What is Global Wafer Cutting Fluids Market?

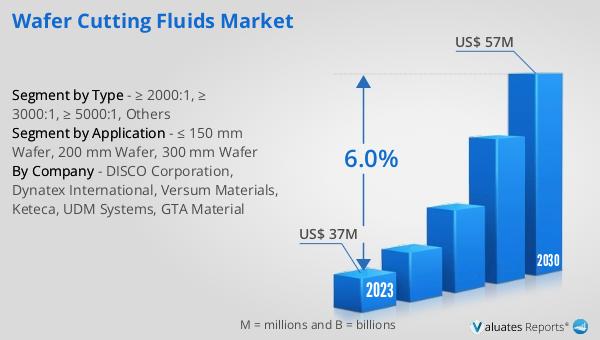

The Global Wafer Cutting Fluids Market is a specialized segment within the semiconductor manufacturing industry, focusing on the production and sale of fluids used in the cutting and slicing of silicon wafers. These fluids play a crucial role in ensuring the precision and efficiency of the wafer cutting process, which is fundamental in the production of semiconductor devices. The market for wafer cutting fluids is driven by the demand for semiconductor devices across various applications, including consumer electronics, automotive, and industrial automation. As technology advances, the need for smaller, more efficient semiconductor components increases, leading to a higher demand for cutting fluids that can support the production of thinner, more precise wafers. The market's dynamics are influenced by factors such as technological advancements in fluid formulations, environmental regulations, and the global expansion of semiconductor manufacturing capabilities. With a valuation of US$ 37 million in 2023, the market is expected to grow to US$ 57 million by 2030, reflecting a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2024 to 2030. This growth trajectory underscores the critical role of wafer cutting fluids in the broader semiconductor manufacturing process and highlights the market's potential for expansion in response to the global demand for advanced semiconductor devices.

≥ 2000:1, ≥ 3000:1, ≥ 5000:1, Others in the Global Wafer Cutting Fluids Market:

In the Global Wafer Cutting Fluids Market, products are often categorized based on their performance ratios, such as ≥ 2000:1, ≥ 3000:1, ≥ 5000:1, among others. These ratios represent the fluid's efficiency in cutting and cooling, which are critical factors in the wafer slicing process. A higher ratio indicates a fluid that can deliver superior performance, allowing for more precise cuts and better heat dissipation. This categorization is crucial for manufacturers in selecting the right cutting fluid that meets their specific requirements for wafer production. For instance, fluids with a ≥ 5000:1 ratio are typically used in applications requiring ultra-thin wafers and high precision, such as in the production of advanced microprocessors and memory chips. On the other hand, fluids with a ≥ 2000:1 ratio might be more suited for standard semiconductor manufacturing processes. The choice of cutting fluid impacts not only the quality of the wafer but also the efficiency of the cutting process, affecting overall production costs and throughput. As the semiconductor industry continues to evolve, with increasing demands for smaller, more powerful devices, the role of cutting fluids in enabling these advancements becomes even more significant. Manufacturers are continually seeking fluids with higher performance ratios to meet the stringent requirements of modern semiconductor production, driving innovation and development within the Global Wafer Cutting Fluids Market.

≤ 150 mm Wafer, 200 mm Wafer, 300 mm Wafer in the Global Wafer Cutting Fluids Market:

The usage of Global Wafer Cutting Fluids Market varies significantly across different wafer sizes, such as ≤ 150 mm, 200 mm, and 300 mm wafers. Each wafer size has its specific requirements and challenges that necessitate the use of specialized cutting fluids. For ≤ 150 mm wafers, which are typically used in older, legacy semiconductor devices, the focus is on cost-efficiency and compatibility with existing manufacturing processes. Cutting fluids for these wafers are formulated to provide reliable performance without the need for the latest technological advancements. In contrast, 200 mm wafers, which represent a significant portion of the market, require fluids that balance performance with environmental considerations. These wafers are common in a wide range of applications, necessitating cutting fluids that can accommodate diverse manufacturing requirements. The most demanding are the 300 mm wafers, which are at the forefront of semiconductor technology. These wafers require cutting fluids that offer the highest level of precision and efficiency, as they are used in the production of the most advanced semiconductor devices. The cutting fluids for 300 mm wafers are often at the cutting edge of chemical and technological innovation, reflecting the ongoing push for smaller, more powerful semiconductor components. As the industry continues to shift towards larger wafer sizes and more complex devices, the role of cutting fluids in ensuring the quality and efficiency of wafer production becomes increasingly critical.

Global Wafer Cutting Fluids Market Outlook:

The Global Wafer Cutting Fluids Market is currently experiencing a period of growth and transformation. In 2023, the market was valued at US$ 37 million and is projected to expand to US$ 57 million by 2030, marking a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. This growth trajectory is indicative of the increasing demand for semiconductor devices and the critical role cutting fluids play in their production. Despite a 2.0 percent decline in the Asia Pacific region, the largest market for wafer cutting fluids, other regions have shown significant growth. The Americas, for instance, saw a 17.0% increase in sales, reaching US$142.1 billion. Europe and Japan also experienced growth, with sales up 12.6% and 10.0% year-on-year, respectively. These figures highlight the dynamic nature of the global market for wafer cutting fluids, with varying trends across different regions. The overall growth in the market, despite regional fluctuations, underscores the essential role of cutting fluids in the semiconductor manufacturing process and points to a positive outlook for the industry's future.

| Report Metric | Details |

| Report Name | Wafer Cutting Fluids Market |

| Accounted market size in 2023 | US$ 37 million |

| Forecasted market size in 2030 | US$ 57 million |

| CAGR | 6.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | DISCO Corporation, Dynatex International, Versum Materials, Keteca, UDM Systems, GTA Material |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |