What is Global High Fructose Corn Syrup (HFCS) Market?

The Global High Fructose Corn Syrup (HFCS) Market is a significant segment within the broader sweeteners market, primarily driven by its extensive use in the food and beverage industry. HFCS is a liquid sweetener derived from corn starch, and it is widely used as a sugar substitute due to its cost-effectiveness and similar sweetness profile to sucrose. The market for HFCS is global, with major production and consumption occurring in regions such as North America, Europe, and Asia-Pacific. The demand for HFCS is influenced by various factors, including the growing consumption of processed foods and beverages, the rising prevalence of obesity and diabetes, and the ongoing debates about the health impacts of high sugar intake. Despite these concerns, HFCS continues to be a popular ingredient due to its functional properties, such as enhancing flavor, texture, and shelf life of products. The market is also shaped by regulatory policies, trade agreements, and advancements in production technologies. Overall, the Global High Fructose Corn Syrup Market is a dynamic and evolving sector, reflecting broader trends in consumer preferences, health awareness, and industrial practices.

HFCS 42, HFCS 55, Others in the Global High Fructose Corn Syrup (HFCS) Market:

High Fructose Corn Syrup (HFCS) is categorized into different types based on the fructose content, with HFCS 42 and HFCS 55 being the most common. HFCS 42 contains approximately 42% fructose and 53% glucose, making it less sweet than HFCS 55, which contains about 55% fructose and 42% glucose. HFCS 42 is primarily used in processed foods, baked goods, and some beverages, where a moderate level of sweetness is desired. It is favored for its ability to retain moisture, enhance texture, and extend the shelf life of products. On the other hand, HFCS 55 is predominantly used in soft drinks and other sweetened beverages due to its higher sweetness level, which is comparable to that of sucrose. This makes it an ideal choice for manufacturers looking to achieve a specific sweetness profile without the higher costs associated with pure sugar. Besides HFCS 42 and HFCS 55, there are other variants of HFCS with different fructose concentrations, such as HFCS 90, which contains about 90% fructose. HFCS 90 is used in specialty applications where a very high level of sweetness is required, although it is less common in mainstream food and beverage products. The choice of HFCS type depends on the specific requirements of the product being manufactured, including desired sweetness, texture, and cost considerations. The versatility of HFCS in various formulations makes it a valuable ingredient in the food and beverage industry, despite ongoing debates about its health implications. Manufacturers continue to innovate and adapt their use of HFCS to meet changing consumer preferences and regulatory standards.

Food, Drinks, Others in the Global High Fructose Corn Syrup (HFCS) Market:

The usage of High Fructose Corn Syrup (HFCS) in the global market spans across various sectors, with significant applications in food, drinks, and other industries. In the food sector, HFCS is widely used in baked goods, cereals, candies, and dairy products. Its ability to retain moisture and enhance texture makes it a preferred ingredient in products like cookies, cakes, and bread, where it helps maintain softness and extend shelf life. In cereals and candies, HFCS acts as a sweetener and flavor enhancer, contributing to the overall taste and appeal of the products. In dairy products, such as flavored yogurts and ice creams, HFCS not only adds sweetness but also improves the creamy texture and mouthfeel. In the beverage industry, HFCS is a key ingredient in soft drinks, fruit juices, and energy drinks. Its high sweetness level, particularly in the form of HFCS 55, makes it an ideal substitute for sucrose, providing the desired sweetness at a lower cost. HFCS also helps in maintaining the stability and consistency of beverages, ensuring a uniform taste and quality. Additionally, HFCS is used in alcoholic beverages, such as flavored beers and ready-to-drink cocktails, where it enhances the flavor profile and balances the overall taste. Beyond food and drinks, HFCS finds applications in other industries, including pharmaceuticals and personal care products. In the pharmaceutical industry, HFCS is used as a sweetener in syrups and liquid medications, making them more palatable, especially for children. In personal care products, such as toothpaste and mouthwashes, HFCS acts as a humectant, helping to retain moisture and improve the texture of the products. The versatility and functional properties of HFCS make it a valuable ingredient across various sectors, despite the ongoing debates about its health impacts. Manufacturers continue to leverage the benefits of HFCS to meet consumer demands and enhance the quality of their products.

Global High Fructose Corn Syrup (HFCS) Market Outlook:

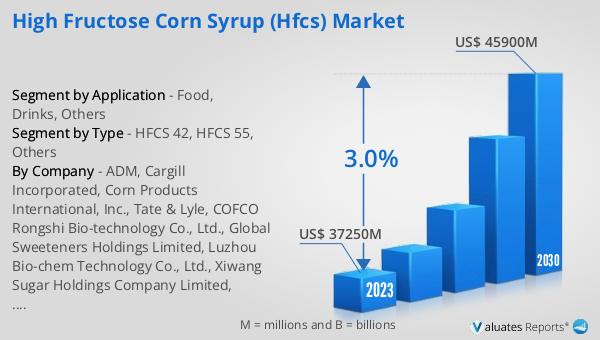

The global High Fructose Corn Syrup (HFCS) market was valued at approximately $37.25 billion in 2023 and is projected to reach around $45.9 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.0% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for sweeteners in the food and beverage industry, coupled with the cost-effectiveness and functional benefits of HFCS. The market dynamics are influenced by various factors, including consumer preferences, health trends, and regulatory policies. Despite the controversies surrounding the health impacts of HFCS, its widespread use in processed foods and beverages continues to drive market growth. The ongoing innovations in production technologies and the development of new HFCS formulations also contribute to the market expansion. As manufacturers strive to meet the evolving consumer demands and regulatory standards, the HFCS market is expected to witness steady growth in the coming years.

| Report Metric | Details |

| Report Name | High Fructose Corn Syrup (HFCS) Market |

| Accounted market size in 2023 | US$ 37250 million |

| Forecasted market size in 2030 | US$ 45900 million |

| CAGR | 3.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | ADM, Cargill Incorporated, Corn Products International, Inc., Tate & Lyle, COFCO Rongshi Bio-technology Co., Ltd., Global Sweeteners Holdings Limited, Luzhou Bio-chem Technology Co., Ltd., Xiwang Sugar Holdings Company Limited, Ingredion, Grain Processing Corporation, Karo Syrups, Baolingbao Biotechnology Co., Ltd., Indiana Sugars |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |