What is Global Professional Liability Insurance Market?

The Global Professional Liability Insurance Market is a specialized segment of the insurance industry that provides coverage to professionals against claims of negligence or inadequate performance. This type of insurance is crucial for professionals who offer advice or services, as it protects them from potential lawsuits that could arise from their work. The market encompasses a wide range of professions, including medical practitioners, lawyers, accountants, and engineers, among others. As businesses and individuals become more aware of the risks associated with professional services, the demand for professional liability insurance has grown. This market is characterized by its complexity, as it must cater to the specific needs of different professions, each with its own set of risks and regulatory requirements. The global nature of this market means that it is influenced by various factors, including economic conditions, legal frameworks, and technological advancements. As such, insurers must continuously adapt their offerings to meet the evolving needs of their clients. The market is also highly competitive, with numerous players vying for market share, which drives innovation and the development of new products and services. Overall, the Global Professional Liability Insurance Market plays a vital role in safeguarding professionals and their businesses from financial loss due to legal claims.

Medical Liability, Lawyer Liability, CPA Liability, Construction & Engineering Liability, Other Liability in the Global Professional Liability Insurance Market:

Medical Liability Insurance is a critical component of the Global Professional Liability Insurance Market, providing coverage to healthcare professionals against claims of malpractice or negligence. This type of insurance is essential for doctors, nurses, and other medical practitioners, as it protects them from the financial repercussions of lawsuits that may arise from their professional activities. Given the high-risk nature of the medical field, where even minor errors can have significant consequences, medical liability insurance is often a mandatory requirement for practicing healthcare professionals. Lawyer Liability Insurance, on the other hand, is designed to protect legal professionals from claims of malpractice or professional misconduct. Lawyers are often involved in complex legal matters, and any oversight or error can lead to substantial financial losses for their clients, making this insurance crucial for their practice. CPA Liability Insurance covers certified public accountants against claims of negligence or errors in their financial reporting and advisory services. As financial advisors, CPAs are entrusted with sensitive financial information, and any mistake can have severe implications for their clients, necessitating the need for liability coverage. Construction & Engineering Liability Insurance is tailored for professionals in the construction and engineering sectors, where the risks of errors or omissions can lead to costly project delays or structural failures. This insurance provides coverage against claims arising from design flaws, construction defects, or other professional oversights. Other Liability Insurance encompasses a wide range of professions, including consultants, architects, and IT professionals, among others. Each of these professions faces unique risks, and liability insurance provides the necessary protection against potential claims of negligence or inadequate performance. As the Global Professional Liability Insurance Market continues to evolve, insurers are developing more specialized products to cater to the diverse needs of different professions, ensuring that professionals across various industries have access to the coverage they need to protect their livelihoods.

Up to $1 Million, $1 Million to $5 Million, $5 Million to $20 Million, Over $20 Million in the Global Professional Liability Insurance Market:

The usage of Global Professional Liability Insurance Market varies significantly across different coverage amounts, reflecting the diverse needs and risk profiles of professionals and businesses. For coverage up to $1 million, this level of insurance is typically sought by small businesses and individual professionals who require basic protection against potential claims. This coverage is often sufficient for professionals in low-risk industries or those who are just starting their careers, providing them with a safety net without incurring high premium costs. As businesses grow and take on more complex projects, the need for higher coverage becomes apparent. The $1 million to $5 million range is commonly chosen by mid-sized firms and professionals in moderately risky fields, such as accountants or consultants, who may face more substantial claims due to the nature of their work. This level of coverage offers a balance between affordability and comprehensive protection, ensuring that professionals can safeguard their assets while managing their insurance expenses. For larger firms or those operating in high-risk industries, such as construction or engineering, coverage between $5 million to $20 million is often necessary. This level of insurance provides robust protection against significant claims that could arise from large-scale projects or complex professional services. It is particularly important for firms that handle high-value contracts or work with sensitive information, where the potential for costly errors is greater. Finally, coverage over $20 million is typically reserved for large corporations or professionals in extremely high-risk sectors, such as medical practitioners or legal professionals involved in high-stakes cases. This level of insurance offers maximum protection against catastrophic claims that could otherwise jeopardize the financial stability of a business or individual. As the Global Professional Liability Insurance Market continues to expand, insurers are offering more flexible and customizable coverage options to meet the diverse needs of their clients, ensuring that professionals at all levels have access to the protection they require.

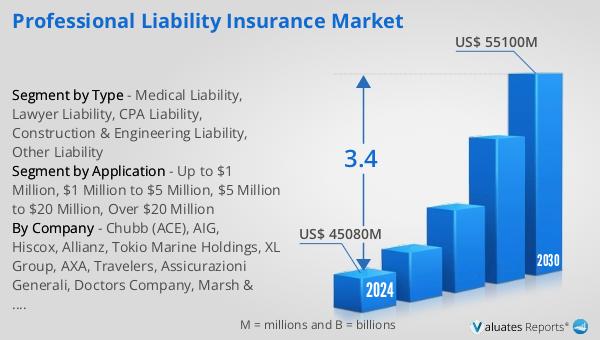

Global Professional Liability Insurance Market Outlook:

In 2024, the global market size for Professional Liability Insurance was valued at approximately US$ 46,460 million. It is projected to grow to around US$ 58,520 million by 2031, with a compound annual growth rate (CAGR) of 3.4% during the forecast period from 2025 to 2031. The market is dominated by the top five manufacturers, who collectively hold a market share exceeding 25%. Within this market, Medical Liability Insurance emerges as the largest segment, accounting for about 30% of the total market share. This significant share underscores the critical importance of medical liability coverage in protecting healthcare professionals from the financial risks associated with malpractice claims. The steady growth of the Professional Liability Insurance Market reflects the increasing awareness among professionals about the need for adequate protection against potential legal claims. As the market continues to evolve, insurers are likely to focus on developing innovative products and services to cater to the diverse needs of professionals across various industries. The competitive landscape of the market also drives insurers to enhance their offerings, ensuring that clients receive comprehensive coverage tailored to their specific requirements. Overall, the Professional Liability Insurance Market plays a vital role in safeguarding professionals and their businesses from financial loss due to legal claims, contributing to the stability and growth of various industries worldwide.

| Report Metric | Details |

| Report Name | Professional Liability Insurance Market |

| CAGR | 3.4% |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA, Travelers, Assicurazioni Generali, Doctors Company, Marsh & McLennan, Liberty Mutual, Medical Protective, Aviva, Zurich, Sompo Japan Nipponkoa, Munich Re, Aon, Beazley, Mapfre |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |