What is Global Estate Planning Software Market?

The Global Estate Planning Software Market is a rapidly evolving sector that caters to the needs of individuals and organizations in managing and planning their estates. Estate planning software provides tools and resources to help users organize their assets, create wills, establish trusts, and ensure that their estate is distributed according to their wishes after their passing. This software is designed to simplify the complex process of estate planning, making it more accessible and efficient for users. It offers features such as document management, financial planning, and legal compliance, which are crucial for effective estate management. The market for estate planning software is driven by the increasing awareness of the importance of estate planning, the growing number of high-net-worth individuals, and the rising demand for digital solutions in the legal sector. As more people recognize the benefits of using technology to manage their estates, the demand for estate planning software is expected to grow, leading to further innovations and advancements in this field.

Cloud-Based, On-Premise in the Global Estate Planning Software Market:

In the Global Estate Planning Software Market, there are two primary deployment models: cloud-based and on-premise. Cloud-based estate planning software is hosted on remote servers and accessed via the internet, offering users the flexibility to access their data and tools from anywhere with an internet connection. This model is particularly appealing to users who require mobility and remote access, such as legal professionals who travel frequently or clients who manage multiple properties in different locations. Cloud-based solutions often come with the advantage of automatic updates, ensuring that users always have access to the latest features and security enhancements. Additionally, cloud-based software typically offers scalable pricing models, allowing users to pay for only the features and storage they need, which can be cost-effective for smaller firms or individual users. On the other hand, on-premise estate planning software is installed directly on a user's local servers or computers. This model provides users with greater control over their data and software environment, which can be crucial for firms that handle sensitive client information and require stringent data security measures. On-premise solutions may also offer more customization options, allowing firms to tailor the software to their specific needs and workflows. However, this model often requires a larger upfront investment in hardware and IT infrastructure, as well as ongoing maintenance and updates. Despite these challenges, some firms prefer on-premise solutions for their perceived reliability and control over data. Both cloud-based and on-premise estate planning software have their unique advantages and challenges, and the choice between the two often depends on the specific needs and preferences of the user or organization. As the market continues to evolve, we can expect to see further innovations in both deployment models, with a focus on enhancing user experience, security, and integration with other legal and financial tools.

Individual Law Firm, Partnership Law Firm, State-owned Law Firm in the Global Estate Planning Software Market:

The usage of Global Estate Planning Software Market varies across different types of law firms, including individual law firms, partnership law firms, and state-owned law firms. Individual law firms, often run by solo practitioners, benefit from estate planning software by streamlining their workflow and reducing the time spent on administrative tasks. The software allows them to efficiently manage client information, generate legal documents, and ensure compliance with legal standards, all of which are crucial for maintaining a successful practice. For partnership law firms, estate planning software facilitates collaboration among partners and associates by providing a centralized platform for managing client cases and documents. This enhances communication and coordination within the firm, leading to improved client service and satisfaction. The software also aids in resource allocation and workload management, ensuring that each case receives the attention it deserves. State-owned law firms, which often handle a large volume of cases, rely on estate planning software to manage their extensive client databases and ensure that all legal processes are conducted efficiently and in compliance with government regulations. The software helps these firms maintain transparency and accountability, which are essential for public trust and confidence. Additionally, estate planning software can assist state-owned firms in managing their resources more effectively, allowing them to serve a larger number of clients without compromising on quality. Overall, the Global Estate Planning Software Market plays a crucial role in enhancing the efficiency and effectiveness of law firms, regardless of their size or structure, by providing them with the tools and resources needed to manage their estates and legal processes effectively.

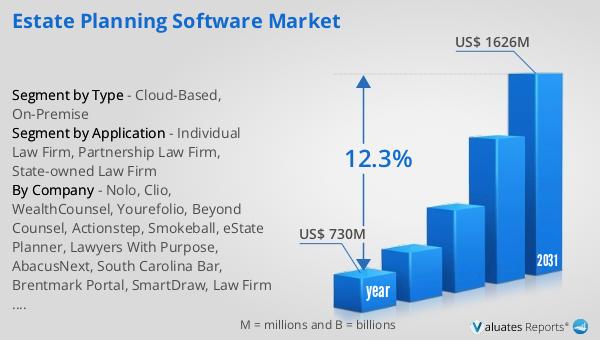

Global Estate Planning Software Market Outlook:

The global market for Estate Planning Software was valued at approximately $730 million in 2024. This figure represents the total worth of the industry at that time, reflecting the demand and supply dynamics of estate planning software solutions worldwide. As the market continues to grow, it is projected to reach a revised size of around $1,626 million by 2031. This significant increase in market size indicates a robust growth trajectory, driven by factors such as technological advancements, increasing awareness of the importance of estate planning, and the rising demand for digital solutions in the legal sector. The compound annual growth rate (CAGR) of 12.3% during the forecast period highlights the strong potential for expansion and innovation within the industry. This growth is likely to be fueled by the increasing adoption of estate planning software by individuals and organizations seeking to streamline their estate management processes and ensure compliance with legal standards. As the market evolves, we can expect to see further developments in software features, integration capabilities, and user experience, all of which will contribute to the continued growth and success of the Global Estate Planning Software Market.

| Report Metric | Details |

| Report Name | Estate Planning Software Market |

| Accounted market size in year | US$ 730 million |

| Forecasted market size in 2031 | US$ 1626 million |

| CAGR | 12.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Nolo, Clio, WealthCounsel, Yourefolio, Beyond Counsel, Actionstep, Smokeball, eState Planner, Lawyers With Purpose, AbacusNext, South Carolina Bar, Brentmark Portal, SmartDraw, Law Firm Software, ZenBusiness, Fidelity Labs, LEAP, Maat Legal, Lawmatics, Tracers, Astute Wheel |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |