What is Global Polyurethane (PU) Adhesives in Electronics Market?

Global Polyurethane (PU) Adhesives in Electronics Market refers to the segment of the adhesive industry that focuses on the use of polyurethane-based adhesives in various electronic applications. These adhesives are known for their excellent bonding properties, flexibility, and resistance to environmental factors such as moisture and temperature variations. They are widely used in the assembly and manufacturing of electronic devices, providing strong and durable bonds between different components. The market for PU adhesives in electronics is driven by the increasing demand for miniaturized and high-performance electronic devices, which require reliable and efficient bonding solutions. Additionally, the growing trend of automation and the use of advanced materials in electronics manufacturing further boost the demand for PU adhesives. The market is characterized by continuous innovation and development of new adhesive formulations to meet the evolving needs of the electronics industry.

One-component Polyurethane (PU) Adhesives, Two-component Polyurethane (PU) Adhesives in the Global Polyurethane (PU) Adhesives in Electronics Market:

One-component Polyurethane (PU) Adhesives and Two-component Polyurethane (PU) Adhesives are two primary types of adhesives used in the Global Polyurethane (PU) Adhesives in Electronics Market. One-component PU adhesives are pre-mixed and ready to use, requiring no additional mixing or preparation before application. They cure through exposure to moisture in the air, making them convenient and easy to use. These adhesives are ideal for applications where quick and efficient bonding is required, such as in the assembly of electronic components and devices. They offer excellent adhesion to a wide range of substrates, including metals, plastics, and glass, and provide strong and durable bonds that can withstand various environmental conditions. On the other hand, Two-component PU adhesives consist of two separate components that need to be mixed together before application. This mixing process initiates a chemical reaction that leads to the curing of the adhesive. Two-component PU adhesives offer greater flexibility in terms of formulation and performance, allowing for customization to meet specific application requirements. They are often used in applications where high strength and durability are critical, such as in the bonding of structural components in electronic devices. These adhesives provide excellent resistance to temperature variations, moisture, and chemicals, making them suitable for use in harsh environments. Both types of PU adhesives play a crucial role in the electronics industry, providing reliable and efficient bonding solutions for a wide range of applications. The choice between one-component and two-component PU adhesives depends on the specific requirements of the application, including factors such as curing time, bond strength, and environmental resistance.

Electronics Manufacturing, Semiconductors, Others in the Global Polyurethane (PU) Adhesives in Electronics Market:

The usage of Global Polyurethane (PU) Adhesives in the Electronics Market spans various areas, including Electronics Manufacturing, Semiconductors, and other related fields. In Electronics Manufacturing, PU adhesives are used extensively in the assembly and production of electronic devices such as smartphones, tablets, laptops, and wearable devices. They provide strong and durable bonds between different components, ensuring the structural integrity and reliability of the devices. PU adhesives are also used in the encapsulation and potting of electronic components, providing protection against moisture, dust, and other environmental factors. In the semiconductor industry, PU adhesives are used in the packaging and assembly of semiconductor devices, including integrated circuits (ICs), microchips, and sensors. They provide excellent adhesion to various substrates, including metals, ceramics, and plastics, and offer high thermal and electrical insulation properties. PU adhesives are also used in the bonding of heat sinks and other thermal management components, ensuring efficient heat dissipation and preventing overheating of electronic devices. In addition to electronics manufacturing and semiconductors, PU adhesives are used in other areas such as automotive electronics, aerospace electronics, and medical electronics. In automotive electronics, PU adhesives are used in the assembly of electronic control units (ECUs), sensors, and other electronic components, providing reliable and durable bonds that can withstand the harsh conditions of automotive environments. In aerospace electronics, PU adhesives are used in the assembly of avionics systems, sensors, and other electronic components, providing high strength and durability in extreme conditions. In medical electronics, PU adhesives are used in the assembly of medical devices such as diagnostic equipment, monitoring devices, and implantable devices, providing biocompatible and reliable bonding solutions. Overall, the usage of PU adhesives in the electronics market is driven by the need for reliable, efficient, and durable bonding solutions that can meet the demanding requirements of various electronic applications.

Global Polyurethane (PU) Adhesives in Electronics Market Outlook:

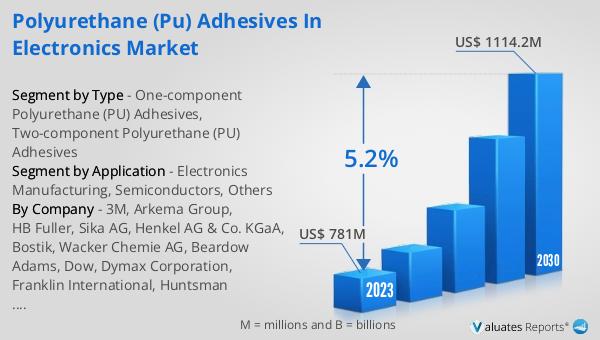

The global market for Polyurethane (PU) Adhesives in Electronics was valued at approximately $781 million in 2023. It is projected to grow significantly, reaching an estimated value of $1,114.2 million by 2030. This growth is expected to occur at a compound annual growth rate (CAGR) of 5.2% during the forecast period from 2024 to 2030. This positive outlook reflects the increasing demand for PU adhesives in the electronics industry, driven by the need for reliable and efficient bonding solutions in the manufacturing and assembly of electronic devices. The market's growth is also supported by continuous innovation and development of new adhesive formulations to meet the evolving needs of the electronics industry.

| Report Metric | Details |

| Report Name | Polyurethane (PU) Adhesives in Electronics Market |

| Accounted market size in 2023 | US$ 781 million |

| Forecasted market size in 2030 | US$ 1114.2 million |

| CAGR | 5.2% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | 3M, Arkema Group, HB Fuller, Sika AG, Henkel AG & Co. KGaA, Bostik, Wacker Chemie AG, Beardow Adams, Dow, Dymax Corporation, Franklin International, Huntsman International LLC, ITW Performance Polymers (Illinois Tool Works Inc.), Jowat AG, Mapei Inc., Pidilite Industries Ltd., Permabond |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |