What is Global Travel Medical Insurance Market?

The Global Travel Medical Insurance Market is essentially a segment of the insurance industry that caters to travelers seeking medical coverage while away from their home country. This type of insurance is crucial for individuals traveling internationally, providing them with peace of mind knowing they are covered in case of medical emergencies, accidents, or illnesses that may occur during their travels. Unlike regular health insurance, which may offer limited or no coverage outside the policyholder's home country, travel medical insurance is designed to fill this gap, offering extensive medical benefits, including emergency medical evacuation, hospital stays, and sometimes even dental emergencies. As globalization increases and more people travel for both leisure and work, the demand for travel medical insurance has seen a significant uptick. This insurance not only ensures travelers are financially protected against unforeseen medical costs abroad but also offers assistance services, such as help in locating a suitable healthcare provider in a foreign country. With the world becoming a global village and international travel becoming more accessible, the Global Travel Medical Insurance Market plays a pivotal role in safeguarding travelers' health and well-being.

Stand-alone Medical Insurance, As Part of Comprehensive Travel Insurance in the Global Travel Medical Insurance Market:

When diving into the Global Travel Medical Insurance Market, it's essential to understand the nuances between Stand-alone Medical Insurance and Comprehensive Travel Insurance. Stand-alone Medical Insurance, as the name suggests, focuses solely on covering medical expenses incurred due to illnesses or accidents while traveling. This type of insurance is particularly appealing to those who may already have trip cancellation or interruption coverage through other means but require coverage for potential medical issues that could arise during their travels. On the other hand, Comprehensive Travel Insurance packages offer a broader range of coverage, including trip cancellation, lost luggage, and medical expenses. This all-encompassing approach is suited for travelers looking for a one-stop-shop insurance solution that covers a wide array of potential travel-related issues beyond just medical concerns. Both options have their place in the Global Travel Medical Insurance Market, catering to different needs and preferences of travelers. Stand-alone Medical Insurance is typically more cost-effective for those solely concerned with health-related expenses, while Comprehensive Travel Insurance provides a more extensive safety net for various travel-related risks. As the market evolves, the availability of customizable insurance packages allows travelers to tailor their coverage to fit their specific travel plans and risk exposure, ensuring they are adequately protected no matter where their journeys take them.

Domestic Travel, Overseas Travel in the Global Travel Medical Insurance Market:

In the realm of the Global Travel Medical Insurance Market, the usage of insurance products varies significantly between Domestic Travel and Overseas Travel. For domestic travelers, the need for travel medical insurance might seem less pressing due to the familiarity with the healthcare system and the potential coverage by their existing health insurance policies. However, certain domestic travel scenarios, such as engaging in high-risk activities or traveling to remote areas, can underscore the importance of having travel medical insurance even within one's country. This insurance can cover unexpected medical emergencies that regular health insurance might not, providing an additional layer of financial protection. Conversely, the necessity for travel medical insurance becomes more apparent and critical for overseas travel. Navigating foreign healthcare systems, dealing with language barriers, and incurring potentially high out-of-pocket medical costs are significant concerns for international travelers. Travel medical insurance for overseas trips often includes benefits like emergency medical evacuation, which can be prohibitively expensive without insurance, and 24/7 assistance services to help find medical care in emergency situations. The distinction in usage between domestic and overseas travel highlights the adaptability of the Global Travel Medical Insurance Market to cater to diverse travel needs, ensuring travelers have access to suitable medical coverage regardless of their destination.

Global Travel Medical Insurance Market Outlook:

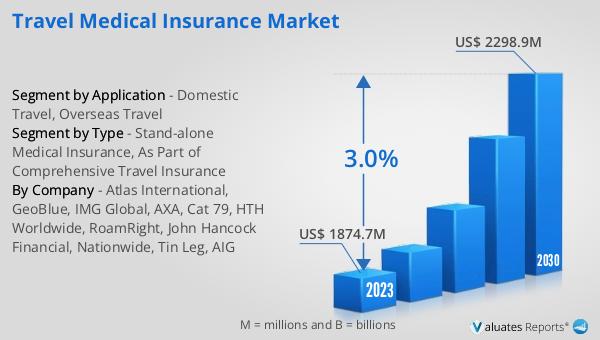

The market outlook for the Global Travel Medical Insurance sector presents a promising growth trajectory. In 2023, the market's valuation stood at approximately $1874.7 million, with projections indicating an increase to around $2298.9 million by the year 2030. This growth is expected to occur at a compound annual growth rate (CAGR) of 3.0% throughout the forecast period spanning from 2024 to 2030. This anticipated expansion within the travel medical insurance market is reflective of a broader trend observed in the global medical devices sector, which itself is estimated to have a market size of $603 billion in 2023. The medical devices sector is on a path to achieve a growth rate of 5% CAGR over the next six years. These figures underscore the dynamic nature of the health and insurance industries, highlighting the increasing demand for travel medical insurance as part of the wider healthcare and medical device markets. The growth in the travel medical insurance market is indicative of a heightened awareness among travelers of the risks associated with international travel and the importance of being adequately insured against potential medical emergencies while away from home.

| Report Metric | Details |

| Report Name | Travel Medical Insurance Market |

| Accounted market size in 2023 | US$ 1874.7 million |

| Forecasted market size in 2030 | US$ 2298.9 million |

| CAGR | 3.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Atlas International, GeoBlue, IMG Global, AXA, Cat 79, HTH Worldwide, RoamRight, John Hancock Financial, Nationwide, Tin Leg, AIG |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |