What is Global High-end Medical Insurance Market?

The Global High-end Medical Insurance Market refers to a specialized segment of the health insurance industry that caters to individuals and groups seeking comprehensive and premium healthcare coverage. This market is characterized by its focus on providing extensive medical benefits, including access to top-tier medical facilities, advanced treatments, and a wide range of healthcare services. High-end medical insurance plans often cover international medical expenses, allowing policyholders to receive treatment in different countries. These plans are designed to meet the needs of expatriates, high-net-worth individuals, and corporate executives who require superior healthcare services. The market is driven by the increasing demand for quality healthcare, rising healthcare costs, and the growing awareness of the importance of health insurance. As a result, insurers in this market offer tailored plans with extensive coverage options, personalized services, and additional benefits such as wellness programs and preventive care. The Global High-end Medical Insurance Market is a dynamic and evolving sector that plays a crucial role in ensuring access to high-quality healthcare for those who can afford premium insurance solutions.

Individual Health Insurance, Group Medical Insurance in the Global High-end Medical Insurance Market:

Individual Health Insurance and Group Medical Insurance are two primary categories within the Global High-end Medical Insurance Market. Individual Health Insurance is designed for single policyholders, providing them with comprehensive coverage tailored to their specific healthcare needs. These plans offer a wide range of benefits, including inpatient and outpatient care, specialist consultations, diagnostic tests, and emergency services. Individual policies are highly customizable, allowing policyholders to choose the level of coverage, deductibles, and additional benefits that best suit their personal health requirements. On the other hand, Group Medical Insurance is typically offered by employers to their employees as part of a benefits package. These plans cover a group of individuals under a single policy, providing uniform benefits to all members. Group insurance plans often include coverage for dependents, such as spouses and children, and may offer additional perks like wellness programs and preventive care services. The primary advantage of group insurance is its cost-effectiveness, as the risk is spread across a larger pool of insured individuals, leading to lower premiums. Both individual and group medical insurance plans in the high-end market are designed to provide superior healthcare services, with access to top-tier medical facilities and advanced treatments. These plans cater to the needs of expatriates, high-net-worth individuals, and corporate executives who require comprehensive and premium healthcare coverage. The Global High-end Medical Insurance Market continues to evolve, with insurers offering innovative solutions to meet the diverse needs of their clients. Whether through individual or group plans, high-end medical insurance ensures that policyholders receive the best possible care, regardless of their location or medical condition.

Bancassurance, Digital & Direct Channel, Broker, Agency in the Global High-end Medical Insurance Market:

The Global High-end Medical Insurance Market utilizes various distribution channels to reach its target audience, including Bancassurance, Digital & Direct Channels, Brokers, and Agencies. Bancassurance involves partnerships between insurance companies and banks, allowing insurers to leverage the bank's customer base and distribution network. This channel is particularly effective in reaching high-net-worth individuals and corporate clients who already have a relationship with the bank. Bancassurance offers the convenience of purchasing insurance products through familiar banking channels, often bundled with other financial services. Digital & Direct Channels have gained significant traction in recent years, driven by the increasing use of technology and the internet. These channels allow insurers to reach a broader audience through online platforms, mobile apps, and direct marketing campaigns. Digital channels offer the advantage of convenience, allowing customers to compare and purchase insurance products from the comfort of their homes. They also enable insurers to provide personalized services and real-time support through chatbots and virtual assistants. Brokers play a crucial role in the high-end medical insurance market by acting as intermediaries between insurers and clients. They provide expert advice, helping clients navigate the complex landscape of insurance products and select the best plan for their needs. Brokers often have extensive knowledge of the market and can negotiate better terms and coverage options on behalf of their clients. Agencies, on the other hand, are dedicated insurance sales organizations that represent one or more insurance companies. They have a deep understanding of the products they offer and provide personalized service to their clients. Agencies often build long-term relationships with their clients, offering ongoing support and assistance with claims and policy management. Each of these distribution channels plays a vital role in the Global High-end Medical Insurance Market, ensuring that clients have access to the best possible healthcare coverage through convenient and reliable means.

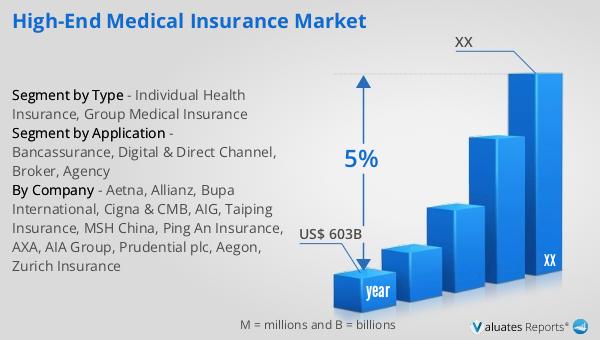

Global High-end Medical Insurance Market Outlook:

Based on our analysis, the global market for medical devices is projected to reach approximately $603 billion by the year 2023, with an anticipated compound annual growth rate (CAGR) of 5% over the next six years. This growth is driven by several factors, including advancements in medical technology, increasing demand for healthcare services, and the rising prevalence of chronic diseases. The medical device market encompasses a wide range of products, from diagnostic equipment and surgical instruments to wearable health monitors and advanced imaging systems. As healthcare providers continue to adopt innovative technologies to improve patient outcomes and streamline operations, the demand for high-quality medical devices is expected to rise. Additionally, the aging global population and the increasing focus on preventive care are contributing to the expansion of the market. Companies operating in this sector are investing heavily in research and development to bring new and improved products to market, further fueling growth. The projected CAGR of 5% indicates a steady and sustained increase in market size, reflecting the ongoing need for advanced medical solutions across the globe. This positive outlook underscores the importance of the medical device industry in enhancing healthcare delivery and improving patient care worldwide.

| Report Metric | Details |

| Report Name | High-end Medical Insurance Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Aetna, Allianz, Bupa International, Cigna & CMB, AIG, Taiping Insurance, MSH China, Ping An Insurance, AXA, AIA Group, Prudential plc, Aegon, Zurich Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |