What is Global Polypropylene Films and Sheets Market?

The Global Polypropylene Films and Sheets Market refers to the worldwide industry involved in the production, distribution, and utilization of polypropylene (PP) films and sheets. Polypropylene is a versatile thermoplastic polymer used extensively in various applications due to its excellent chemical resistance, durability, and cost-effectiveness. The market encompasses a wide range of products, including biaxially oriented polypropylene (BOPP) films, cast polypropylene (CPP) films, and various types of PP sheets. These materials are used in numerous industries such as packaging, construction, automotive, and agriculture. The market is driven by the increasing demand for lightweight and sustainable packaging solutions, advancements in manufacturing technologies, and the growing need for high-performance materials in various end-use sectors. The global market is characterized by a competitive landscape with numerous players striving to innovate and expand their product portfolios to meet the evolving needs of consumers and industries.

PP Plastic Films, PP Plastic Sheets in the Global Polypropylene Films and Sheets Market:

Polypropylene (PP) plastic films and sheets are integral components of the Global Polypropylene Films and Sheets Market. PP plastic films are thin, flexible sheets made from polypropylene resin, which can be produced through various processes such as extrusion, casting, and biaxial orientation. These films are known for their excellent clarity, high tensile strength, moisture resistance, and barrier properties, making them ideal for packaging applications. Biaxially oriented polypropylene (BOPP) films, for instance, are widely used in food packaging due to their ability to preserve freshness and extend shelf life. Cast polypropylene (CPP) films, on the other hand, offer superior heat-sealing properties and are commonly used in packaging applications that require high transparency and gloss. PP plastic sheets, in contrast, are thicker and more rigid than films, providing structural support and durability. These sheets are used in a variety of applications, including automotive interiors, construction materials, and consumer goods. The versatility of PP plastic films and sheets lies in their ability to be customized with different additives, coatings, and laminations to enhance their performance characteristics. For example, metallized PP films are used for their reflective properties in packaging and decorative applications, while anti-fog and anti-static coatings are applied to improve functionality in specific environments. The global market for PP plastic films and sheets is driven by the increasing demand for sustainable and recyclable materials, advancements in production technologies, and the growing need for high-performance packaging solutions. Manufacturers are continuously innovating to develop new grades of PP films and sheets that meet the stringent requirements of various industries, ensuring that these materials remain a vital part of the global supply chain.

Food Packaging, Construction, Consumer Goods Packaging, Industrial Packaging, Agriculture, Others in the Global Polypropylene Films and Sheets Market:

The usage of Global Polypropylene Films and Sheets Market spans across various sectors, including food packaging, construction, consumer goods packaging, industrial packaging, agriculture, and others. In the food packaging industry, PP films and sheets are extensively used due to their excellent barrier properties, which help in preserving the freshness and extending the shelf life of food products. BOPP films, for instance, are commonly used for packaging snacks, confectionery, and bakery products, while CPP films are preferred for packaging fresh produce, meat, and dairy products due to their superior heat-sealing capabilities. In the construction sector, PP sheets are used for applications such as insulation, vapor barriers, and protective coverings due to their durability, moisture resistance, and ease of installation. These sheets provide an effective solution for enhancing the energy efficiency and longevity of buildings. In consumer goods packaging, PP films and sheets are used for packaging a wide range of products, including personal care items, household goods, and electronics. The versatility of PP materials allows for the creation of attractive and functional packaging that meets the diverse needs of consumers. In industrial packaging, PP films and sheets are used for wrapping and protecting goods during transportation and storage. Their high tensile strength and resistance to chemicals and moisture make them ideal for securing and preserving industrial products. In agriculture, PP films are used for applications such as greenhouse coverings, mulch films, and silage wraps. These films help in improving crop yield, protecting plants from adverse weather conditions, and reducing water usage. The versatility and performance characteristics of PP films and sheets make them suitable for a wide range of other applications, including medical packaging, automotive components, and stationery products. The global market for PP films and sheets continues to grow as industries seek sustainable, high-performance materials that meet their specific requirements.

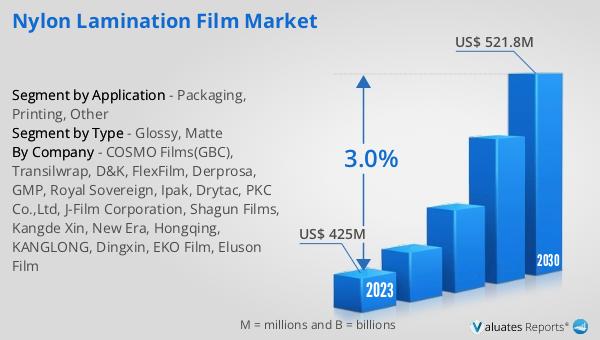

Global Polypropylene Films and Sheets Market Outlook:

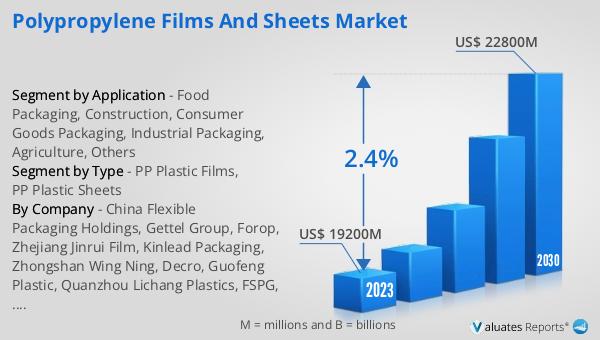

The global Polypropylene Films and Sheets market was valued at US$ 19,200 million in 2023 and is anticipated to reach US$ 22,800 million by 2030, witnessing a CAGR of 2.4% during the forecast period 2024-2030. This market outlook highlights the steady growth trajectory of the industry, driven by the increasing demand for polypropylene materials across various sectors. The market's valuation reflects the widespread adoption of PP films and sheets in applications ranging from packaging to construction and agriculture. The projected growth rate indicates a consistent rise in the consumption of these materials, fueled by their advantageous properties such as durability, chemical resistance, and cost-effectiveness. The market's expansion is also supported by advancements in manufacturing technologies, which enable the production of high-quality PP films and sheets with enhanced performance characteristics. As industries continue to prioritize sustainability and efficiency, the demand for polypropylene materials is expected to remain robust, contributing to the overall growth of the market. The competitive landscape of the market is characterized by the presence of numerous players striving to innovate and expand their product offerings to meet the evolving needs of consumers and industries. This market outlook underscores the importance of polypropylene films and sheets as essential materials in the global supply chain, driving growth and innovation across various sectors.

| Report Metric | Details |

| Report Name | Polypropylene Films and Sheets Market |

| Accounted market size in 2023 | US$ 19200 million |

| Forecasted market size in 2030 | US$ 22800 million |

| CAGR | 2.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | China Flexible Packaging Holdings, Gettel Group, Forop, Zhejiang Jinrui Film, Kinlead Packaging, Zhongshan Wing Ning, Decro, Guofeng Plastic, Quanzhou Lichang Plastics, FSPG, Zhejiang Great Southeast Corp., Ltd, Toray Plastics, Huangshan Novel Co., Ltd., Jiangyin Zhongda Flexible New Material |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |