What is Global Commercial Auto Insurance Market?

The Global Commercial Auto Insurance Market is a significant segment within the broader insurance industry, providing coverage for businesses that use vehicles for commercial purposes. This market encompasses a variety of insurance products designed to protect companies from financial losses related to their commercial vehicles. These vehicles can range from passenger cars used by sales representatives to large trucks used for transporting goods. The primary goal of commercial auto insurance is to offer financial protection against accidents, theft, and other unforeseen events that can cause damage or loss. This type of insurance is crucial for businesses as it helps mitigate risks and ensures that operations can continue smoothly even in the event of a mishap. The market is driven by factors such as the increasing number of commercial vehicles on the road, stringent government regulations, and the growing awareness among businesses about the importance of having adequate insurance coverage. As businesses continue to expand and rely more on transportation, the demand for commercial auto insurance is expected to grow, making it a vital component of the global insurance landscape.

Liability Insurance, Physical Damage Insurance, Others in the Global Commercial Auto Insurance Market:

Liability insurance, physical damage insurance, and other types of coverage are essential components of the Global Commercial Auto Insurance Market. Liability insurance is designed to cover the costs associated with injuries or damages that a business's vehicle may cause to other people or property. This type of insurance is crucial because it helps protect businesses from potentially devastating financial losses resulting from lawsuits or claims. For example, if a delivery truck owned by a company is involved in an accident that injures another driver, liability insurance would cover the medical expenses and any legal fees that might arise. Physical damage insurance, on the other hand, covers the repair or replacement costs of the insured vehicle itself in the event of an accident, theft, or other covered incidents. This type of insurance is divided into two main categories: collision and comprehensive coverage. Collision coverage pays for damages resulting from collisions with other vehicles or objects, while comprehensive coverage takes care of damages caused by non-collision events such as theft, vandalism, or natural disasters. Both types of physical damage insurance are vital for businesses to ensure that their vehicles can be quickly repaired or replaced, minimizing downtime and maintaining operational efficiency. In addition to liability and physical damage insurance, there are other types of coverage that businesses can opt for based on their specific needs. These may include uninsured/underinsured motorist coverage, which protects against accidents involving drivers who do not have sufficient insurance, and medical payments coverage, which pays for medical expenses for the driver and passengers in the insured vehicle, regardless of fault. Another important type of coverage is rental reimbursement, which covers the cost of renting a replacement vehicle while the insured vehicle is being repaired. Businesses may also choose to add coverage for specific risks such as cargo insurance, which protects against the loss or damage of goods being transported, or hired and non-owned auto insurance, which provides coverage for vehicles that are not owned by the business but are used for business purposes. By offering a comprehensive range of insurance products, the Global Commercial Auto Insurance Market helps businesses manage the various risks associated with operating commercial vehicles, ensuring that they can continue to function smoothly and efficiently even in the face of unexpected challenges.

Passenger Car, Commercial Vehicle in the Global Commercial Auto Insurance Market:

The usage of Global Commercial Auto Insurance Market in areas such as passenger cars and commercial vehicles is extensive and varied. For passenger cars used for business purposes, commercial auto insurance provides essential coverage that protects both the vehicle and the business from financial losses. Sales representatives, for instance, often use passenger cars to travel to client meetings, and having commercial auto insurance ensures that any accidents or damages incurred during these trips are covered. This type of insurance is particularly important for businesses that rely heavily on their sales force to generate revenue, as it helps maintain continuity and reduces the financial burden of unexpected incidents. Additionally, commercial auto insurance for passenger cars can include coverage for rental reimbursement, ensuring that the business can continue its operations without interruption even if a vehicle is temporarily out of service. For commercial vehicles, which include trucks, vans, and other larger vehicles used for transporting goods or providing services, commercial auto insurance is indispensable. These vehicles are often exposed to higher risks due to their size, the nature of their use, and the value of the cargo they carry. Commercial auto insurance for these vehicles typically includes liability coverage, which protects the business from claims related to injuries or damages caused by the vehicle, and physical damage coverage, which covers the repair or replacement costs of the vehicle itself. In addition to these standard coverages, businesses can also opt for specialized insurance products tailored to their specific needs. For example, a logistics company that operates a fleet of trucks may choose to add cargo insurance to protect against the loss or damage of goods during transit. Similarly, a construction company that uses heavy-duty vehicles may require additional coverage for equipment attached to the vehicles. By providing comprehensive coverage options, the Global Commercial Auto Insurance Market ensures that businesses can effectively manage the risks associated with their commercial vehicles, safeguarding their assets and maintaining operational efficiency. Furthermore, commercial auto insurance can also include coverage for non-owned and hired vehicles, which are vehicles that the business does not own but uses for business purposes. This is particularly useful for businesses that occasionally rent vehicles or use employees' personal vehicles for work-related tasks. By extending coverage to these vehicles, businesses can ensure that they are protected from potential liabilities and financial losses, regardless of the ownership status of the vehicle. Overall, the Global Commercial Auto Insurance Market plays a crucial role in supporting businesses that rely on passenger cars and commercial vehicles, providing them with the necessary protection to navigate the complexities and risks of operating in today's dynamic business environment.

Global Commercial Auto Insurance Market Outlook:

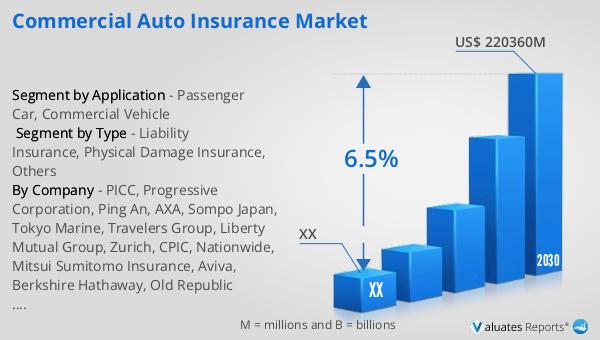

The global market for Commercial Auto Insurance was estimated to be worth US$ 141,070 million in 2023 and is forecast to reach a revised size of US$ 220,360 million by 2030, with a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2030. Major companies in the industry include PICC, Progressive Corporation, and Ping An Insurance, which accounted for 5.03%, 3.82%, and 3.41% of revenue in 2019, respectively. By region, Europe had the highest share of income at 35.56%.

| Report Metric | Details |

| Report Name | Commercial Auto Insurance Market |

| Forecasted market size in 2030 | US$ 220360 million |

| CAGR | 6.5% |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | PICC, Progressive Corporation, Ping An, AXA, Sompo Japan, Tokyo Marine, Travelers Group, Liberty Mutual Group, Zurich, CPIC, Nationwide, Mitsui Sumitomo Insurance, Aviva, Berkshire Hathaway, Old Republic International, Auto Owners Grp., Generali Group, MAPFRE, Chubb, AmTrust NGH |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |