What is Global Commercial Payment Cards Market?

The Global Commercial Payment Cards Market refers to the worldwide industry that deals with the issuance and usage of payment cards specifically designed for business purposes. These cards are used by companies to manage their expenses, streamline payments, and improve cash flow. They include various types such as credit cards, debit cards, and other specialized cards tailored for commercial use. The market encompasses a wide range of services and products offered by financial institutions, card issuers, and payment networks. It is driven by the increasing need for efficient financial management in businesses, the rise of digital transactions, and the globalization of trade. Companies of all sizes, from small enterprises to large corporations, utilize these cards to handle travel expenses, procurement, and other business-related payments. The market is characterized by continuous innovation, with new features and technologies being introduced to enhance security, convenience, and functionality. As businesses increasingly adopt digital solutions, the demand for commercial payment cards is expected to grow, making it a vital component of the global financial ecosystem.

Commercial Credit Cards, Commercial Debit Cards, Others in the Global Commercial Payment Cards Market:

Commercial credit cards, commercial debit cards, and other types of payment cards play a crucial role in the Global Commercial Payment Cards Market. Commercial credit cards are issued by financial institutions to businesses, allowing them to make purchases on credit. These cards offer a revolving line of credit, enabling companies to manage their cash flow more effectively by deferring payments. They often come with various benefits such as rewards programs, travel insurance, and expense tracking tools. Commercial debit cards, on the other hand, are linked directly to a business's bank account. When a purchase is made, the funds are immediately deducted from the account, providing a straightforward way to manage expenses without incurring debt. These cards are particularly useful for businesses that prefer to operate on a pay-as-you-go basis. Other types of commercial payment cards include prepaid cards and virtual cards. Prepaid cards are loaded with a specific amount of money and can be used until the balance is exhausted. They are ideal for controlling spending and are often used for specific purposes such as employee incentives or travel expenses. Virtual cards, which are generated for one-time use, offer enhanced security for online transactions by reducing the risk of fraud. Each type of card serves a unique purpose, catering to different business needs and preferences. The choice between credit, debit, and other cards depends on factors such as the company's financial strategy, spending habits, and the need for flexibility or control. As the market evolves, businesses have access to a growing array of options, allowing them to select the most suitable payment solutions for their operations.

Travel and Entertainment, B2B Payments, Others in the Global Commercial Payment Cards Market:

The usage of Global Commercial Payment Cards Market spans various areas, including travel and entertainment, B2B payments, and other business-related expenses. In the travel and entertainment sector, commercial payment cards are indispensable tools for managing expenses related to business trips, client meetings, and corporate events. They provide a convenient way to book flights, hotels, and rental cars, while also offering benefits such as travel insurance, airport lounge access, and rewards points. These cards help companies track and control travel expenses, ensuring compliance with corporate policies and simplifying the reimbursement process. In the realm of B2B payments, commercial payment cards facilitate transactions between businesses, streamlining the procurement process and improving cash flow management. They enable companies to pay suppliers, vendors, and service providers efficiently, reducing the need for paper checks and manual processing. This not only speeds up payment cycles but also enhances transparency and accountability. Additionally, commercial payment cards can be integrated with accounting and ERP systems, providing real-time data and insights into spending patterns. Other areas where commercial payment cards are utilized include employee expenses, utility payments, and subscription services. For instance, companies can issue cards to employees for business-related purchases, such as office supplies or client entertainment, ensuring that expenses are tracked and managed effectively. Utility payments, such as electricity and internet bills, can also be automated using commercial payment cards, reducing administrative burden and ensuring timely payments. Subscription services, such as software licenses or industry publications, can be easily managed with recurring payments set up on commercial cards. Overall, the versatility and convenience of commercial payment cards make them essential tools for modern businesses, enabling them to operate more efficiently and effectively.

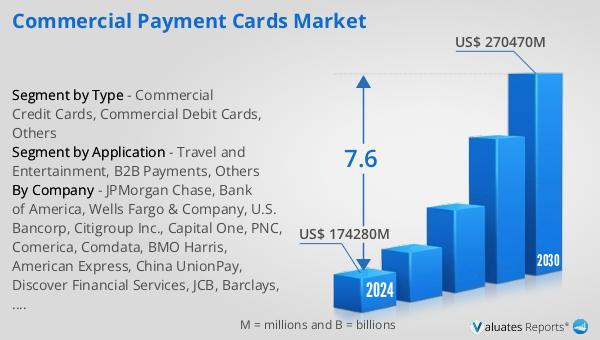

Global Commercial Payment Cards Market Outlook:

The Global Commercial Payment Cards Market is anticipated to experience significant growth, with projections indicating an increase from US$ 174,280 million in 2024 to US$ 270,470 million by 2030. This growth represents a Compound Annual Growth Rate (CAGR) of 7.6% during the forecast period. The market is highly competitive, with the top five global manufacturers holding a combined market share of over 15%. This indicates a concentrated market where a few key players dominate, driving innovation and setting industry standards. The projected growth is driven by several factors, including the increasing adoption of digital payment solutions, the need for efficient expense management in businesses, and the globalization of trade. As companies continue to seek ways to streamline their financial operations and enhance security, the demand for commercial payment cards is expected to rise. The market's expansion also reflects the broader trend towards digitalization in the financial sector, with businesses of all sizes embracing new technologies to improve their payment processes. The competitive landscape of the market underscores the importance of innovation and differentiation, as companies strive to offer unique features and benefits to attract and retain customers. Overall, the Global Commercial Payment Cards Market is poised for robust growth, driven by technological advancements and the evolving needs of businesses worldwide.

| Report Metric | Details |

| Report Name | Commercial Payment Cards Market |

| Accounted market size in 2024 | US$ 174280 in million |

| Forecasted market size in 2030 | US$ 270470 million |

| CAGR | 7.6 |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | JPMorgan Chase, Bank of America, Wells Fargo & Company, U.S. Bancorp, Citigroup Inc., Capital One, PNC, Comerica, Comdata, BMO Harris, American Express, China UnionPay, Discover Financial Services, JCB, Barclays, Airplus International |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |