What is Global Baby Food and Infant Formula Market?

The global Baby Food and Infant Formula market is a rapidly evolving sector that caters to the nutritional needs of infants and toddlers. This market encompasses a wide range of products designed to provide essential nutrients to babies who are either not breastfed or are transitioning to solid foods. Baby food includes purees, cereals, and snacks, while infant formula is a manufactured food designed to support infants under 12 months of age. The market is driven by factors such as increasing awareness about infant nutrition, rising disposable incomes, and the growing number of working mothers. Additionally, advancements in food technology and stringent safety standards have led to the development of high-quality, nutrient-rich products. The market is highly competitive, with numerous global and regional players striving to capture a significant share. The demand for organic and natural baby food products is also on the rise, reflecting a broader consumer trend towards healthier and more sustainable food options.

Milk Formula, A2 Infant Formulas, Infant Complementary Foods in the Global Baby Food and Infant Formula Market:

Milk formula is a cornerstone of the global Baby Food and Infant Formula market, accounting for a significant portion of sales. It is designed to mimic the nutritional profile of human breast milk and is often fortified with essential vitamins and minerals to support infant growth and development. Milk formula is available in various forms, including powder, liquid concentrate, and ready-to-feed options, catering to different consumer preferences and lifestyles. A2 infant formulas are a relatively new entrant in the market, distinguished by their use of A2 beta-casein protein, which is believed to be easier to digest and less likely to cause discomfort in infants compared to traditional A1 beta-casein protein found in most cow's milk. This type of formula is gaining popularity among parents who are looking for alternatives to standard milk formulas, especially for babies with sensitive digestive systems. Infant complementary foods, on the other hand, are designed to be introduced alongside breast milk or formula as babies begin to transition to solid foods. These products include a variety of purees, cereals, and snacks that are fortified with essential nutrients to support the developmental needs of growing infants. The introduction of complementary foods is a critical phase in an infant's diet, as it helps to establish healthy eating habits and provides additional nutrients that may not be sufficiently supplied by milk alone. The global Baby Food and Infant Formula market is characterized by continuous innovation, with manufacturers constantly developing new products to meet the evolving needs and preferences of parents and caregivers. This includes the incorporation of organic ingredients, the reduction of sugar and artificial additives, and the enhancement of nutritional profiles to support specific health outcomes, such as brain development and immune support. The market is also influenced by regulatory standards and guidelines, which vary by region and play a crucial role in ensuring the safety and quality of baby food and infant formula products. As a result, companies invest heavily in research and development, quality control, and compliance to maintain their competitive edge and build consumer trust.

Offline Retail, E-Commerce in the Global Baby Food and Infant Formula Market:

The usage of baby food and infant formula in offline retail and e-commerce channels has seen significant growth and transformation in recent years. Offline retail, which includes supermarkets, hypermarkets, specialty stores, and pharmacies, remains a dominant distribution channel for baby food and infant formula products. These physical stores offer the advantage of immediate product availability, allowing parents to purchase items as needed without waiting for delivery. Additionally, offline retail provides an opportunity for consumers to physically inspect products, read labels, and seek advice from store staff, which can be particularly reassuring for first-time parents. Many retailers also offer in-store promotions, discounts, and loyalty programs to attract and retain customers. However, the rise of e-commerce has revolutionized the way parents shop for baby food and infant formula. Online platforms offer unparalleled convenience, allowing parents to browse and purchase products from the comfort of their homes at any time of day. E-commerce websites and mobile apps often feature a wider range of products than physical stores, including niche and specialty items that may not be readily available offline. The ability to compare prices, read reviews, and access detailed product information online empowers consumers to make informed purchasing decisions. Subscription services and auto-replenishment options offered by many e-commerce platforms further enhance convenience by ensuring that parents never run out of essential baby food and formula products. The COVID-19 pandemic has accelerated the shift towards online shopping, as lockdowns and social distancing measures prompted many consumers to turn to e-commerce for their baby food and infant formula needs. This trend is expected to continue, with more parents recognizing the benefits of online shopping and the increasing availability of digital payment options and fast delivery services. Both offline retail and e-commerce channels play a crucial role in the distribution of baby food and infant formula, and manufacturers often adopt an omnichannel strategy to maximize their reach and cater to diverse consumer preferences. By leveraging the strengths of both channels, companies can ensure that their products are accessible to a broad audience and provide a seamless shopping experience for parents and caregivers.

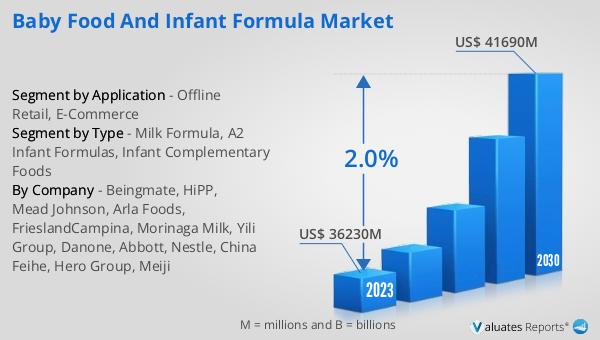

Global Baby Food and Infant Formula Market Outlook:

The global Baby Food and Infant Formula market is anticipated to expand from $37,020 million in 2024 to $41,690 million by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 2.0% over the forecast period. The top four global manufacturers collectively hold nearly 40% of the market share. Among the various product categories, milk formula stands out as the largest segment, accounting for approximately 70% of the market. This significant share underscores the critical role that milk formula plays in infant nutrition, providing essential nutrients that support growth and development during the early stages of life. The market's steady growth is driven by factors such as increasing awareness about the importance of infant nutrition, rising disposable incomes, and the growing number of working mothers who seek convenient and reliable feeding options for their babies. Additionally, advancements in food technology and stringent safety standards have led to the development of high-quality, nutrient-rich products that meet the diverse needs of infants and toddlers. As the market continues to evolve, manufacturers are focusing on innovation and product differentiation to capture a larger share and build consumer trust.

| Report Metric | Details |

| Report Name | Baby Food and Infant Formula Market |

| Accounted market size in 2024 | US$ 37020 in million |

| Forecasted market size in 2030 | US$ 41690 million |

| CAGR | 2.0 |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Segment by Region |

|

| By Company | Mead Johnson, Arla Foods, FrieslandCampina, Morinaga Milk, Yili Group, Danone, Abbott, Nestle, China Feihe, Hero Group, Meiji |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |