What is Global Insurance Franchise Market?

The Global Insurance Franchise Market is a dynamic and expansive sector that encompasses a wide range of insurance services offered through franchise models across the world. This market includes various types of insurance such as health, life, property, and casualty insurance, provided by franchised agencies. These franchises operate under the brand and guidelines of a parent insurance company, allowing them to leverage established brand recognition, marketing strategies, and operational support. The global nature of this market means that it is influenced by diverse economic conditions, regulatory environments, and consumer preferences across different regions. The growth of the Global Insurance Franchise Market is driven by the increasing demand for insurance products, the need for risk management solutions, and the benefits of the franchise model, which offers a proven business framework and support system for franchisees. This market is characterized by its competitive landscape, with numerous players striving to expand their market share through innovation, customer service excellence, and strategic partnerships. The Global Insurance Franchise Market is poised for continued growth as more individuals and businesses recognize the importance of insurance in safeguarding their financial futures.

Office Agency, Retail Agency in the Global Insurance Franchise Market:

Office Agency and Retail Agency are two significant segments within the Global Insurance Franchise Market, each catering to different client needs and operational environments. Office Agencies typically operate from fixed locations, providing a stable and professional setting where clients can receive personalized insurance consultations and services. These agencies benefit from the franchise model by utilizing the established brand reputation and operational support of the parent company, which helps in building trust and credibility with clients. Office Agencies often focus on a broad range of insurance products, including life, health, property, and casualty insurance, tailored to meet the specific needs of individuals and businesses. They are equipped with trained professionals who offer expert advice, helping clients navigate the complexities of insurance policies and coverage options. On the other hand, Retail Agencies are more flexible and accessible, often located in high-traffic areas such as shopping malls, retail centers, and other commercial hubs. These agencies aim to provide convenient and quick insurance solutions to walk-in customers, making insurance more accessible to a broader audience. Retail Agencies leverage the franchise model to offer a wide array of insurance products, often focusing on more immediate and straightforward insurance needs such as auto, travel, and renter’s insurance. The retail setting allows these agencies to attract a diverse clientele, including individuals who may not have previously considered purchasing insurance. Both Office and Retail Agencies play a crucial role in the Global Insurance Franchise Market by expanding the reach of insurance services and making them more accessible to different segments of the population. The franchise model supports these agencies by providing a structured business framework, marketing support, and ongoing training, which helps them maintain high standards of service and customer satisfaction. As the demand for insurance continues to grow, both Office and Retail Agencies are expected to play an increasingly important role in meeting the diverse needs of clients around the world.

Individual, Enterprise in the Global Insurance Franchise Market:

The usage of the Global Insurance Franchise Market varies significantly between individual and enterprise clients, each with distinct needs and expectations. For individuals, insurance franchises provide a wide range of personal insurance products designed to protect against various risks and uncertainties. These products include health insurance, life insurance, auto insurance, home insurance, and travel insurance, among others. Individual clients benefit from the personalized service and expert advice offered by franchise agents, who help them choose the right coverage based on their specific needs and circumstances. The franchise model ensures that individual clients receive consistent and reliable service, backed by the reputation and resources of the parent insurance company. This personalized approach helps build long-term relationships with clients, fostering trust and loyalty. On the other hand, enterprise clients, which include businesses of all sizes, have more complex and varied insurance needs. Insurance franchises catering to enterprises offer a comprehensive range of commercial insurance products, such as property insurance, liability insurance, workers' compensation, and business interruption insurance. These products are designed to protect businesses from potential financial losses due to unforeseen events, legal liabilities, and operational disruptions. Enterprise clients benefit from the expertise and industry knowledge of franchise agents, who provide tailored insurance solutions that address the unique risks and challenges faced by different types of businesses. The franchise model allows these agents to leverage the resources and support of the parent company, ensuring that enterprise clients receive high-quality service and comprehensive coverage. Additionally, insurance franchises often offer risk management and consulting services to enterprise clients, helping them identify potential risks and implement strategies to mitigate them. This proactive approach not only helps businesses protect their assets but also enhances their overall resilience and sustainability. In summary, the Global Insurance Franchise Market serves both individual and enterprise clients by providing a wide range of insurance products and services tailored to their specific needs. The franchise model ensures that clients receive consistent, high-quality service, backed by the expertise and resources of established insurance companies. As the demand for insurance continues to grow, the Global Insurance Franchise Market will play a crucial role in helping individuals and businesses manage their risks and secure their financial futures.

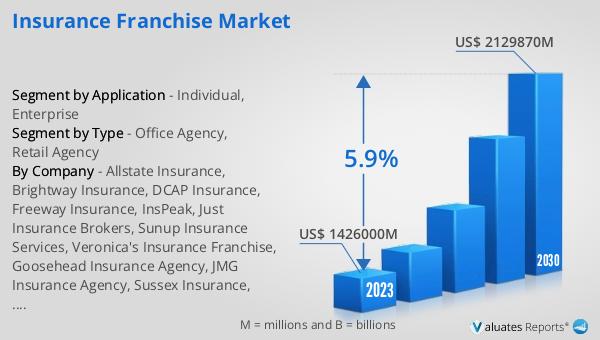

Global Insurance Franchise Market Outlook:

The global Insurance Franchise market was valued at US$ 1,426,000 million in 2023 and is anticipated to reach US$ 2,129,870 million by 2030, witnessing a CAGR of 5.9% during the forecast period from 2024 to 2030. This significant growth reflects the increasing demand for insurance products and services worldwide, driven by factors such as rising awareness of the importance of insurance, economic development, and regulatory changes. The franchise model has proven to be an effective way to expand the reach of insurance services, providing franchisees with the support and resources needed to succeed in a competitive market. By leveraging the established brand reputation and operational framework of parent insurance companies, franchisees can offer high-quality, reliable insurance products to a broad range of clients. This growth trajectory underscores the potential of the Global Insurance Franchise Market to continue expanding and evolving, meeting the diverse needs of individuals and businesses across different regions. The market's robust performance is a testament to the effectiveness of the franchise model in delivering consistent, high-quality insurance services, and its ability to adapt to changing market conditions and consumer preferences. As the market continues to grow, it will play an increasingly important role in helping individuals and businesses manage their risks and secure their financial futures.

| Report Metric | Details |

| Report Name | Insurance Franchise Market |

| Accounted market size in 2023 | US$ 1426000 million |

| Forecasted market size in 2030 | US$ 2129870 million |

| CAGR | 5.9% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allstate Insurance, Brightway Insurance, DCAP Insurance, Freeway Insurance, InsPeak, Just Insurance Brokers, Sunup Insurance Services, Veronica's Insurance Franchise, Goosehead Insurance Agency, JMG Insurance Agency, Sussex Insurance, Elders Insurance, NFP, Sebanda Insurance, Fiesta Insurance Franchise Corporation, All-Risks Insurance Brokers, Aon Risk Services Australia, Velox Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |