What is Global Automotive Usage Based Insurance Market?

The Global Automotive Usage Based Insurance (UBI) Market is a rapidly evolving sector within the insurance industry that tailors premiums based on individual driving behaviors and patterns. Unlike traditional insurance models that rely on generalized risk assessments, UBI leverages advanced telematics technology to monitor real-time data such as mileage, speed, braking patterns, and overall driving habits. This data is then used to calculate personalized insurance premiums, offering a more accurate reflection of the driver's risk profile. The primary goal of UBI is to incentivize safer driving behaviors by rewarding low-risk drivers with lower premiums, while high-risk drivers may face higher costs. This approach not only benefits consumers by potentially reducing their insurance expenses but also helps insurers better manage risk and reduce claims. The market for UBI is expanding globally, driven by advancements in telematics, increasing consumer demand for personalized services, and regulatory support in various regions. As more vehicles become connected and capable of transmitting data, the adoption of UBI is expected to grow, transforming the traditional auto insurance landscape.

PAYD (Pay As You Drive), PHYD (Pay How You Drive) in the Global Automotive Usage Based Insurance Market:

PAYD (Pay As You Drive) and PHYD (Pay How You Drive) are two prominent models within the Global Automotive Usage Based Insurance Market that offer distinct approaches to calculating insurance premiums based on driving behavior. PAYD, as the name suggests, charges drivers based on the distance they travel. This model is particularly beneficial for infrequent drivers who may not rack up many miles but still need insurance coverage. By paying only for the miles driven, these drivers can significantly reduce their insurance costs. The PAYD model relies heavily on telematics devices installed in vehicles to accurately track mileage. These devices can be standalone units or integrated into the vehicle's onboard systems. The data collected is then transmitted to the insurance provider, who calculates the premium based on the total distance covered during the policy period. This model not only promotes fairness by aligning costs with actual usage but also encourages drivers to reduce unnecessary trips, thereby contributing to lower traffic congestion and reduced emissions. On the other hand, PHYD (Pay How You Drive) takes a more comprehensive approach by considering various aspects of driving behavior, such as speed, acceleration, braking patterns, and even the time of day when the vehicle is driven. This model aims to provide a more nuanced assessment of risk by evaluating how safely or aggressively a driver operates their vehicle. For instance, a driver who consistently adheres to speed limits, avoids sudden braking, and drives primarily during daylight hours may be deemed lower risk and rewarded with lower premiums. Conversely, a driver who frequently speeds, engages in harsh braking, or drives during high-risk periods like late at night may face higher insurance costs. The PHYD model also relies on telematics technology to gather and transmit driving data to the insurer. This data is then analyzed using sophisticated algorithms to generate a risk profile for each driver. One of the key advantages of PHYD is its potential to improve road safety by incentivizing safer driving habits. Drivers who are aware that their behavior is being monitored and directly impacts their insurance costs are more likely to adopt cautious driving practices. This not only benefits the individual driver but also contributes to overall road safety. Both PAYD and PHYD models offer significant advantages over traditional insurance models. They provide a more personalized and fair approach to calculating premiums, which can lead to cost savings for low-risk drivers. Additionally, these models encourage responsible driving behavior, which can result in fewer accidents and claims. However, there are also challenges associated with UBI models. Privacy concerns are a major issue, as drivers may be wary of having their driving behavior constantly monitored. Insurers must ensure that the data collected is securely stored and used solely for the purpose of calculating premiums. Another challenge is the initial cost of implementing telematics technology, which can be a barrier for some insurers and consumers. Despite these challenges, the benefits of UBI models like PAYD and PHYD are driving their adoption in the global market. As technology continues to advance and consumer demand for personalized services grows, the UBI market is expected to expand, offering innovative solutions that transform the traditional auto insurance landscape.

Commercial Vehicle, Passenger Car in the Global Automotive Usage Based Insurance Market:

The usage of Global Automotive Usage Based Insurance Market in commercial vehicles and passenger cars presents unique opportunities and challenges. For commercial vehicles, UBI offers a way to manage fleet insurance costs more effectively. Fleet operators can benefit from PAYD and PHYD models by gaining insights into their drivers' behavior and vehicle usage patterns. By monitoring mileage and driving habits, fleet managers can identify high-risk drivers and implement targeted training programs to improve safety. This not only helps in reducing insurance premiums but also minimizes the risk of accidents and associated costs. Additionally, UBI can provide valuable data on vehicle utilization, helping fleet operators optimize routes and reduce fuel consumption. For instance, a delivery company can use UBI data to identify the most efficient routes, thereby saving on fuel costs and reducing wear and tear on vehicles. The ability to track and analyze driving behavior also enables fleet operators to enforce company policies more effectively, ensuring that drivers adhere to safety standards and regulations. This can lead to a reduction in maintenance costs and an overall improvement in fleet performance. In the context of passenger cars, UBI offers individual drivers the opportunity to lower their insurance costs by adopting safer driving habits. PAYD models are particularly attractive to low-mileage drivers, such as retirees or individuals who primarily use public transportation and only drive occasionally. By paying for insurance based on the actual miles driven, these drivers can achieve significant cost savings. PHYD models, on the other hand, appeal to drivers who are confident in their safe driving abilities. By demonstrating responsible driving behavior, such as obeying speed limits and avoiding harsh braking, these drivers can benefit from lower premiums. The personalized nature of UBI also appeals to tech-savvy consumers who value customization and control over their expenses. The integration of telematics technology in passenger cars allows for real-time feedback on driving behavior, enabling drivers to make immediate adjustments and improve their risk profile. This can lead to a more engaging and interactive insurance experience, where drivers are actively involved in managing their premiums. However, the adoption of UBI in passenger cars also faces challenges. Privacy concerns are a significant barrier, as drivers may be uncomfortable with the idea of continuous monitoring. Insurers must address these concerns by ensuring transparency in data collection and usage, as well as implementing robust data security measures. Additionally, the initial cost of telematics devices and the complexity of installation can deter some consumers from adopting UBI. Despite these challenges, the benefits of UBI in passenger cars are driving its growth in the market. The ability to offer personalized premiums based on actual driving behavior aligns with the growing consumer demand for tailored services. As more vehicles become equipped with advanced telematics systems, the adoption of UBI is expected to increase, providing drivers with innovative solutions that enhance their insurance experience. Overall, the usage of UBI in both commercial vehicles and passenger cars presents a promising opportunity to improve road safety, reduce insurance costs, and promote responsible driving behavior.

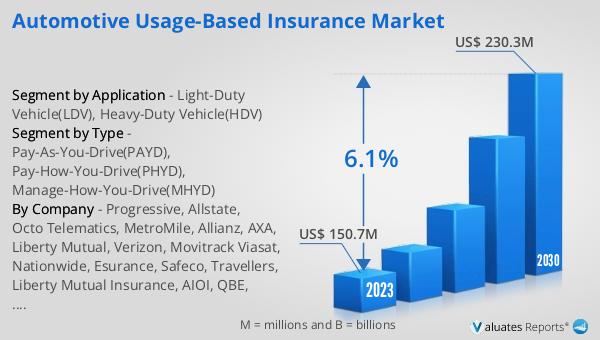

Global Automotive Usage Based Insurance Market Outlook:

The global Automotive Usage Based Insurance market was valued at US$ 19,600 million in 2023 and is anticipated to reach US$ 108,880 million by 2030, witnessing a CAGR of 25.2% during the forecast period 2024-2030. At present, more than 90% of the world's automobiles are concentrated in the three continents of Asia, Europe, and North America. Of these, Asia's automobile production accounts for 56% of the world, Europe accounts for 20%, and North America accounts for 16%. This significant concentration of automobiles in these regions highlights the potential for substantial growth in the UBI market. As the automotive industry continues to evolve with advancements in technology and increasing consumer demand for personalized services, the adoption of UBI is expected to rise. The integration of telematics systems in vehicles is becoming more prevalent, enabling insurers to offer customized premiums based on individual driving behavior. This shift towards personalized insurance models is not only beneficial for consumers but also helps insurers better manage risk and reduce claims. The growing awareness of the benefits of UBI, coupled with regulatory support in various regions, is driving the expansion of the market. As more drivers become aware of the potential cost savings and safety benefits associated with UBI, the demand for these innovative insurance solutions is likely to increase. Overall, the global Automotive Usage Based Insurance market is poised for significant growth, transforming the traditional auto insurance landscape and offering new opportunities for both consumers and insurers.

| Report Metric | Details |

| Report Name | Automotive Usage Based Insurance Market |

| Accounted market size in 2023 | US$ 19600 million |

| Forecasted market size in 2030 | US$ 108880 million |

| CAGR | 25.2% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allstate Insurance Company, Esurance, Credit Karma,LLC, DriveSense, Liberty Mutual, Metromile, Progressive, State Farm, The Travelers Indemnity Company, AXA, Assicurazioni Generali, Desjardins Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |