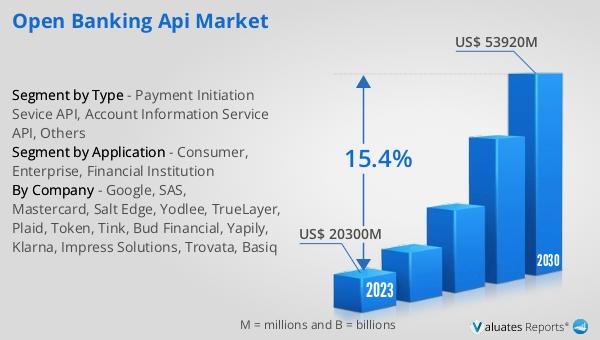

Global Open Banking API Market Outlook:

The global Open Banking API market was valued at US$ 20,300 million in 2023 and is projected to reach US$ 53,920 million by 2030, reflecting a compound annual growth rate (CAGR) of 15.4% during the forecast period from 2024 to 2030. This substantial growth underscores the increasing adoption of Open Banking APIs by financial institutions, fintech companies, and other stakeholders in the financial services industry. The market's expansion is driven by several factors, including regulatory mandates, technological advancements, and the growing demand for digital banking solutions. Regulatory frameworks, such as the PSD2 directive in Europe, have played a crucial role in promoting the adoption of Open Banking APIs by requiring banks to open their payment services and customer data to third-party providers with customer consent. Technological advancements, such as the development of secure and efficient APIs, have further facilitated the integration of Open Banking APIs into various financial services. Additionally, the increasing use of smartphones and internet services has fueled the demand for digital banking solutions, driving the growth of the global Open Banking API market. As a result, financial institutions and fintech companies are leveraging these APIs to offer innovative services, enhance customer experiences, and stay competitive in a rapidly evolving market.

| Report Metric | Details |

| Report Name | Open Banking API Market |

| Accounted market size in 2023 | US$ 20300 million |

| Forecasted market size in 2030 | US$ 53920 million |

| CAGR | 15.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Google, SAS, Mastercard, Salt Edge, Yodlee, TrueLayer, Plaid, Token, Tink, Bud Financial, Yapily, Klarna, Impress Solutions, Trovata, Basiq |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |